Join Our Telegram channel to stay up to date on breaking news coverage

The Hedera price prediction shows that HBAR faces significant downward pressure as the coin moves near the channel’s lower boundary.

Hedera Prediction Data:

- Hedera price now – $0.223

- Hedera market cap – $8.53 billion

- Hedera circulating supply – 38.26 billion

- Hedera total supply – 50 billion

- Hedera Coinmarketcap ranking – #19

Getting into crypto projects early can be highly rewarding, and Hedera (HBAR) is a prime example, having surged +2129.13% from its all-time low of $0.01001 on January 2, 2020. Currently trading between $0.2216 and $0.2427 in the past 24 hours, HBAR is still down 60.85% from its all-time high of $0.5701 on September 16, 2021, but its historical growth highlights the potential of long-term investments in promising blockchain projects. As the crypto market evolves, opportunities like these continue to emerge for those who stay ahead of the curve.

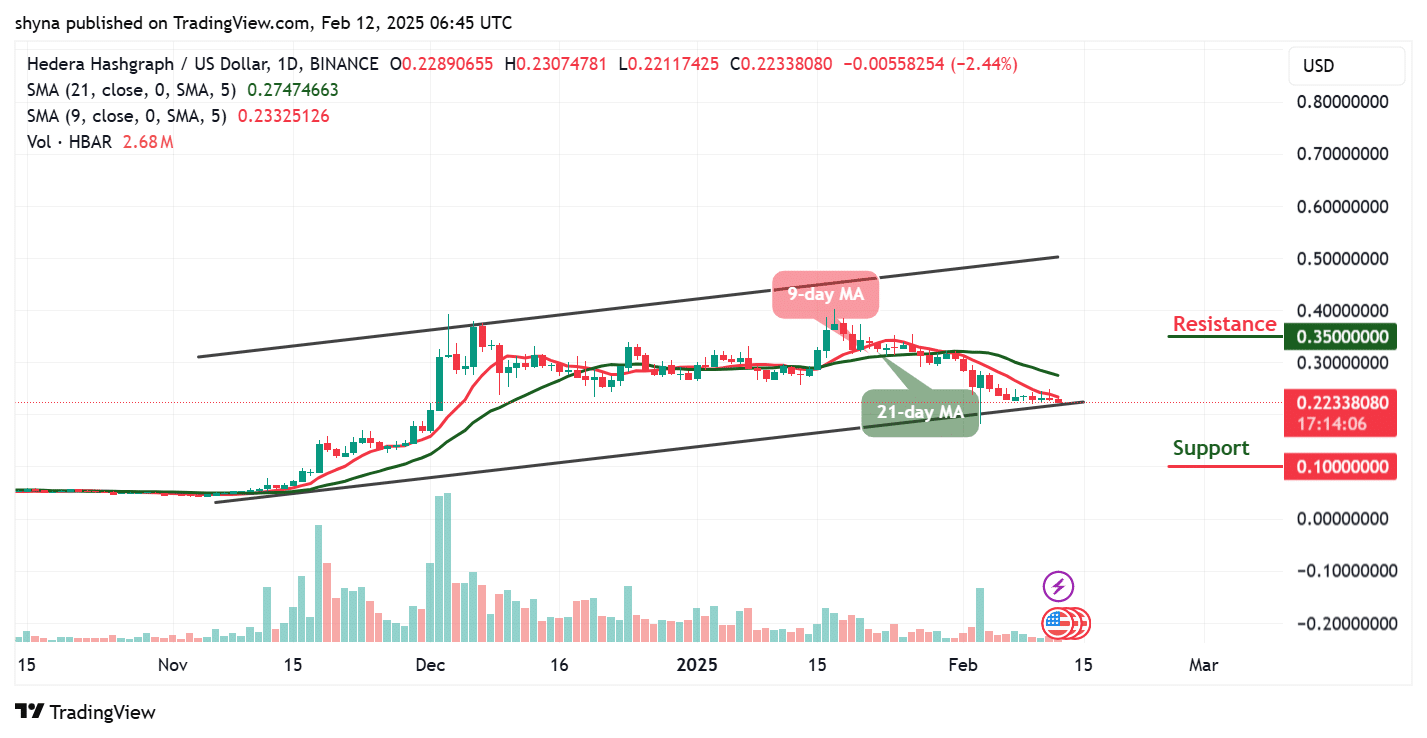

HBAR/USD Market

Key Levels:

Resistance levels: $0.350, $0.370, $0.390

Support levels: $0.100, $0.080, $0.060

HBAR/USD is experiencing a period of consolidation followed by a breakdown in price action. The key trading range between $0.220 and $0.230 has been maintained since early December, providing a strong support zone. However, the recent drop below this range signals bearish momentum, indicating that HBAR is struggling to sustain price stability amid a weakening altcoin market. While Hedera’s fundamentals remain strong, including an increase in Total Value Locked (TVL) and potential ETF-related catalysts in 2025, these factors have not been enough to counter the ongoing market downturn.

Hedera Price Prediction: Hedera May Touch $0.150 Low

According to the daily chart, the Hedera price is currently hovering at $0.223, hovering near a key support level of $0.220 while remaining inside an ascending channel. The 9-day MA (0.233) is below the 21-day MA (0.274), signaling ongoing bearish momentum. Meanwhile, the price is testing the lower boundary of the trend channel, which has historically acted as strong support. Therefore, if buyers step in at this level, a potential rebound toward the 9-day and 21-day MAs could occur, with a breakout above these levels opening the door for a retest of $0.300 resistance. However, if the 21-day MA continues sloping downward, it may act as dynamic resistance, preventing a strong recovery.

On the downside, if the current support fails to hold and $0.150 is breached, it could trigger further downside pressure toward the support levels of $0.100, $0.080, and $0.060, possibly leading to a more significant correction. Moreover, the declining MAs and weakening momentum suggest sellers are still in control unless volume increases significantly to confirm a reversal. For a bullish recovery, HBAR must reclaim $0.274 (21-day MA) and break above the $0.300 resistance to shift the overall trend upward which may locate the potential resistance levels at $0.350, $0.370, and $0.390. Until then, the market structure remains bearish, and traders should monitor support levels closely for confirmation before entering long positions.

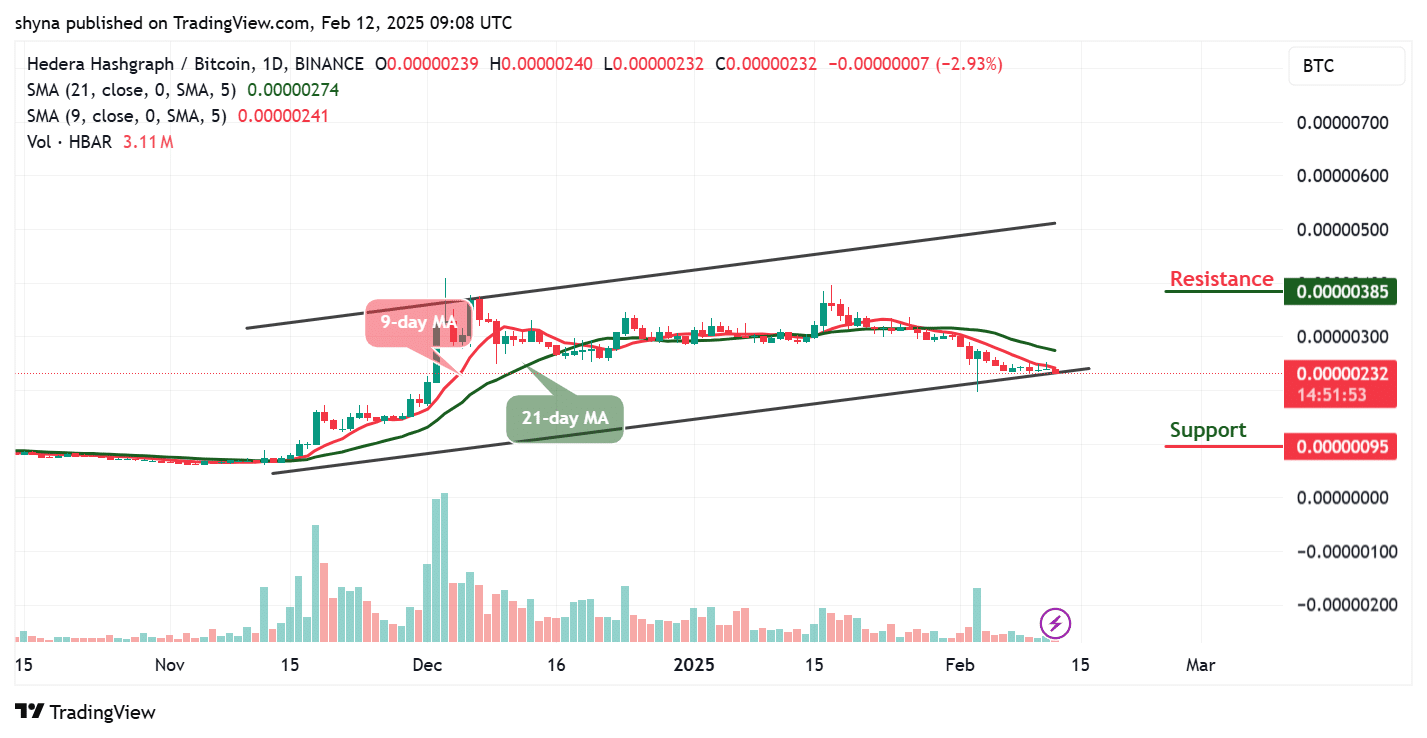

HBAR/BTC Consolidates Below the Moving Averages

The HBAR/BTC pair is currently trading at 232 SAT, sitting just above a crucial support level of 950 SAT while maintaining an overall bullish channel structure. The 9-day MA (241 SAT) is below the 21-day MA (274 SAT), indicating short-term bearish pressure. However, price action is still respecting the ascending trendline, suggesting that bulls are defending the lower boundary of the channel. Meanwhile, if buyers step in at this level and push the price above the 9-day MA, traders could see a recovery toward 274 SAT (21-day MA) and possibly hit the resistance level of 385 SAT and above. A confirmed breakout above this level would signal a continuation of the broader uptrend.

On the downside, failure to hold the current support and a break below 100 SAT could trigger a strong sell-off, leading to a significant drop in price. Any further bearish movement could touch the support at 95 SAT and below. However, the declining short-term MAs suggest that momentum is currently in favor of the bears unless volume spikes and buying pressure increases. Meanwhile, for the bullish structure to remain intact, HBAR must reclaim 274 SAT (21-day MA) and close above 300 SAT in the coming sessions. Until then, the market remains in a consolidation phase with a risk of further downside if bulls fail to defend the trendline support.

Crypto analyst @CryptoZenStudio shared on X (formerly Twitter) that $HBAR has been consolidating for months, eliminating weak hands and gaining strength. According to him, once it breaks out, the rally will be legendary.

$HBAR has been consolidating in this range for months, shaking out the weak hands, and building strength. When it breaks out, it’ll be legendary. pic.twitter.com/4GhgyoZgQW

— Birdman (@CryptoZenStudio) February 11, 2025

Alternatives to Hedera

HBAR continues to face downward pressure until it finds strong support. The lack of bullish momentum and declining open interest suggest a higher probability of a further dip before a potential recovery. However, if buying volume increases near the $0.20-$0.18 range, a price reversal could be triggered, leading to a retest of previous highs. Meanwhile, Wall Street Pepe has surged past $73 million in its pre-sale phase, with demand continuing to rise despite a slight pullback in the broader crypto market. The project is currently raising over $1 million per day, making it one of the most promising ICOs in recent times. With just 9 days and 18 hours left until the pre-sale ends, investors are rushing to secure tokens ahead of the first exchange listing.

Wall Street Pepe Ahead Of First Exchange Listings

With Wall Street Pepe surpassing $73 million in its pre-sale and raising over $1 million daily, now is the time to secure your tokens before the sale ends in just a few days. The project is rapidly gaining momentum, with a strong community and high expectations for major exchange listings, mirroring the 7x gains seen with Pepe Unchained. Early investors stand to benefit the most, especially if market conditions turn bullish at launch. Don’t miss this opportunity—buy with ETH, USDT, or BNB, and position yourself for potentially massive returns. Act fast before the $75 million hard cap is reached.

Related News

- Hedera Price Prediction: HBAR Pumps 4%, But Investors Rush To Buy This Crypto Wallet Token With 506% Staking APY

- Wall Street Pepe Presale Ends Early After WEPE Tokens Soak Up More Than $73M – Listing Soon

Newest Meme Coin ICO - Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool - High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage