Join Our Telegram channel to stay up to date on breaking news coverage

As Web3 becomes a more prominent part of popular culture, NFTs, or non-fungible tokens, have grown to be possibly the most divisive topic in the crypto debate.

An unlikely person, Time’s president Keith Grossman, who has spent the past year constructing the 99-year-old media company’s NFT business, TIMEPieces, from the ground up, is able to block out the cacophony on all sides of the debate.

NFTs are distinctive digital goods, such as works of art and sports trading cards, that are validated and saved using blockchain technology. However, given the energy-intensive nature of cryptocurrencies, some view NFTs as overhyped and potentially environmentally destructive. The network that supports Ethereum, the second-largest coin, is the foundation for many NFTs.

With the development of the Internet, anyone could now watch videos, listen to music, and view photographs for free. People purchase NFTs with the hope that, with the help of blockchain technology, they would be able to demonstrate ownership of a virtual good.

“All it is is a token that enables blockchain ownership verification. The owner’s ability to manage their personal information is its secondary benefit”, according to Grossman, who recently spoke with CNBC.

20,000 TIMEPieces worth $10 million

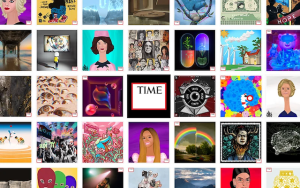

Holders of TIMEPieces tokens can link their digital wallets to TIME’s website to gain unrestricted access to TIME content and exclusive invitations to both online and offline events. Photographs and other digital artwork by 89 up-and-coming Web3 artists, including Julie Pacino, the daughter of actor Al Pacino, Joanne Hollings, and Farokh Sarmad, are among the most well-known tokens in the TIMEPieces collection. Additionally, it has drawn a large number of well-known celebrity collectors, including Anthony Hopkins, Eva Longoria, and Miguel.

TIME puts its recognizable red-frame to every NFT produced by this group of up-and-coming artists, a group that has been hand-selected by the media giant’s creative director, D.W. Pine, in addition to auctioning off original renditions of their most well-known cover stories. As the company gets ready to mark a century of publishing the news-related cover art it is now known for, Grossman characterizes it as emphasizing the “next generation of artists.”

According to Grossman, since September, TIME has created, or “dropped,” more than 20,000 TIMEPieces NFTs that are held by roughly 12,000 digital wallets, roughly half of which are linked to Time.com. This has resulted in $10 million in profit for TIME as well as $600,000 generated for various charities.

TIME recently collaborated with ethereum-based gaming platform The Sandbox to build TIME Square, a virtual place in the metaverse that will be the brand’s primary hub for hosting virtual events for art and commerce.

The Sandbox is one of the biggest metaverse projects, with a $1.5 billion market cap, according to CoinGecko, mostly because it used blockchain technology early on. The Sandbox developer Republic Realm spent $4.3 million to buy a virtual parcel from Atari in November, setting the record for the most expensive digital land sale.

Investors have been eager to claim that the utility of digital assets will be what gives them long-term worth. Institutional investors have found it challenging to understand this message as the prices of collectible artwork, such the well-known Bored Ape Yacht Club and the equally hyped Crypto Punks, have recently plummeted.

One camp developed around the idea of creating a community that had a set of values and beliefs as this new technology was being adopted, according to Grossman. And yet another one centered on what I would refer to as “greed-based communities”

Overcoming communities built on greed

In a recent interview with TIME, Vitalik Buterin, who co-founded ethereum in 2013, expressed concern about tendencies he has noticed in the industry, saying that “crypto itself has a lot of dystopian potential if done wrong.”

“With these $3 million monkeys, it becomes a different form of gambling, which is the danger”, according to Buterin.

Bill Gates claimed that the cryptocurrency and NFT phenomena are “100% based on greater fool theory,” which holds that overvalued items will increase in value when there are enough buyers prepared to pay more for them. Gates made this claim during a recent TechCrunch talk. The multibillionaire co-founder of Microsoft quipped that “expensive digital photos of monkeys” will “immensely benefit the world.”

Since reaching all-time highs in November 2021, the value of cryptographic currencies and metaverse projects has significantly decreased, according to CoinGecko. $2 trillion in value has been lost in cryptocurrencies. It calculates that the metaverse market is currently worth more than $6 billion.

Concerns about the cryptocurrency market have increased as a result of the recent Chapter 11 bankruptcy filing of Celsius, a platform for crypto financing that offered customers who deposited their bitcoin substantial rates. The largest NFT market in the world and the location of the TIMEPieces token listings, OpenSea, said on Thursday that it is reducing its personnel by 20%.

For a second, “forget Bored Apes,” Grossman advised CNBC. “The tokens not only allow you to prove ownership, but it also allows them to affix a royalty on future sales,” the author writes. “When you move out of the collectible sector and focus on the community [of creators and artists]

As the markets are currently somewhat unstable and correcting themselves, Grossman explained, “you’re seeing that the greed-based communities without liquidity in the system are not really performing with the expectations of those communities’ members.”

Online renters becoming brand owners

According to Avery Akkineni, president of NFT consultancy firm Vayner3, the value created in the Web2 era of technology over the previous ten years has gone to tech behemoths rather than innovators. She predicted that media will use blockchain to enable a more decentralized system of payments, incentives, and rewards.

In a May interview with Gary Vaynerchuk’s VeeCon in Minneapolis, Akkineni said, “For enterprises, there’s never been a better time to launch a product that’s free, or very little cost, that allows your audience to participate without a very high barrier to entry pricing point.”

Time is owned by Salesforce co-founder and co-CEO Marc Benioff. In a blog post, Mathew Sweezey, director of market strategy at Salesforce, predicted that 2022 would be the year when “pioneering brands will hunt for utility via NFTs,” citing Time’s project as a “wonderful example.”

Coca-Cola, McDonald’s, Nike, Gucci, and the National Football League are just a few of the large corporations that have included NFTs into their marketing strategies.

According to many commentators, TIME’s entry into the metaverse portends promising future prospects. Illuvium co-founder Kieran Warwick told The Defiant that the more well-known firms that switch to Web 3 the faster broad adoption will happen. For anyone in the industry, partnering with The Sandbox is huge news.

According to Grossman, “media firms have been looking at consumers for years and saying, ‘you’re a renter on my platform. I’ll give you access to portraying your identity on Facebook, Twitter, Instagram, or the like, and in exchange, I’m going to collect your data.'” “What an NFT truly does in the background is it enables customers to own an asset, so you go from being a renter to an owner online… and not actually identify who they are from a personally identifiable perspective.”

In the realm of traditional media, it’s not only Time. In the past year, both The New York Times and The Associated Press have introduced their own NFT collections. However, the premise behind Grossman’s plan is that an online identity is just as significant as a physical one.

According to Grossman, “I started getting extremely interested in the cryptocurrency space in September 2020 because I kept hearing people claim there wouldn’t be any inflation while simultaneously pushing money into the system to attempt to fend off Covid.” “To me, that equation made no sense.”

Covid significantly contributed to the NFT boom. According to a study from NonFungible and BNP Paribas-affiliated research firm L’Atelier, the total value of NFT transactions reached $17.6 billion last year, up from $250 million the year before. This increase was driven by a boom in many asset markets during the pandemic as people were forced to spend more time at home and increased their cash savings by using the internet and other online services.

When everything came together for Time’s president and Marc Benioff

An online auction in February 2021 saw a crypto art recreation of the 2011 Nyan Cat meme sell for around $590,000. Benioff, who selected Grossman as the publication’s first president after purchasing it from Meredith Corp. for $190 million in 2018, noticed it, according to Grossman.

When everything finally came together, according to Grossman, it was a logical continuation of Time’s red-frame cover stories. “I promised that we would begin accepting cryptocurrencies for online payments in 30 days. Currently, 33 coins are accepted by us for digital subscriptions. Then I added that we will find out how to use a token and a blockchain to alter a consumer’s relationship with our brand within six months,” Grossman continued. “Sincerely, I had no idea how we were going to pull that off. I just had a feeling it was doable.

Time platforms have a wide range of populations. The average TIME magazine reader is a 50-year-old guy, whereas the average Time.com reader is a 40-year-old woman. Sixty-two percent of TIME’s social media users are under the age of 35, and one-third are located outside of the United States.

It’s “tiny; it’s like a psychographic of people who weren’t thinking about Time before, but all of a sudden like the brand” in the case of NFTs, according to Grossman.

While a Time.com digital subscription typically costs around $24, TIMEPieces NFTs typically cost around $1,000.

As a result of community development, he claimed, “we’re able to have just as strong a relationship with the consumer, if not greater, as when we sell a $24 subscription.” “The hero is always the creator, outside of the [Time] name and outside of a tiny emblem in the corner. They have a sizable fan base and are supported by their community; TIMEPieces then steps in and says, “We want you to be a part of this. We’re validating the creative and their community.

There are many naysayers, despite the fact that well-known investors continue to believe in the long-term potential of digital assets.

According to Akkineni, there is “a lot of hesitation” regarding the importance of this wave of digital asset ownership. It’s amazing how many CEOs genuinely make the time to learn, both from a business-building perspective and from a community-building perspective, as well as from a customer engagement viewpoint.

Although the rise of NFTs is still relatively recent, collectors have already traded enormous sums of money. According to NonFungible, which analyzes historical sales data of NFTs, for instance, NFT collectibles have earned over $6.2 billion in sales since 2017, while digital art has generated over $1.9 billion.

Grossman, who is the most optimistic about the fundamental idea, claims that the ultimate goal is to advance the technology beyond the NFT.

According to Grossman, it wasn’t until Steve Jobs held up the iPod and declared that we would have “1,000 tunes in our pocket” that consumers began to focus on the experience rather than the technology. “I believe that in order for technology to be widely adopted, it must become invisible. The technology is driving the debate at this early stage of NFTs, and the term NFT ought to become obsolete. The token should essentially disappear into the background and serve just to support the experience’s online verification.”

“You need a lot of friction to come out of the system for it to happen,” he continued.

Related

- The Sandbox Teams up with Time to bring Times Square to the Metaverse

- NFTs Explored — What are NFTs? How to Buy NFTs & What’s the Best NFT to Buy Now in 2022?

- Best NFTs to Buy and How to Buy NFTs

Join Our Telegram channel to stay up to date on breaking news coverage