Join Our Telegram channel to stay up to date on breaking news coverage

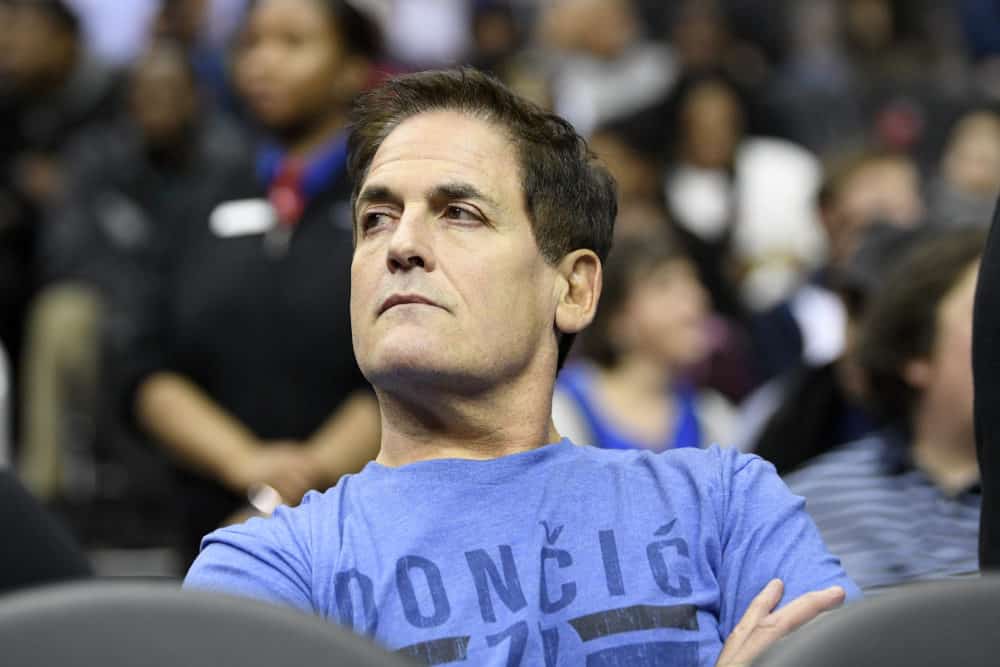

Mark Cuban is no stranger to the power of the internet, having leveraged it to make billions for himself. With Wall Street currently in what appears to be a battle against online-based investors, the billionaire owner of the Dallas Mavericks has made his allegiances clear.

No Mercy for “Fat, Happy” Wall Street

Like many, Cuban had a front-row seat at last week’s incredible event that saw the shares of electronics retail company GameStop surge by over 600 percent. The event already drew a significant amount of comparisons and reactions. Not one to shy away from trending issues, Cuban shared his excitement.

In a blog post, the billionaire went on the offensive, explaining that Wall Street had become too complacent and was getting a reckoning from investors on digital platforms – members of what he called the “store of vague: generation.

As Cuban explained, millennials have built a deeper understanding of digital assets and their values. This changing of the guard began when most were younger, and they’ve now grown up to appreciate the digital space even more.

Wall Street Gets Its Reckoning

Cuban also discussed technologies like blockchain and its personal favorite—non-fungible tokens, that allow people to ascribe digital values to physical assets. This operation ensures that the assets’ values can be stored, while investors don’t need to face the same downsides of having physical collectibles and assets.

Cuban added that the same paradigm could apply to the stock market. Stocks represent just another digital store of value, and members of the new generation have understood how to take advantage of the legacy system’s inefficiencies. By banding together, they’ve been able to neutralize Wall Street’s powers and hold hedge funds and other powerful players accountable.

In truth, the GameStop saga has been more of a memorandum on Wall Street and the dwindling powers of its players. Melvin Capital, the company that shorted GameStop’s stock and led to Reddit investors’ retaliation, was forced to close its position and had to take additional funding to keep its operations afloat.

Last weekend, the Wall Street Journal reported that the company had only about $8 billion in assets at the end of January. Considering that it began the month with $12.5 billion – and with the $2.75 billion in additional capital in the aftermath of the short squeeze – Melvin Capital lost 53 percent of its assets, thanks to the influence of a band of retail investors on Reddit.

Many of these Reddit investors have now found their groove and have so far been behind significant gains in XRP and DOGE. While this newfound power could age consequences, we could very well be witnessing a shift in consciousness – especially for young investors. Suddenly, Wall Street doesn’t look so powerful anymore.

Join Our Telegram channel to stay up to date on breaking news coverage