Join Our Telegram channel to stay up to date on breaking news coverage

As the cryptocurrency market continues to experience a prolonged bear market, industry leaders are embracing this challenging phase as an opportunity for growth and maturation.

Cryptocurrency Industry Seeks Growth and Maturation Amidst Ongoing Bear Market

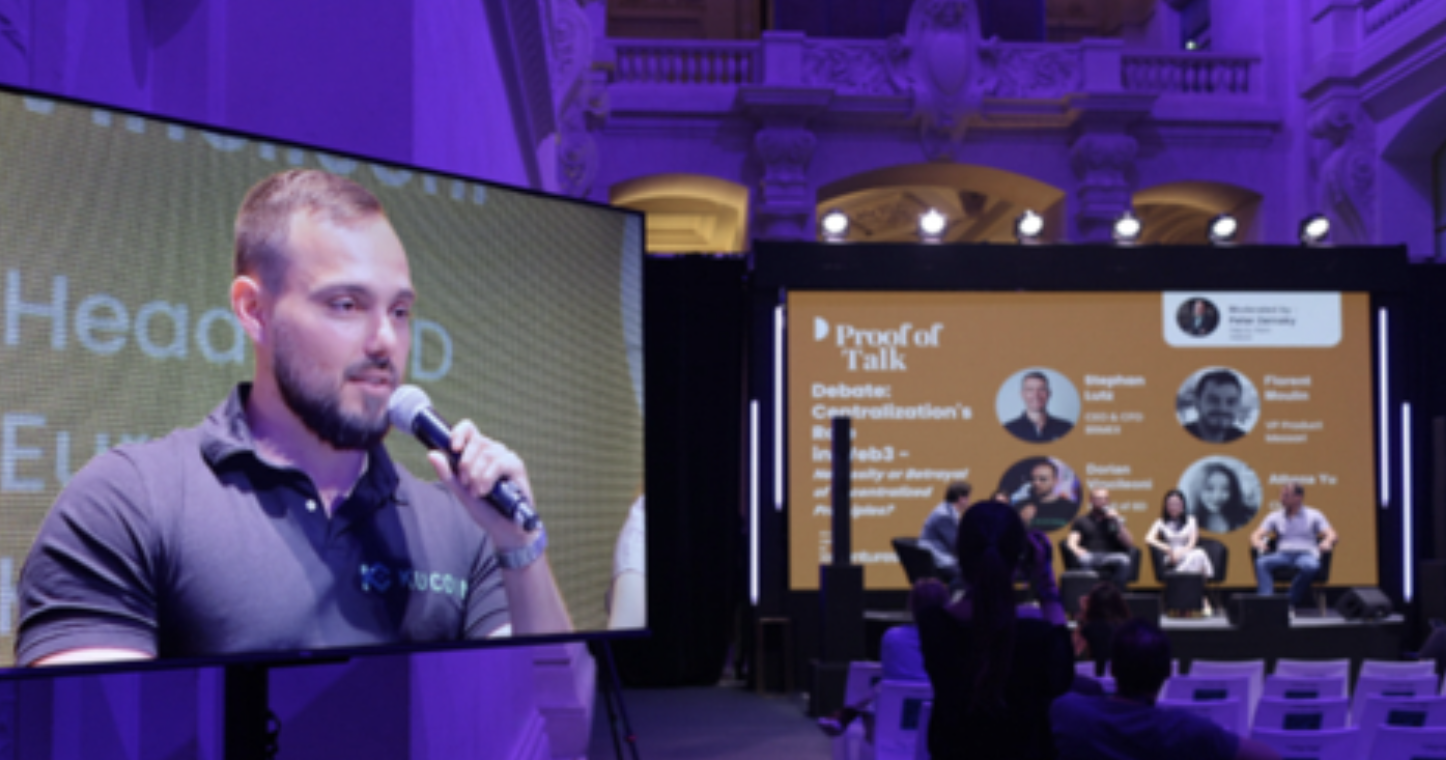

Dorian Vincileoni, Europe business development lead at KuCoin, shared insights at the Proof of Talk 2023 blockchain conference, emphasizing the importance of prioritizing user-centric strategies during these times.

Vincileoni highlighted the value of bear markets in allowing companies to focus on innovation, product development, and enhancing user experiences. By tuning out the noise of bull markets, businesses can better understand the genuine needs of their organic user base.

Rather than being consumed by negative news, Vincileoni urged exchanges to concentrate on continuous improvement and community support, emphasizing that favorable market conditions will eventually return.

“We closely listen to what our organic base is saying and what they are interested in. Our objective is to provide services to actual invested or interested communities,” Vincileoni explained.

Despite a decline in overall market interest, Vincileoni noted that organic communities within the crypto space continue to thrive, indicating that the level of engagement remains substantial.

In terms of regulatory uncertainty, Vincileoni advised against making assumptions, urging industry players to react and adapt swiftly when clear guidelines are established. He described the current landscape as an “adaptive race” and emphasized the industry’s responsibility to ensure user asset safety.

KuCoin’s market survey revealed a strong user interest in the implementation of artificial intelligence (AI) for enhanced security. The exchange promptly refunded affected users following a recent compromise of their Twitter account, demonstrating their commitment to user protection.

Vincileoni concluded on an optimistic note, stating that despite current market conditions, the industry remains brimming with untapped opportunities. He believes that we are merely at the dawn of an era that holds vast potential for future growth and innovation.

As the crypto bear market continues, industry players are leveraging this period to strengthen their offerings, improve user experiences, and foster resilient communities.

Binance CEO CZ Finds Relief as SEC Dispute Concludes Successfully

Binance’s CEO, Changpeng “CZ” Zhao, expressed a sense of relief as the protracted dispute with the United States Securities and Exchange Commission (SEC) finally reached a positive resolution. The prolonged period of regulatory uncertainty had caused tension and uncertainty within the company, making this resolution a much-welcomed outcome for CZ.

As the regulatory uncertainty dissipates, CZ, the CEO of Binance, can now direct his attention towards shaping the future of the company. In a tweet, he emphasized that the SEC’s emergency relief request was unnecessary, underscoring the fact that the agreed-upon resolution would allow Binance to move forward unhindered.

In a significant development, Judge Amy Berman Jackson from the U.S. District Court for the District of Columbia has given her seal of approval to the “Proposed Stipulation and Consent Order ” forged between Binance, Binance.US, and the SEC on June 18. This landmark decision marks a significant step forward in the resolution of the dispute.

As per the court’s ruling, the consent order requires Binance to “repatriate” all fiat currency and cryptocurrency assets associated with Binance.US.

Furthermore, the agreement places restrictions on Binance global officials, preventing them from accessing private keys of all wallets, including cold and hot wallets.

Despite encountering challenges and regulatory obstacles, Binance remains committed to its operations with steadfast determination. Binance CEO CZ expressed his satisfaction with the resolution of the SEC matter and reassured users that their funds are safeguarded and secure across all Binance-related services.

During the period of regulatory scrutiny, Binance remained committed to safeguarding user funds by implementing stringent security measures across all its platforms. The company’s top priority was ensuring the safety and security of funds, providing users with peace of mind amidst the evolving regulatory landscape.

Additionally, Binance disclosed that its BNB Smart Chain is actively exploring the development and launch of a layer-2 blockchain scaling solution to enhance the efficiency and scalability of its ecosystem.

However, that doesn’t necessarily mean that Binance.us is out of the woods yet, as it has been ordered to repatriate all fiat currencies associated with Binance.US.

As per the consent order, Binance must “repatriate” all fiat currency and cryptocurrency assets associated with @BinanceUS by the date specified in the court’s ruling. Additionally, the agreement imposes restrictions on #Binance global officials, disallowing them from accessing…

— Cointelegraph (@Cointelegraph) June 18, 2023

Related Articles

- Kucoin Exchange Review

- Cryptocurrency Market Volatility Persists Amid Bitcoin’s Price Dip and Fed Meeting Anticipation

- Crypto Legislation in Congress Just the First Step, Says Policy Expert

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage