Join Our Telegram channel to stay up to date on breaking news coverage

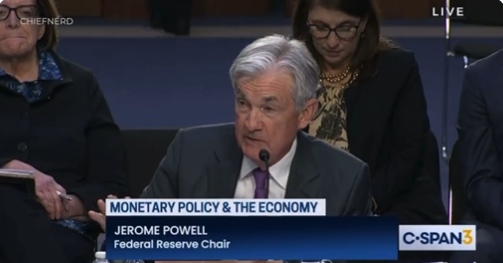

On March 7, during a hearing before the Senate Banking, Housing, and Urban Affairs Committee, Senator Cynthia Lummis (R-Wyoming) inquired about the significance of permissionless distributed ledgers in the financial system. Responding to Senator Lummis’ question, Federal Reserve Chair Jerome Powell said:

“The susceptibility of permissionless public blockchains to fraud and money laundering has raised genuine concerns. As stated in one of their reports, such blockchains are generally viewed as incompatible with safety and soundness.”

Powell suggested that stablecoins have the potential to integrate with traditional banks if they are subject to adequate regulation comparable to other financial products in the industry. If stablecoins are regulated like other financial products, they could be considered a viable option for the financial services sector.

During the hearing, Lummis also raised concerns about regulating digital assets and drew a parallel between the U.S. and other countries like the U.K., the E.U., Switzerland, and Singapore. These nations have made significant strides in developing legislative frameworks for digital assets in recent years, while the U.S. has been trailing behind.

Powell stressed the importance of developing a practical and effective legal framework for digital activities. He acknowledged it is a critical issue that needs to be addressed, but added that it falls outside the Federal Reserve’s purview. Powell suggested Congress take the lead in creating such a framework, as they have the jurisdiction and expertise to develop a comprehensive legislative framework for digital assets.

The recent events surrounding Silvergate Bank serve as a live demonstration of the potential risks associated with a crypto concentration in the banking industry. Most of the bank’s crypto customers have withdrawn their deposits from the struggling institution, underscoring the potential downsides of relying too heavily on cryptocurrency.

Hope for Crypto Regulation

During his testimony before the Senate Banking Committee on Tuesday, Federal Reserve chairperson Jerome Powell offered little optimism for the crypto industry. However, he expressed his hope that there could be something valuable and groundbreaking within the chaos of the crypto market.

Powell stated:

“It’s important to remain open to the possibility that the technology underlying crypto could lead to beneficial innovation that improves people’s lives. However, there is a need to explore and understand the potential uses of this technology despite the current volatility and instability in the crypto industry.”

In his testimony, which continues on Wednesday, Powell highlighted the issues surrounding cryptocurrency several times. He noted the crypto space experienced significant turmoil over the past year, with companies collapsing and high-profile fraud being exposed. He further advised regulated financial institutions to exercise caution when engaging in crypto activities, citing various indicators that suggest the need for prudence in the crypto space.

U.S. banking regulators, including the Federal Reserve, have consistently issued statements and policy interpretations that warn banks about their involvement in the crypto industry. In their latest warning, the regulators explicitly stated that banks primarily concentrating on crypto-related activities are unlikely to meet the safety-and-soundness standards, which are the basic requirements for continued operation in the United States.

Powell’s remarks on the economy immediately impacted the cryptocurrency sector, particularly his view on inflationary pressures being higher than expected. This caused Bitcoin (BTC), considered a riskier asset that declines when interest rates increase, to drop by 1.6% and fall below $22,000. However, the price has since rebounded slightly and is currently trading at $22,319.

More News

Interest Rates May Rise Higher Than Expected, Warns FED Chair Powell

SBF’s Alameda Rese Yuarch Wants $9 Billion From Grayscale

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage