Join Our Telegram channel to stay up to date on breaking news coverage

Facing dwindling business prospects, Ihor Kolomoisky, a former politician and businessman from Ukraine, appears to be turning to the crypto mining space. CC Metals & Alloys (CCMA), a Kentucky-based steel plant owned by Kolomoisky, has been mining Bitcoins for months since shutting down, per reports.

Time to Switch Up

As the report explained, the 70-year-old steel plant shut its doors in July after its core business operations stopped. Following a significant layoff, the plant hopes to get back to its feet by generating income through crypto mining activities.

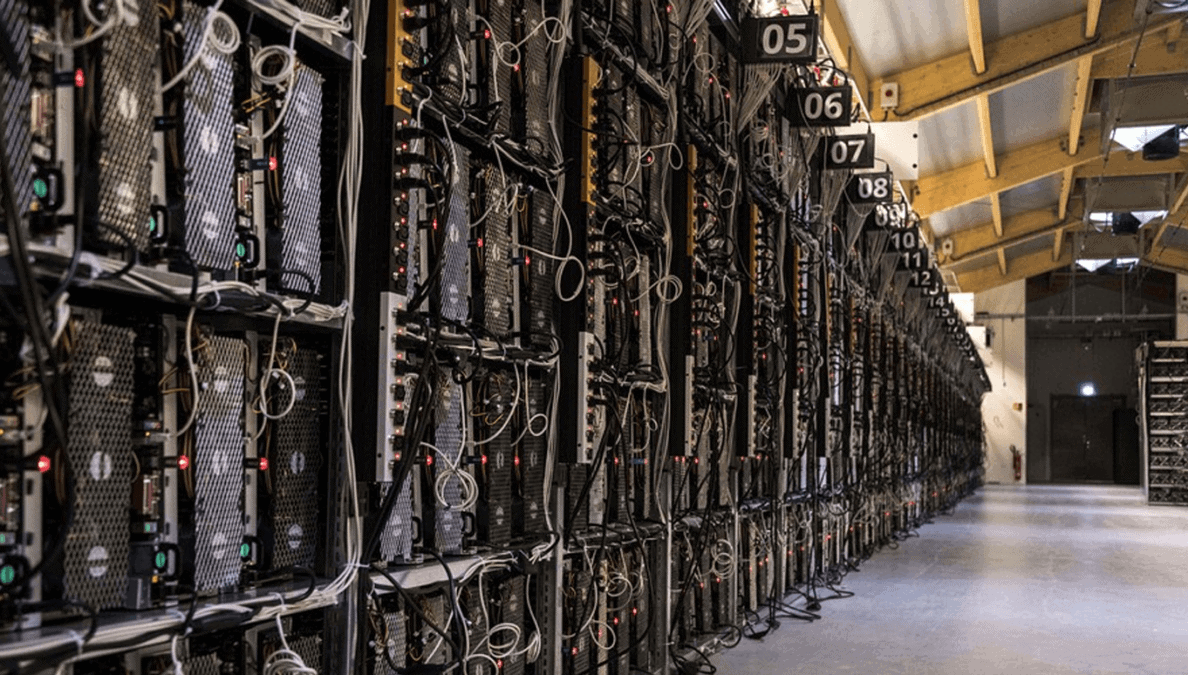

A worker at the steel plant confirmed converting an entire warehouse into a data center. Computers were installed, and according to a separate employee, they have been rigged with mining equipment to operate round the clock. The warehouse is estimated to have possibly thousands of computers mining Bitcoins.

The plant, which started mining Bitcoins in July, reportedly plans to continue its operation for the foreseeable future. A company spokesperson explained that CCMA also expects to jump into the blockchain and artificial technology spaces soon.

Kolomoisky is the former Governor of Dnipropetrovsk Oblast, a city in Central Ukraine. With a reported net worth of $1.1 billion, he is rated as the second-richest man in Ukraine. However, he is not without his controversies. The businessman and his partner, Hennadiy Bogolyubov, are facing a civil lawsuit in the United States after funneling ill-gotten gains into the country.

Russian Businessman Joins the DeFi Craze

The Ukrainian businessman isn’t the only oligarch to make bets on the crypto space recently. In October, Russian news source RBC reported that Aleksandr Lebedev, a former local bank owner and a powerful businessman, was gearing up to back a decentralized finance (DeFi) project.

Per the RBC report, the former oligarch was at the time finalizing a deal to invest between $10 million and $15 million into Independent Decentralized Finance Ecosystem (InDeFinEco,) a DeFi lending protocol. The company also reportedly drew interest from Sergey Mendeleev, the founder of the Russian exchange Garantex.

Lebedev began his career in the KGB and built close ties with the Kremlin and the Soviet ruling party. He acquired the National Reserve Bank of Russia following the fall of the Soviet Union, making it one of the country’s top financial institutions. However, like many oligarchs, he eventually had a run-in with the government.

Speaking of his investment, Lebedev told the news source that he admired the lack of government interference in the DeFi space. He added that while InDeFinEco will primarily focus on lending, the platform will also provide derivatives trading (crypto-based futures and options, mainly) and portfolio management tools.

The businessman added that he would incorporate the platform’s holding company in the crypto-friendly country of Switzerland. He pointed out that they targeted a possible $500 million in total assets locked soon enough, with the hope of cracking the top 10 DeFi protocols.

Join Our Telegram channel to stay up to date on breaking news coverage