Join Our Telegram channel to stay up to date on breaking news coverage

LTC Price Prediction – February 8

The Litecoin price is currently changing hands at $76.93 while the RSI (14) indicator swims within the overbought territory.

LTC/USD Market

Key Levels:

Resistance levels: $84, $86, $88

Support levels: $66, $64, $62

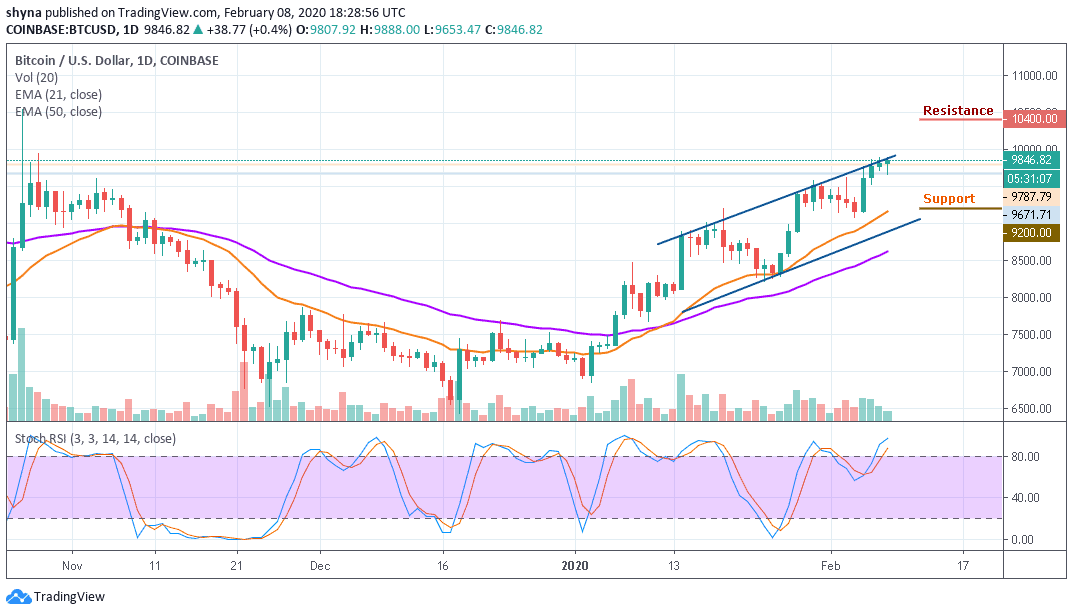

LTC/USD is seen trading in the green in today’s session, moving around the upper boundary of the channel where the coin has gained over 3.61%. At the time of writing this, the Litecoin (LTC) bulls broke out from a downward trend and capped to the upside at $77 and supported the downside at $71, within tight conditions.

Moreover, early this month, Litecoin (LTC) price was trapped in a slight downward trend after the bullish rally failed to materialize several times. The coin has failed to clear the hurdles towards the resistance level of $73 but today, the bears are trying to force their way back to the market when the price started revising. More so, a break below the $70 support level may provoke an even deeper decline towards the $66, $64 and $62 support levels.

However, the daily chart reveals that LTC/USD may exhibit the tendencies to correct lower after the coin begin to purge from the overbought zone, the indicator is confidently stable at the average. Nevertheless, if the buyers continue to push the market above the upper boundary of the channel, the price may reach the resistance levels of $84, $86 and $88 respectively.

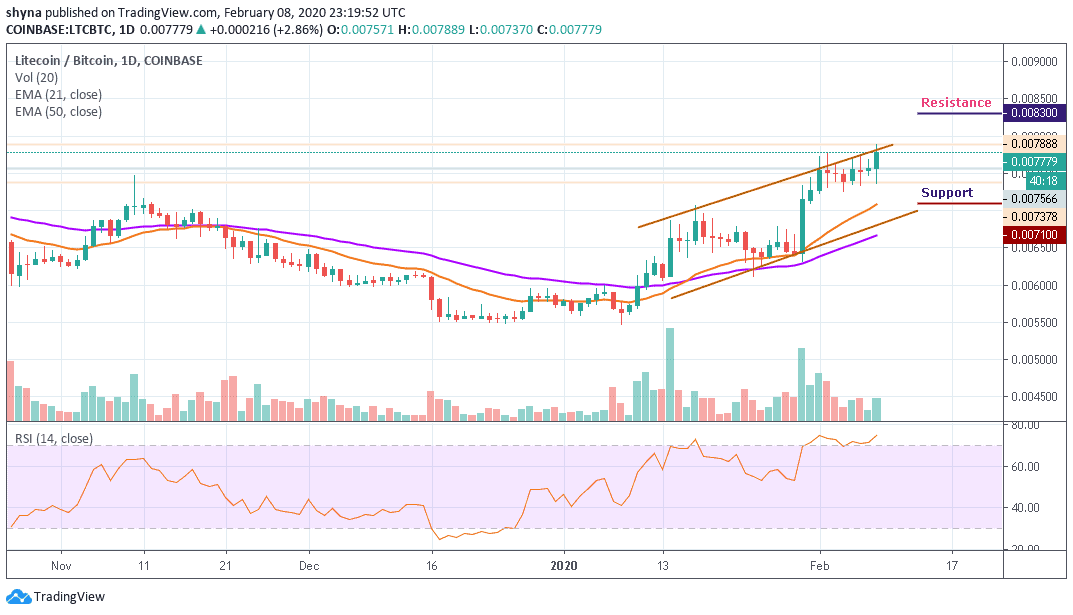

Against Bitcoin, Litecoin price is making an attempt to cross the channel in other to reach the resistance at 0.0080 BTC. Unless this coin crossed above the trend line and the price ends up closing above it, there might not be any reason to expect the bullish reversal.

However, any movement below the nearest support could refresh lows under 0.0075 BTC and a possible bearish continuation may likely meet the major support at 0.0073 BTC before falling to 0.0071 BTC and below while the buyers may push the market towards resistance at 0.0083 BTC and above. The RSI (14) still moves within the overbought zone but traders should watch out for the change of trend in the nearest term.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage