Join Our Telegram channel to stay up to date on breaking news coverage

GBPJPY Price Analysis – May 28

Further increase in pressure of the Bears may decrease the price further to the demand level of $137. Should the Bulls interrupt the bearish move, the price may consolidate further for a short period of time before a specific direction is taken.

GBP/JPY Market

Key levels:

Supply levels: $139, $141, $143

Demand levels: $137, $134, $130

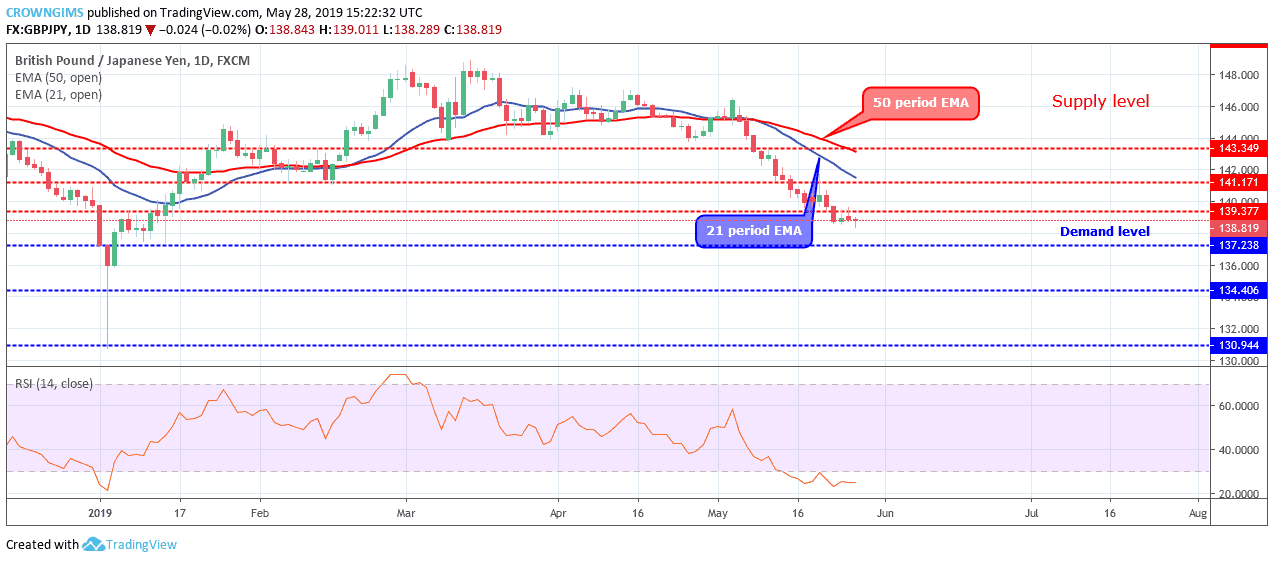

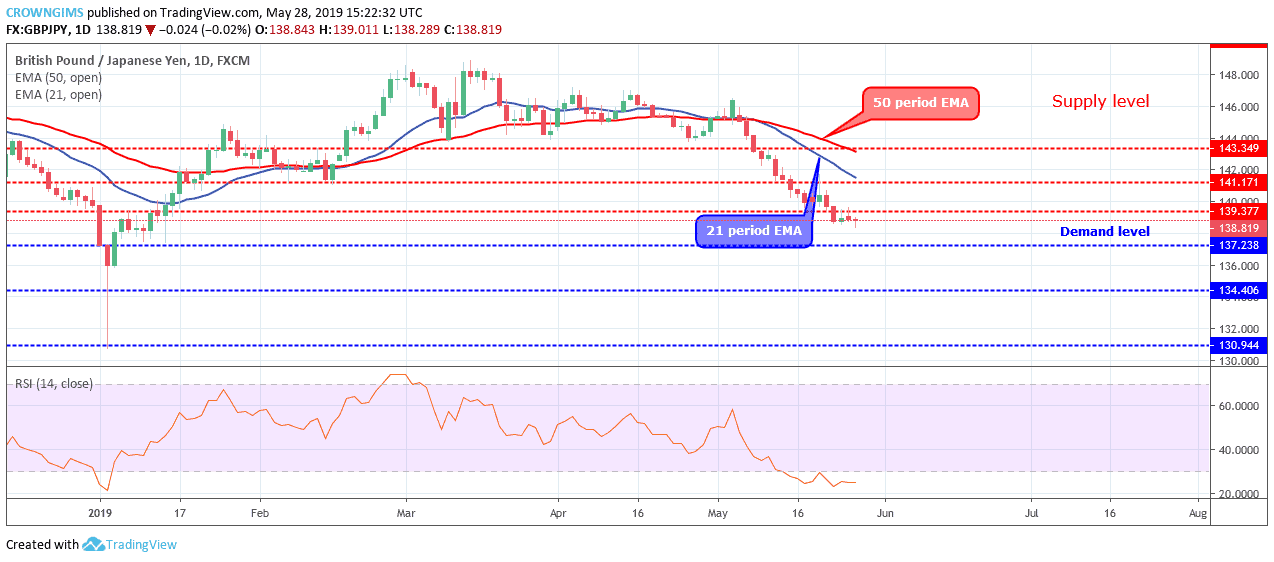

GBPJPY Long-term trend: Bearish

GBPJPY continue bearish movement on the long-term outlook. The bears hold tight to the GBPJPY market. The bearish trend continues; the Bears defended the supply level of $141 and exerted more pressure with the formation of more bearish candles. The bearish momentum broke down the $139 former demand level. The price is currently exposed to $137 level, though the bearish momentum is getting weak as the pair is consolidating.

Further increase in pressure of the Bears may decrease the price further to the demand level of $137. Should the Bulls interrupt the bearish move, the price may consolidate further for a short period of time before a specific direction is taken.

Meanwhile, the currency pair is still trading below 21 periods EMA and 50 periods EMA, the distance between the pair and the EMAs is increasing as a sign of an increase in bearish momentum. The Relative Strength Index period 14 is below 30 levels with the signal lines flat horizontally showing no direction to indicate consolidation is ongoing in the GBPJPY market.

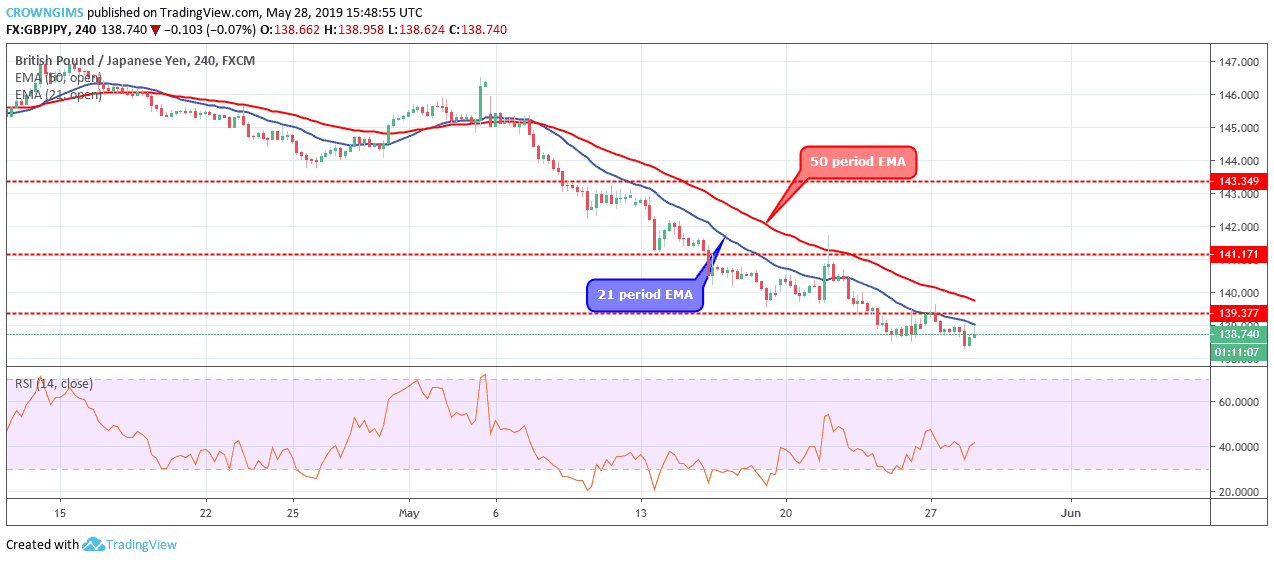

GBPJPY medium-term Trend: Bearish

GBPJPY is under the strong bearish momentum in the medium-term outlook. The GBPJPY currency pair is making lower lows movement in the 4-hour chart. The price is trending downward. The pin bar candle formed on May 21 empowers the Bears to increase their momentum which led to a further decrease in GBPJPY price.

The price remains trading under the 21 period EMA and 50 periods EMA. The Relative Strength Index period 14 is at 40 levels and the signal line pointing upward as an indication to go long.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage