Join Our Telegram channel to stay up to date on breaking news coverage

XPTUSD Price Analysis – June 01

Platinum price may decrease further and reached the $776 demand level in case the Bears’ momentum does not weak. In case the Bears’ momentum becomes weak, the price may start consolidation within the range of $833 and $776 level.

XPT/USD Market

Key levels:

Supply levels: $833, $898, $962

Demand levels: $776, $714, $657

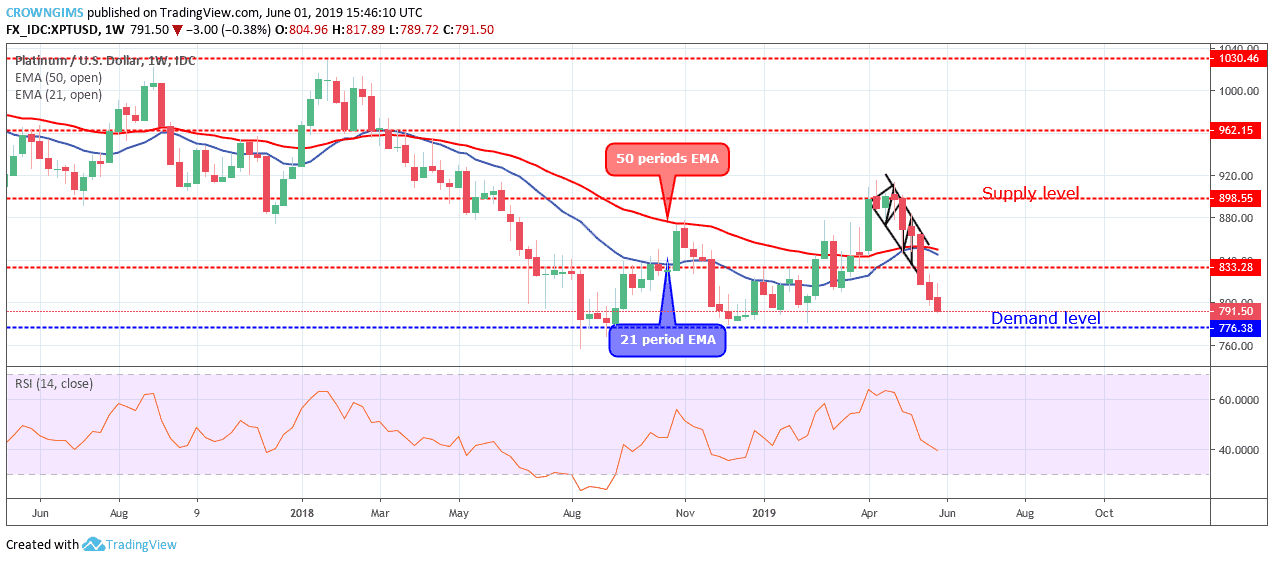

XPTUSD Long-term trend: Bearish

XPTUSD is bearish on the weekly chart. At the early stage of the last week trading, the Platinum price was increasing towards $833 level. After few days of Bullish trading, the Bears interrupted the price increase and pushed the Platinum price down towards the demand level of $776 level; that is why the weekly candle has an upper long tail, although, the $776 mark was not reached.

There is a further increase in the distance between the price and the two EMAs; which is an indication of strong bearish pressure. Meanwhile, Platinum continues trading below the 21 periods EMA and 50 periods EMA, and the Relative Strength Index period 14 is at 40 levels with the signal line pointing down to indicate sell signal. Platinum price may decrease further and reached the $776 demand level in case the Bears’ momentum does not weak. In case the Bears’ momentum becomes weak, the price may start consolidation within the range of $833 and $776 level.

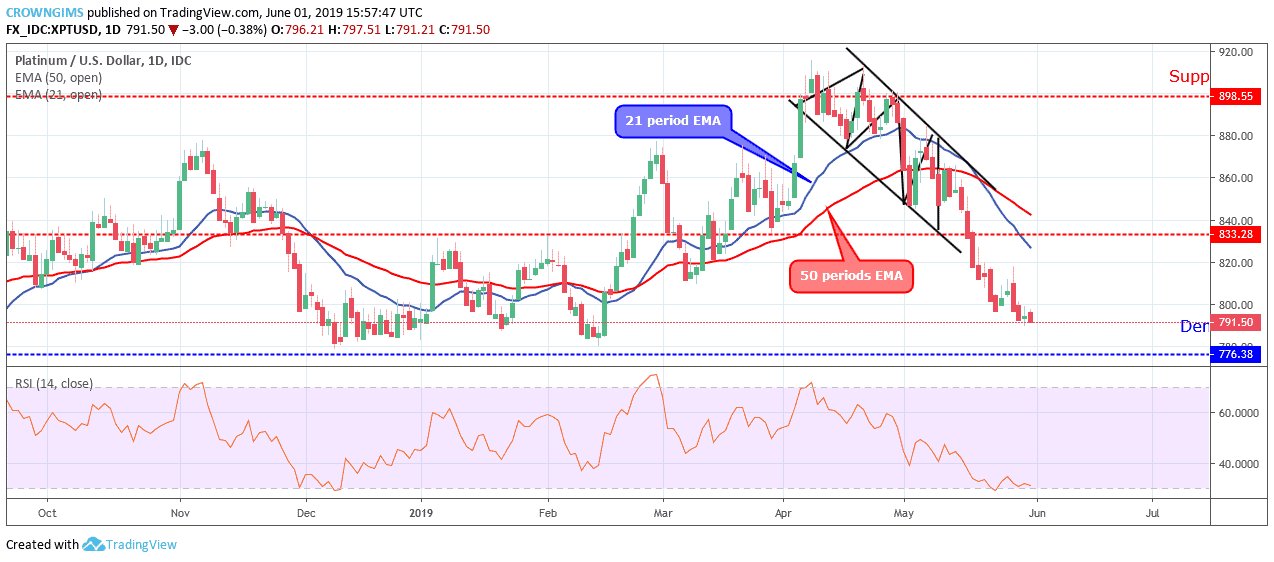

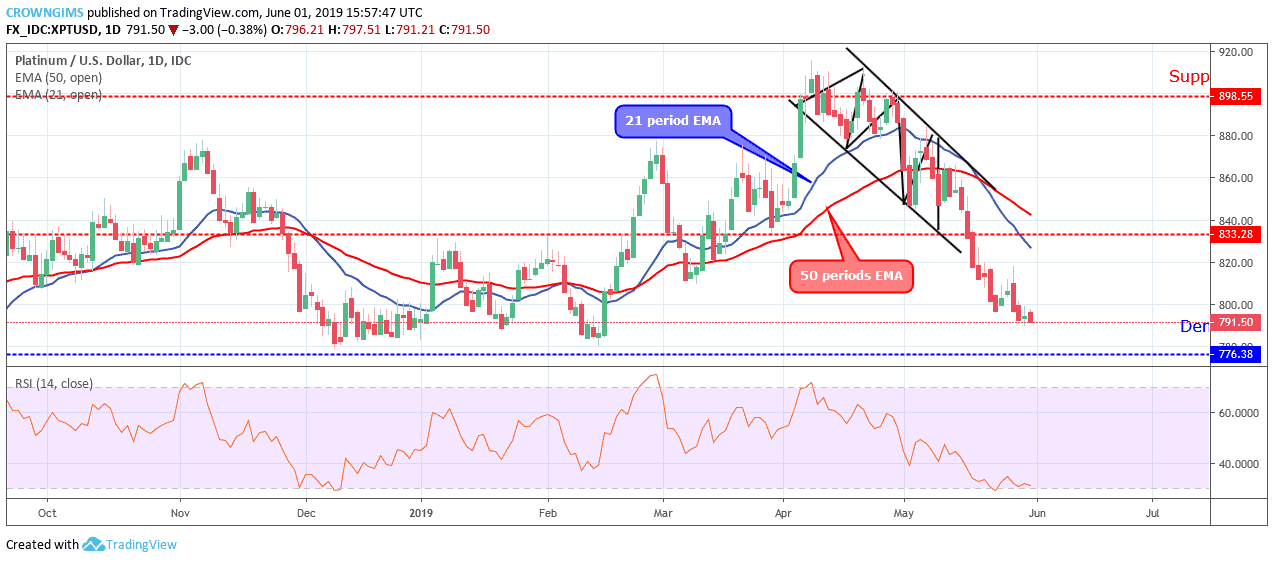

XPTUSD medium-term Trend: Bearish

XPTUSD is on the bearish trend in the medium-term outlook. Platinum price experienced a pullback on May 24 and May 27; this is a normal phenomenon in a good trending market. Later on May 28, the Bears resumed their bearish duty and the price descended further towards $776 level.

The 21 periods has crossed the 50 periods EMAs downward and the Platinum maintains its trading below the 21 periods EMA and 50 periods EMA which indicates a strong bearish movement in the Platinum market. The Relative Strength Index period 14 is at 20 levels and the signal lines bending down, which connotes sell signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage