Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin perpetuals exchange FTX has been rising in recent days. Its liquidity is now at par with major derivatives exchange BitMEX. This is a sign of increasing interest in the digital currency markets.

Reaching new heights

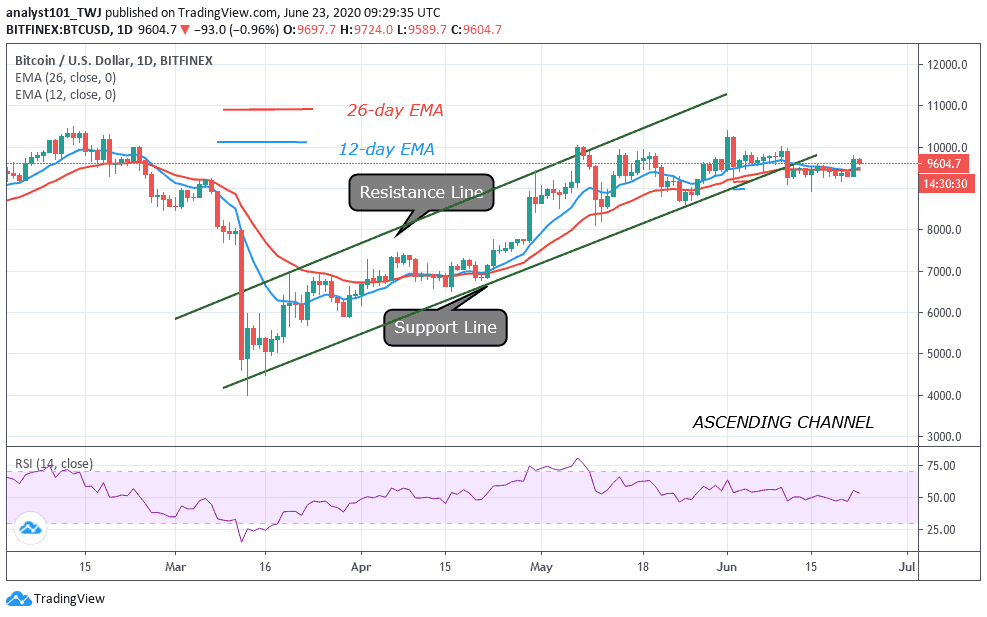

The Antigua-based Bitcoin perpetuals exchange FTX recently achieved an order book depth equivalent to BitMEX. Bitcoin has been trading between $9,000 and $10,000 for the second straight month, without showing any signs of price movement clarity.

However, investor interest in digital currencies remains higher, especially in Bitcoin perpetuals. They are a unique type of futures contract that do not have an expiry date. This means that these contracts never get settled. They come with a funding rate that changes every eight hours. Traders holding a position during the timestamp can pay or receive funding.

As of Monday afternoon, the daily average bid/offer spread for Bitcoin on the exchange was 0.32% for a $10 million. According to the crypto derivatives research firm Skew, the number for BitMEX was 0.28%. Founded in 2014, BitMEX is one of the biggest bitcoin perpetuals exchanges in the world by trading volume. FTX was launched in May 2018.

How is the gap reducing?

Skew noted that liquidity on FTX is still less than that of BitMEX. However, “Liquidity for bitcoin perpetuals swaps on FTX has caught up with BitMEX.” The liquidity on FTX has risen so sharply that the gap between Bitcoin perpetual on both platforms decreased by 40% on March 12.

Market depth collapsed after the March 12 Bitcoin price crash when the currency lost 40% of its value. However, BitMEX continued to report smaller spreads. Note that the bid-ask spreads widen up during extreme activity on the asset. FTX had a consistently higher spread before the crash and even 2.5 months after it. The spread on BitMEX on May 11 was 0.62% while on FTX it was 2.75%. The situation reversed in early June and the gaps have slowly reduced.

An FTX spokesperson said that this is because of the growing userbase and volume.

Join Our Telegram channel to stay up to date on breaking news coverage