Join Our Telegram channel to stay up to date on breaking news coverage

Lawyers are the big winners from a series of crypto industry bankruptcies with a fee fest worth more than $700 million, the New York Times (NYT) reported.

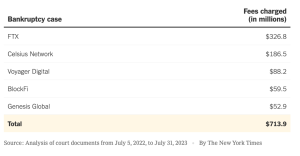

Lawyers, accountants, consultants, cryptocurrency analysts, and other professionals have earned the fees since last year, according to an analysis by the NYT. The tally is based on what the newspaper called an exhaustive review of more than 5,000 pages of billing statements and court documents from the bankruptcies of FTX, Celsius Network, Voyager Digital, BlockFi, and Genesis Global.

FTX stands out as the case with the highest fees, totaling $326.8 million. The total fees comprise both those officially approved by a bankruptcy judge and some that are still pending approval.

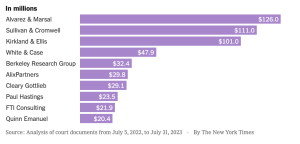

Two major law firms, Sullivan & Cromwell and Kirkland & Ellis, emerge as among the biggest beneficiaries, the story said. Sullivan & Cromwell, managing FTX’s bankruptcy, has billed over $110 million in legal fees, while Kirkland & Ellis has charged $101 million for their involvement in three of the cryptocurrency bankruptcies, the NYT reported.

Some said the fees charged as exorbitant and unnecessary given that many of the individuals owed money are amateur traders who lost their personal savings, the NYT story said

Legal Experts Defend Crypto Bankruptcy Fees

Lawyers defended the fees, saying they bill at market rates and argue that the bankruptcies are complex and time-intensive.

They also cited the lack of clear cryptocurrency regulations as a factor contributing to the complexity and increased costs of handling the cases, the story added.

Fee Examiners to Monitor Costs

In some instances, judges overseeing the bankruptcy cases have reportedly chosen to bring in independent lawyers as fee examiners, to keep an eye on expenses and collaborating with the firms to trim any unnecessary spending, the story said.

Katherine Stadler, as the fee examiner for the FTX bankruptcy case, said that the proceedings were on track to be very expensive by any measure. She said the costs incurred so far already amounted to a significant portion of FTX’s remaining cash, the story added

Related Articles

- How to Buy Bitcoin Online Safely

- South Korea Bill Will Freeze North Korea Crypto Assets Used To Fund Weapons Programme

- Japan Regulator Aims to Remove Unrealized Gains Tax To Boost Crypto Industry

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage