Join Our Telegram channel to stay up to date on breaking news coverage

Terra Luna Classic (LUNC) is currently facing challenges in maintaining an upward trend, as it struggles to hold above a descending triangle pattern.

The lack of momentum to sustain the recovery is a cause for concern for traders and investors alike, particularly considering the upcoming release of the Consumer Price Index (CPI) data by the U.S. Bureau of Labor Statistics.

Given the potential impact of the CPI data on the market, as well as the latest insights from the U.S. Federal Reserve’s monetary policy, volatility is expected to increase. As a result, it is important to closely monitor any “fakeouts” that may occur in the lead-up to the Bureau of Labor Statistics report.

Additionally, investors should know the Federal Reserve will release the minutes of its latest Federal Open Market Committee (FOMC) meeting, in which it continued raising interest rates. This news could further contribute to market volatility, making it a critical event to watch out for.

Terra Luna Classic (LUNC) Price Could Be Heading Further downwards

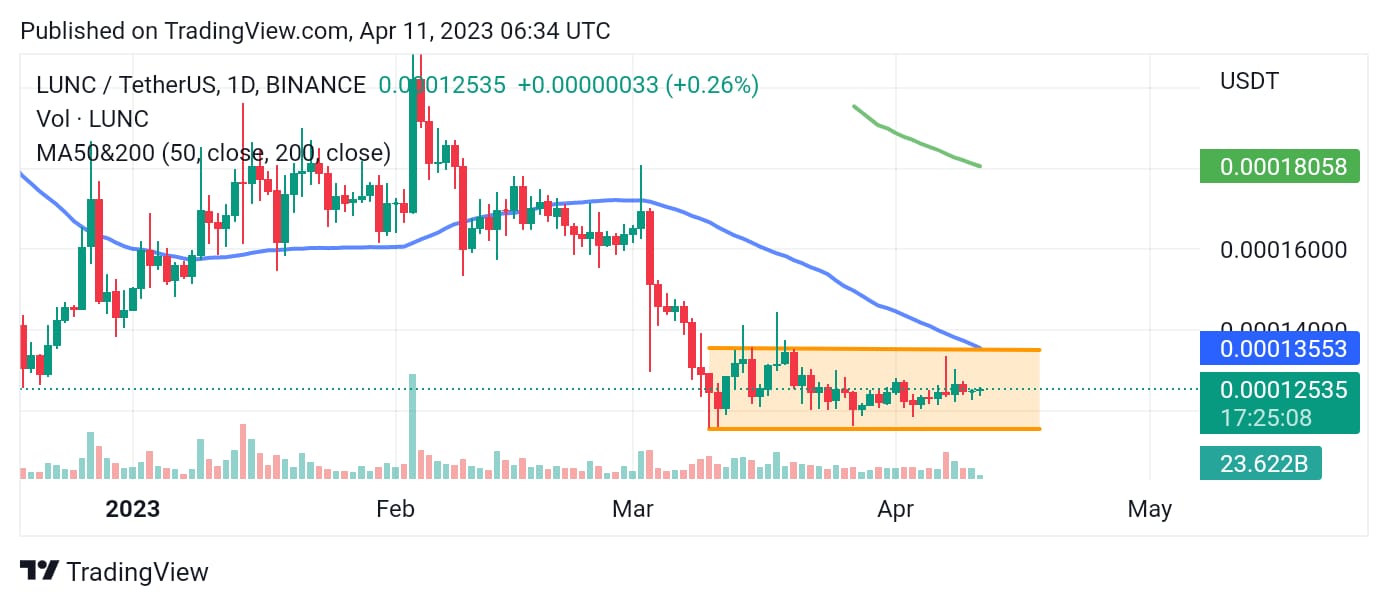

In early March, Terra Luna Classic (LUNC) experienced a price drop to $0.000118, following a failed attempt by the bulls to recover from a new 2023 high of $0.00021 reached in February. Analysts at the time presented two scenarios: a breakout above $0.00018, which could lead to a return to $0.00021 and increase investor confidence, or a confirmed break below $0.00015, which would extend losses to $0.00012.

Unfortunately, the first scenario did not materialize, and LUNC’s price was left vulnerable to selling pressure because of factors such as collapsing US banks, increased regulatory scrutiny, and the arrest of Terra’s founder, Do Kwon.

Currently, LUNC’s price has broken above the resistance line of a descending triangle at $0.000123. The next hurdle is resistance at $0.000130, and a break above it could lead to an expected upward recovery, potentially reaching gains above the 50-day Simple Moving Average at $0.000136 and ultimately to $0.000144. This would represent a 15.64% increase from the current price.

LUNC Price Analysis

At the time of writing, Terra Luna Classic (LUNC) is trading for $0.00012554, with a 24-hour trading volume of $42,503,336. The token has witnessed a modest increase of 0.81% in its price over the past 24 hours and 3.09% over the past seven days. With a circulating supply of 5.9 trillion LUNC tokens, the market capitalization of the token stands at $742,043,939.

Over the last 24 hours, LUNC’s trading volume has surged by 5.80%, showing a recent rise in market activity. LUNC’s current price is significantly lower than its all-time high of $119.18, which was achieved around a year ago on April 5, 2022.

According to CoinGecko’s market capitalization ranking, LUNC currently ranks #69. The market cap of LUNC is determined by multiplying the token price by the circulating supply of tokens, which is 5.9 trillion in LUNC’s case.

LUNC Price Prediction: LUNCUSD Chart Analysis

After creating a bearish hanging man candle the price of LUNC is still boisted for a bullish move. However, the price is still drugging within the consolidation phase pending. Looks like LUNC might fall further to the bottom of the consolidation phase.

The price of Terra Luna Classic (LUNC) may experience a significant drop if it loses support between the ranges of $0.000123 and $0.000118 in the next few days. Such a decline could trigger a wave of selling, potentially predicting the price down to $0.00011 or even lower, toward the bearish target of $0.0000977 shown by the technical pattern. Furthermore, the price of LUNC is trading below the 50-day and 200-day moving averages.

Related

LUNA Price Prediction: Terra Continues the Downtrend. Will LUNA Find an Anchor for Bullish Move?

Ethereum Price Prediction: Could a Successful Shanghai Upgrade Drive ETH’s Price Up?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage