Join Our Telegram channel to stay up to date on breaking news coverage

Loom Network (LOOM) price action in the four-hour timeframe shows an ongoing markup phase. It is recording higher highs after an accumulation phase. This is based on Wyckoff’s analysis of trading ranges and could translate to a 20% surge if the second markup continues.

Meanwhile, shorts are having a bad day in the office as Loom Network’s price ascends. The surge caught them off guard, with many now looking for exit points, possibly after breaking even.

I'm waiting for break-even to exit

Funding kills TA #loom $loom pic.twitter.com/UmcO00gLj8

— Prof.Noan.Ai 𓃵 (@CryptoNoan) October 6, 2023

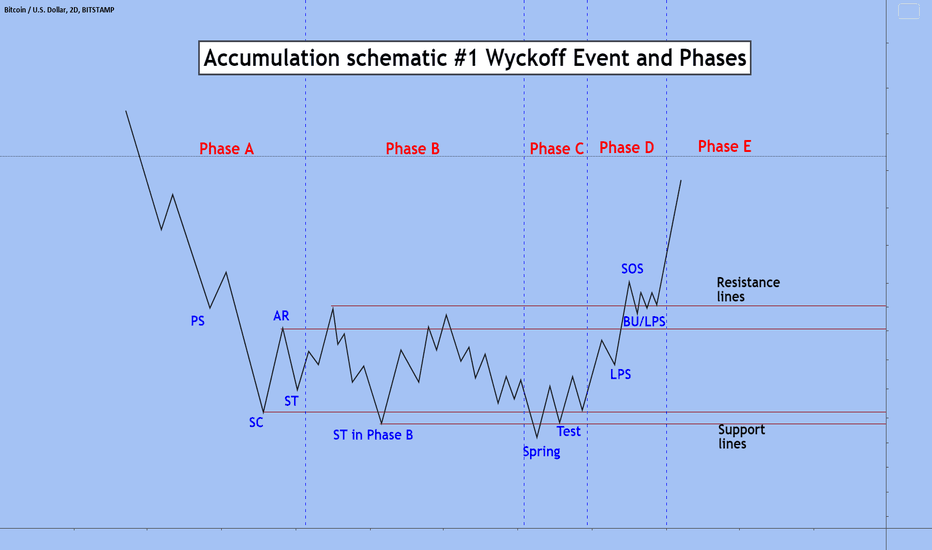

The Wyckoff Method With Loom Network Price Action In Mind

The Wyckoff method enhances the position of the market as it predicts upcoming price movements.

The accumulation phase comes after a downtrend, with traders trying to build positions ready for the next run. During this time, the smaller fish exit the market subtly as assets bought outweigh those sold, a new run commences, hence the markup.

During the markup, you might find shorter re-accumulation phases with the more significant uptrend pausing before continuing north. The consolidation could indicate the re-accumulation phase for Loom Network price before a continued uptrend.

Increased buying pressure could facilitate this, with Loom Network’s price enjoying robust support downward. This is first presented by the immediate support at $0.16827, followed by the Parabolic SAR at $0.14657. All these represent buyer congestion levels and possible entry points for sidelined or late investors. The next rally or a continuation of the current markup could see LOOM hit the $0.20000 psychological level, 20% above current levels.

The Relative Strength Index (RSI) supports this outlook, at 77, showing strong price strength. The Awesome Oscillator (AO) indicator also flashes green in the positive territory, suggesting bulls have a strong presence in the LOOM market.

Investors should exercise caution because when a coin is pumping, trading the pump is often ill-advised. Instead, trading the retrace is better by finding support levels and establishing trendlines.

Given its current outlook, Loom Network price tested the support formed on September 27 at around $0.11649. This was a good entry point.

Converse Case

A rejection from the $0.17745 resistance level could send Loom Network price south, potentially tagging the 50-day Exponential Moving Average (EMA) at $0.13400. Further down, the slump could see LOOM tag the support confluence between the horizontal line and the 100-day EMA at $0.11649. This could present another buying opportunity, but investors should wait for confirmation that LOOM holds and closes above it.

In the dire case, the load-shedding exercise could see Loom Network price hit the 200-day EMA at $0.09306. Such a move would constitute a 45% slump from current levels.

Besides LOOM, several other tokens are doing very well and have low entry barriers regarding cost. Among them is BTCMTX, the ticker for the Bitcoin Minetrix ecosystem. Analysts are very bullish about it

LOOM Alternative

Regarding alternatives, Bitcoin Minetrix is the choice candidate, going for as low as $0.011 per BTCMTX token in the presale. The project is still budding, having made its market debut only recently, but this is not stopping it from succeeding. The latest update on the website shows that more than $556,000 is already in the bank.

Update from #BitcoinMinetrix! 📣

We have raised over $500,000. pic.twitter.com/twJWjK7MjH

— Bitcoinminetrix (@bitcoinminetrix) October 5, 2023

The project is out to change the narrative of how things have been done since 2008, when mining was used for security. This has been a costly and complex process, made worse by the increasing number of swindles. The project also plans to disenfranchise BTC mining, taking it from the hands of big corporations and making it accessible even to the ordinary folk.

In 2008, #Bitcoin used mining for security.

It started accessible but grew complex and costly.

Cloud mining had scams, raising doubts.

Now, big corporations dominate $BTC mining and limit individuals. 🏭#BitcoinMinetrix aims to make $BTC mining available to all users. 👥 pic.twitter.com/ZDBpWMw5o2

— Bitcoinminetrix (@bitcoinminetrix) October 5, 2023

It is a stake-to-mine project, meaning you stake BTCMTX tokens, earn credit for them, and use these credits to mine Bitcoin. Taking a line from the website:

“Bitcoin Minetrix mines bitcoin so that you don’t have to. Buy and stake BTCMTX tokens to join our safe and secure Bitcoin cloud mining platform.”

The project operates a tokenized cloud-mining ecosystem where everyone can mine Bitcoin in a decentralized way. By tokenizing cloud mining, the Bitcoin Minetrix has achieved what no other project has been able to: confer control in the hands of token holders. Further, it has removed risks relating to third-party scams prevalent in the broader market. Buy and stake your BTCMTX tokens.

#BitcoinMinetrix aims to transform the #Bitcoin Cloud Mining landscape by introducing a Stake-to-Mine mechanism automated by smart contracts.

Envisioning a safe and efficient ecosystem between #Blockchains that combats the drawbacks of conventional cloud mining. 🌐 pic.twitter.com/NtNlMWROmx

— Bitcoinminetrix (@bitcoinminetrix) October 5, 2023

One benefit of the Bitcoin Minetrix network is that its native token, BTCMTX, is an ERC-20 token, unlike the original BTC mining that depends on traditional money. Also, you get to enjoy complete control, and the fact that it leverages the ETH smart contract enhances security and decentralization.

Also Read:

- Next Cryptocurrency to Explode in October – Bitcoin Minetrix, dYdX, Mantle

- $BTCMTX Presale Hits $500,000: Top Influencers Recommend Jumping In

- Top 3 Crypto Presales to Buy in October 2023 – New 10X Potential Cryptocurrencies?

- Top 3 Hottest Crypto Presales to Buy in 2023 – Altcoins with Potential 10x Returns

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage