Join Our Telegram channel to stay up to date on breaking news coverage

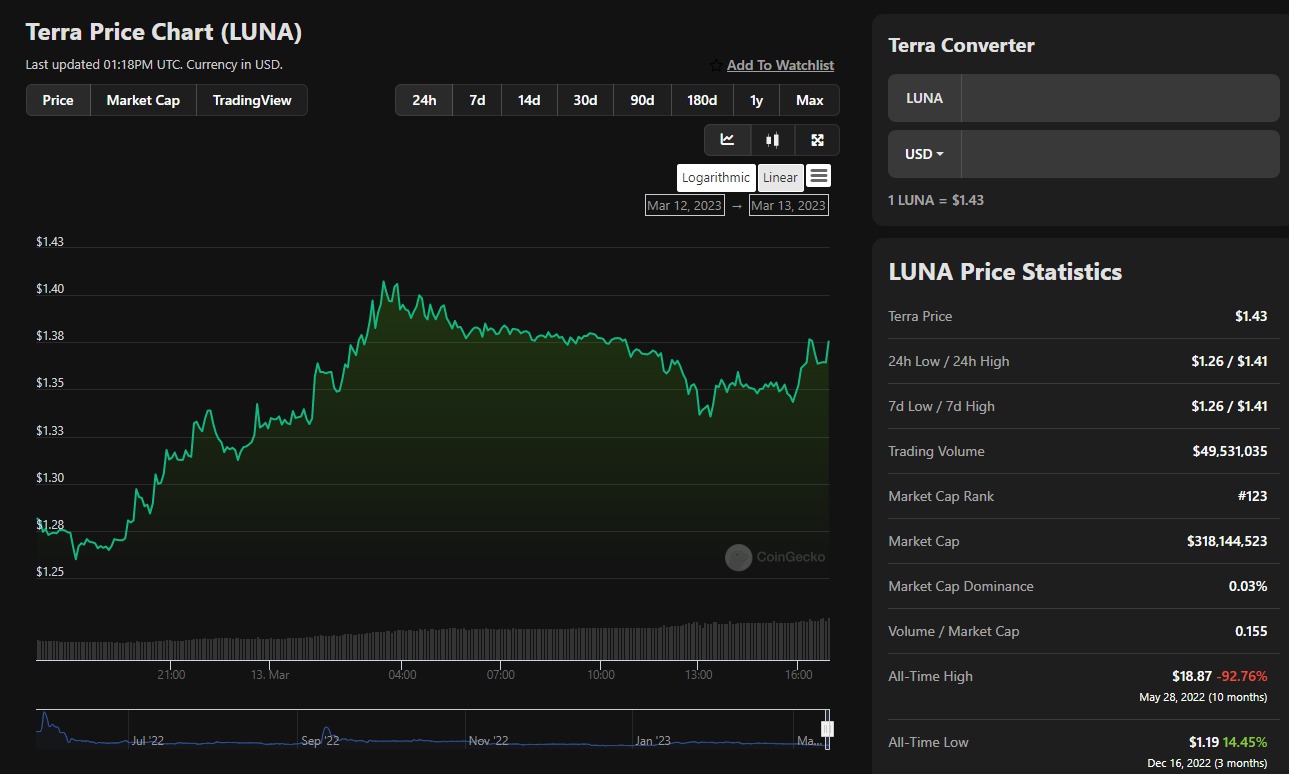

LUNA, has been experiencing a decline in price for several weeks. It is currently trading at $1.36, with the market capitalization of cryptocurrencies also dropping to as low as $293 million.

LUNA’s Trading Performance for the Future of Stablecoins

The future of LUNA is of critical importance for the cryptocurrency industry as a whole. The coin was launched as part of a regeneration strategy, but its performance has yet to be awe-inspiring thus far.

The Terra 2.0 blockchain, on which LUNA operates, uses a proof-of-stake (PoS) consensus mechanism to validate transactions. At any given time, the network has 130 validators working to secure the network, with validator power proportional to the number of tokens staked.

LUNA’s trading performance will have significant implications not only for the cryptocurrency itself but also for the broader stablecoin market. If investors trust LUNA, it could significantly further the development of stablecoins as an asset class.

LUNA Market Price Analysis

LUNA started trading at approximately $19 on May 28, 2022, but its value quickly plummeted below $5 the following day. By the end of May 2022, LUNA’s value had slightly recovered to above $11, but it subsequently experienced a downward spiral as June began.

Throughout the next few months, LUNA’s value was consolidating between $1.7 and $2.5. Currently, it is being traded at $1.38 with a market capitalization of slightly over $293 million. In June 2022, LUNA’s market capitalization exceeded $300 million, but it fluctuated between $210 million and $300 million for much of July. At present, the market capitalization is still within that range.

🔥Total supply:

-43,981.913 / 6,859,953,611,246.24#TERRA #LUNA #BURNLUNA— $LUNA Supply Alert🔔 (@LUNASupplyAlert) March 13, 2023

The collapse of the twin coins triggered a crisis that affected the entire market, and LUNA was especially vulnerable to volatile market conditions. The market has also been curtailed by the Russia-Ukraine crisis and increasing cryptocurrency regulations worldwide.

When writing, Terra (LUNA) is trading at $1.38 per token, with a 24-hour trading volume of $49,536,082. This marks a 10.4% increase in price over the past day, although the token has declined in value by -9.40% over the past 7 days. With 230 million LUNA tokens in circulation, the market capitalization of Terra is currently estimated at $318,144,523.

LUNA Price Prediction: LUNA/USD Daily Chart Analysis

The LUNA altcoin has been on a downtrend since the beginning of March. The coin has been bouncing along the bottom support level since November 2022. The past 24 hours have seen LUNA bounce back its proceeds by 10.4%. This means that if the price continues to surge, more ground will be covered, bringing the cost of LUNA to new all-time highs in the process of recovery.

The price of LUNA is still trading below the 50-day and 200-day moving averages. However, the rebound seen from the bottom support level could push the daily averages back to the former resistance level. At the time of writing, the 200-day moving average is trading at $2.03, while the 50 day moving average is trading at $1.83.

The relative strength index (RSI-14) is also recovering, trading above the 20 level at 36. This is a good signal for the bulls. Based on this analysis, LUNA’s price prediction can be projected to reach the former resistance at $2.5.

Related

- Securedverse is Bringing an Intense Combat First-Person Shooter Game to Web 3.0

- ApeCoin Price Prediction for Today, March 12: APE/USD May Head For $4.5 Resistance

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage