Join Our Telegram channel to stay up to date on breaking news coverage

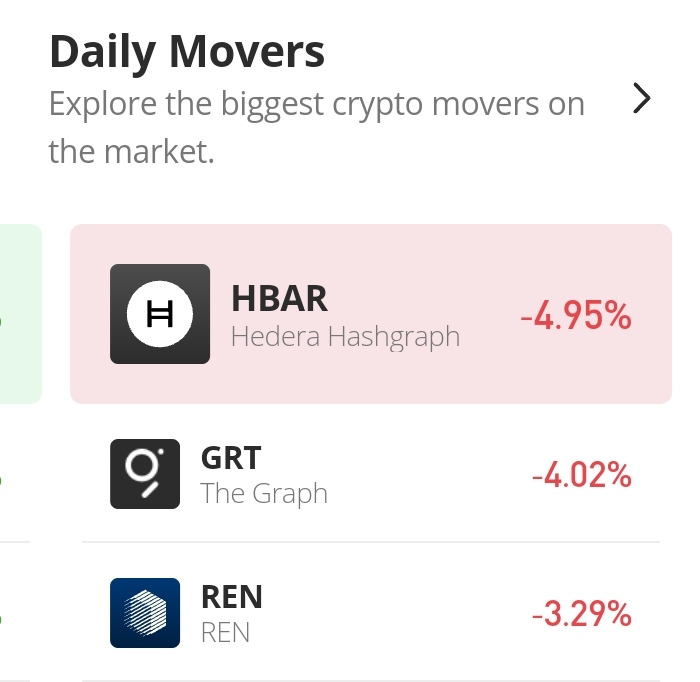

HBAR/USD had a very bullish price trend yesterday. The price increased by 15.3% in that one day. It rose from $0.06414544 to $0.07394772. At this height of the price in today’s market, traders decided to sell their crypto after considering that it is the highest point that the price will reach. This accounts for the very bearish market trend that we are seeing in today’s market. There is still the chance that the market may reverse to continue its upward trend.

Hedera Hashgraph Market Price Statistic:

- HBAR/USD price now: $0.069880255

- HBAR/USD market cap: $1,579,716,032

- HBAR/USD circulating supply: 22.97 Billion

- HBAR/USD total supply: 50,000,000,000

- HBAR/USD coin market ranking: #38

Key Levels

- Resistance: $0.07500000, $0.07758857, $0.08000000

- Support: $ 0.065000000, $0.06412611, $0.06000000

Your capital is at risk

Hedera Hashgraph Market Price Analysis: The Indicators’ Point of View

In the Relative Strength Index, we can see that the RSI line had not reached the overbought zone. The price of the asset is still within the range of its value. Therefore it is likely that the price resume the uptrend soon. Between yesterday and today, the RSI line fell from 64% to 54%. This is still in the range of a strong market measurement. The signal line confirms that the uptrend may continue as it has not responded to the change in the market yet. The histogram of the Moving Average Convergence and Divergence still shows strong bullish activities. But the bullish histogram for today does not have much height when compared with that of yesterday’s histogram. But, yesterday’s histogram is much taller than that of the day before it.

Hedara Hashgraph: HBAR/USD 4-Hour Chart Outlook

On this timeframe chart, we can see how sellers aggressively dominated the first trading session of the day, but in the second session, the bearish momentum reduced. This signifies a bullish recovery. The bulls are beginning to take the third session. And, the RSI line is attempting a recovery to the upper level to confirm that the trend may soon continue.

Related

Join Our Telegram channel to stay up to date on breaking news coverage