Join Our Telegram channel to stay up to date on breaking news coverage

Grayscale Bitcoin Trust’s (GBTC) share price rallied on Tuesday morning, charged by projections of its conversions into an exchange-traded fund (ETF) following BlackRock’s recent filing for a spot Bitcoin ETF.

GBTC Shares Surpassed $16 Billion Mark

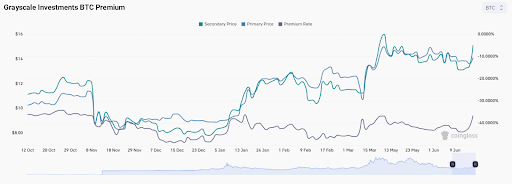

GBTC shares on secondary markets rallied, surpassing the $16 billion mark for the first time since May 10. Since BlackRock lodged its filing last Thursday, there has been a noteworthy upswing in share prices, with an impressive 24% increase, as reported by Bloomberg.

Following this impressive performance, Grayscale’s discount on its underlying Bitcoin holdings tapered to about 37% versus 44% a week ago.

According to CoinTelegraph, data from the blockchain monitoring resource CoinGlass shows that on June 17, the GBTC almost hit new 2023 highs.

“If the BlackRock ETF gets approved, the real winner will be GBTC,” Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, wrote in part of Twitter commentary at the weekend.

I’m a skeptic and a pessimist and even I think the Blackrock ETF filing has good odds.

Very different structure than other efforts by a behemoth who doesn’t lose.

‘30 act redeemable trust w/ redemptions (unlike GBTC) + proposed rule change filing.

They came to play.

— Adam Cochran (adamscochran.eth) (@adamscochran) June 16, 2023

Cochran Is Optimistic that BlackRock will get U.S. Regulatory Approval

The BlackRock move is already clouded in its squabbles as market commentators argue over whether it is, in fact, an ETF at all. Some argued that it is similar to Grayscale’s Bitcoin Trust, while others, including Cochran, have adopted a completely different view stating that Blackrock’s bid will sail through.

Separately, investor interest in GBTC is rising, and North Rock Digital is among the eager buyers.

“We have been accumulating more of the Grayscale trusts consistently over the last several weeks,” the investment company announced post-BlackRock spot Bitcoin ETF proposal. “RR seems massively skewed at current levels. 50% upside if Grayscale wins and minimal downside if they lose. This filing could catalyze them to tighten to more logic levels.”

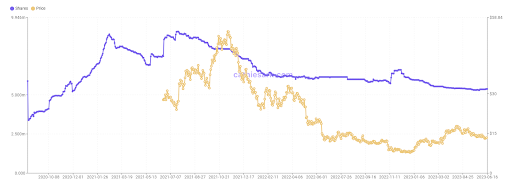

Meanwhile, ARK Invest is another holder yet to up exposure, although it holds around $5.37 million GBTC shares. Data from Cathie’s ARK-a dedicated tracking website for ARK Invest CEO Cathie Wood-confirms those holdings are declining through 2023.

“Because BlackRock will show the path to conversion, and GBTC’s 40%+ discount will resolve on top of industry growth.”

Cochran said that he thought BlackRock’s offering has “good odds” of getting U.S. regulatory approval.

Positive Market Sentiment Is Boon For Bitcoin

Bitcoin market sentiment improved last week as news emerged that the world’s largest asset manager, BlackRock, had filed to launch a Bitcoin spot price exchange-traded fund.

This surge in investor optimism is due to the probability of future fund redemptions, coupled with the ongoing lawsuit between Grayscale and the U.S. Securities and Exchange Commission (SEC) regarding the conversion of its Bitcoin Trust (GBTC) into an ETF.

Market participants see BlackRock’s direct entrance into the crypto market as a positive signal for the Bitcoin Trust’s discount case. Additionally, this could increase redemption opportunities for GBTC holders soon.

On the contrary, Grayscale’s liquidity remains low, further contributing to the narrowing of discounts.

“Many are taking BlackRock’s conviction as a sign that they expect Grayscale to win its case against the SEC, and want to be in with an ETF filing should that happen,” macro analyst Noelle Acheson said in a note, as reported by Yahoo Finance.

She added that it doesn’t mean that GBTC could convert into an ETF right away if Grayscale wins (it depends on whether the SEC chairperson pulls out more tools in his box to fight it), making it more likely that the Trust’s holders would be able to redeem their shares.

“The discounts have also narrowed further as GBTC’s liquidity remains low,” Vetle Lunde, an analyst at digital asset research firm K33, said in a written statement.

Lunde added that at the current discount level, “the market implies that GBTC will remain close-ended until 2042 (when adjusting for annual fees). Thus, one could easily argue that Grayscale remains substantially underpriced due to backlash from all the built-up leverage from 2020-2021.”

Moreover, rumors have emerged surrounding Fidelity, another prime investment management firm, potentially filing for a spot Bitcoin ETF or acquiring Grayscale. News that has been confirmed indicates that Fidelity Investments backed EDX Markets is now live, with trading for BTC, ETH, LTC, and BCH.

Nonetheless, a Fidelity spokesperson clarified that the company has not made steps toward the application of a spot BTC ETF with the SEC. He explicitly stated that there were no filings since the SEC’s contradiction of the Wise Origin Bitcoin Trust application in March 2021.

Related Articles

- How to Buy Bitcoin Online Safely

- TWITCH Token Surges 7,500% on DEXTools, Drawing Crypto Whales to Accumulate Before Exchange Listings – Early Buying Tips

- Late to Binance Coin? Recent Recovery of BNB Token Shows 3% Upswing, With Traders Eyeing AI Crypto Signals Platform for Next High Performance

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage