Join Our Telegram channel to stay up to date on breaking news coverage

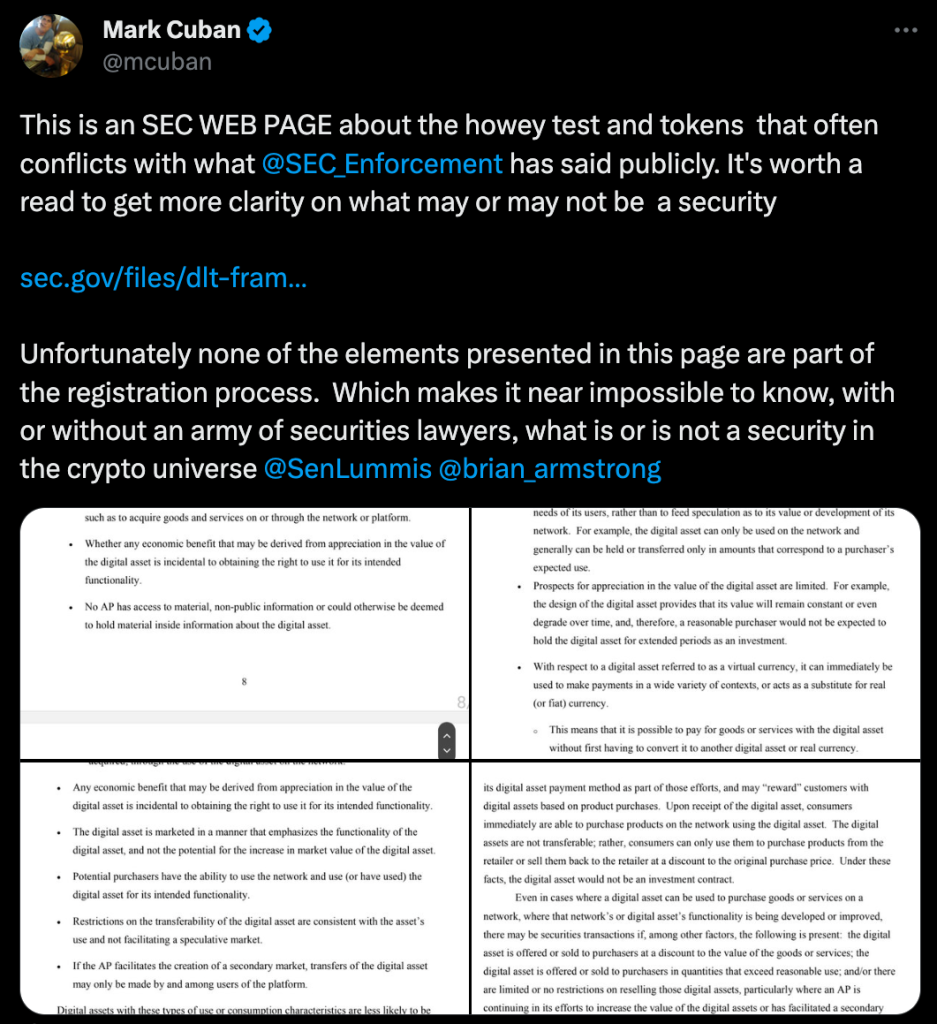

Billionaire investor Mark Cuban recently criticized the United States securities regulator, accusing them of failing to establish a clear registration process for cryptocurrency firms.

According to Cuban, the “Framework for ‘Investment Contract’ Analysis of Digital Assets” document by the United States Securities and Exchange Commission (SEC) does not provide any registration guidelines, creating confusion about what qualifies as a security in the crypto industry.

Mark Cuban Criticizes US SEC’s Lack of Clarity on Cryptocurrency Registration Process

In a tweet posted on June 11, Mark Cuban voiced his discontent, claiming that the elements outlined in the SEC document do not contribute effectively to the process of registration. Consequently, discerning the classification of securities in the realm of cryptocurrency proves to be exceedingly difficult, even when seeking guidance from securities lawyers.

Although the SEC document does offer a brief explanation of the requirements for firms in compliance with federal securities laws, it does not provide a step-by-step outline. These requirements include the disclosure of all pertinent information for investors to make informed decisions and the implementation of essential managerial efforts that affect the enterprise’s success.

Cuban highlighted the lack of transparency from the SEC compared to other areas of the finance industry. Instead of designating “stock loans” as securities or pursuing legal action against brokers and banks, these sectors engage in a “comments process” for clarification. Cuban suggested that a similar approach should be adopted for cryptocurrencies to determine which aspects should be classified as securities and which should not.

U.S. Senator Cynthia Lummis also criticized the regulator for not establishing a comprehensive legal framework or providing clear legal guidance for firms to adhere to.

During the Global Exchange & Fintech Conference on June 8, SEC Chair Gary Gensler asserted that there is indeed a registration process in place, and firms are familiar with the procedures for registration. Gensler’s statements were made in light of recent assertions by Robinhood and top crypto exchange Coinbase, who claimed that they made registration attempts that were ultimately turned down by the SEC.

On June 5 and June 6, the SEC filed lawsuits against Binance and Coinbase, respectively, alleging that these exchanges violated several securities regulations, primarily by offering cryptocurrencies that the regulator considers unregistered securities.

Presently, the SEC classifies a total of 68 cryptocurrencies as securities.

US SEC Classifies 68 Cryptocurrencies as “Securities” in Recent Actions

The United States securities regulator has recently announced an estimated 68 cryptocurrencies being classified as “securities,” with the addition of several more from its lawsuits against Binance and Coinbase.

Throughout its history, the Securities and Exchange Commission (SEC) has undertaken diverse legal initiatives that resulted in categorizing these 68 cryptocurrencies as securities.

As part of its litigation against Binance, the SEC identified 10 cryptocurrencies, namely Binance Coin (BNB), Binance USD (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), and COTI (COTI), and classified them as securities.

In the Coinbase lawsuit, the SEC identified 13 cryptocurrencies, which reaffirmed the classification of SOL, ADA, MATIC, SAND, and AXS as securities and added six more: Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), Near (NEAR), Voyager Token (VGX), and Nexo (NEXO).

Furthermore, the SEC has classified several noteworthy cryptocurrencies as securities, such as XRP (XRP) from Ripple, LBRY Credits (LBC) from LBRY, and ALGO (Algorand). In April, when the SEC took legal action against Bittrex, it identified ALGO among five other cryptocurrencies.

The SEC’s most substantial grouping of cryptocurrencies as securities occurred in February when Terraform Labs faced fraud charges. Sixteen crypto assets, including Terra Luna Classic (LUNC), Terra Classic USD (USTC), Mirror Protocol (MIR), and an estimated 13 Mirrored Assets (mAssets), were classified as securities. These assets aimed to replicate the stock prices of companies like Apple and Tesla.

As a result of its litigated actions, the SEC now oversees over $100 billion worth of the crypto market, representing around 10% of the total market cap of $1.09 trillion.

While SEC Chair Gary Gensler has stated that “everything other than Bitcoin” falls under the agency’s jurisdiction as a security, there are approximately 25,500 cryptocurrencies listed on the CoinMarketCap platform.

Related News

- Why the SEC Excludes Proof-of-Work Assets from Securities Labeling

- Binance.US Suspends All USD Deposits Following SEC Lawsuit

- Mark Cuban Bashes Bitcoin Despite Record Price Levels

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage