Join Our Telegram channel to stay up to date on breaking news coverage

There has been a great deal of excitement around Ethereum following the implementation of the London hard fork. Considering that this is one of the most important network upgrades to come to the popular decentralized applications (dapps) platform, fans and industry insiders believe that there is a lot of potential for Ether price to jump even higher.

In this article, we explore the recent upgrade and how it could drive growth for Ether.

The London Hard Fork: What is It?

As explained, the London hard fork is one of the most important in Ethereum’s journey to its much-anticipated Ethereum 2.0 upgrade. The hard fork went live on August 5, marking another step in Ether’s goal of becoming a deflationary asset.

While the hard fork contains five Ethereum Improvement Proposals (EIPs), the most important is EIP-1559, which will introduce a base fee burn on each Ether transaction. This will automatically reduce the amount of ETH in circulation. This is the primary trigger for Ethereum’s deflationary transformation.

There is also the EIP-3554, which will play a significant role in Ether’s move to proof-of-stake (PoS) mining.

EIP-3554 delays the “difficulty bomb,” which is coded to increase the difficulty of Ether mining. The difficulty bomb essentially freezes Ether in preparation for its transition to PoS. It is meant to disincentivize miners from using proof-of-work (PoW) once Ethereum 2.0 goes live by making it more difficult to get block rewards.

So far, the London hard fork has been working pretty well. Data from Etherchain shows that the network has burnt about 4,381.2 ETH since London went live. That’s about $12.1 million worth of ETH at current prices.

With EIP-3554, the difficulty time bomb is pushed to December 1. This means that Ethereum 2.0 could come at the end of the year. This marks the fourth time that the time bomb will be delayed. Unless the Ethereum network is ready for its transition, the time bomb will be delayed again.

ETH: Price Movement and Analysis

Even before the London hard fork went live, Ether has been on an impressive price trajectory. As one of the large-cap cryptos, the Ether has benefited from the current market recovery.

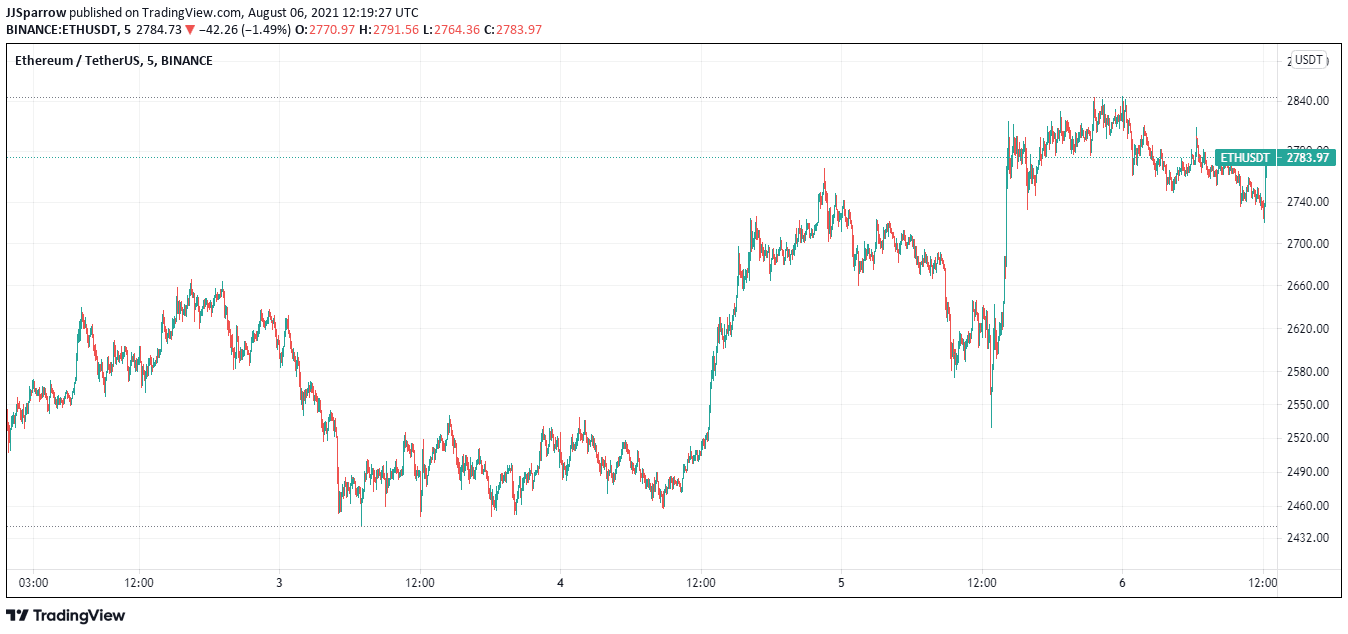

After falling from its all-time high of $4,340 in May, Ether has failed to cross the $3,000 mark. The current market recovery has brought it to $2,771, meaning that the asset might be ready to challenge its downturn high of $2,904.

Ether is currently trading at $2,783 – up 6.5 percent in the past 24 hours and 18 percent in the last week.

As for technicals, Ether isn’t performing so badly. The asset has a relative strength index (RSI) of 70, showing that it is approaching the overbought level. But, considering that it is a large-cap asset, this isn’t so bad.

Ether is well outperforming its 20-day moving average (MA) of $2,310. This means that the asset has everything needed to hit new highs soon.

67% of retail investor accounts lose money when trading CFDs with this provider

Join Our Telegram channel to stay up to date on breaking news coverage