Join Our Telegram channel to stay up to date on breaking news coverage

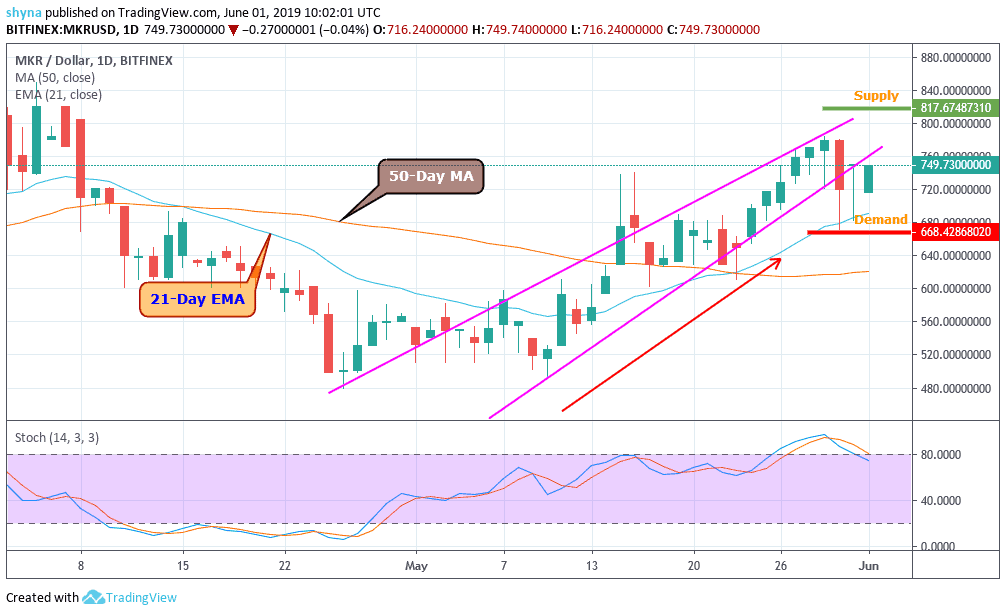

MKR Price Analysis – June 1

Maker is beginning to experience downward pressure in the short term, as buyers struggle to move the cryptocurrency to new highs. However, the cryptocurrency still remains above its trend, which establishes the 50-day moving average.

MKR/USD Market

Key Levels:

Supply levels: $817, $857, $877

Demand levels: $665, $625, $585

Simply by looking at the chart, the upward trend in the daily time frame suggests that the MKR/USD pair should continue trading in the medium term, with prices still above the 50-day MA and 21-day EMA, while the signal lines of Stochastic 14 warn that a deeper technical correction could occur in the short term.

The stochastic daily, which currently trades above level 80, has revealed the few days of this positive evolution. On the positive side, we can expect an upward search for supply levels of $817 and $857. But for now, the MKR/USD market is still in the bullish territory despite the recent fall.

MKR/BTC Market

The value of MKR has depreciated in recent weeks due to the low liquidity that brought prices to the trend line below 0.08BTC on May 23. Although prices have been moderate, the MKR market has evolved significantly. The last 120 trading hours so far, the price has skyrocketed and then went down.

Looking at the RSI, the current side market is shown at level 45. An upward bull trend should reach the resistance level at 0.10BTC, where the upper trend line is at rest. Above this resistance are the levels of 0.11BTC and 0.12BTC. However, a bearish point could retest the previous minimum to 0.08BTC before placing a new one around 0.07BTC.

Please note: Insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage