Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum price finally crossed the $2,000 market on April 13, a few hours after the Shanghai/Capella upgrade which went live on the Ethereum mainnet at 10.27 pm UTC on April 12 at epoch number 194,048. ETH has held above this level since then as market participants expect the access to staked Ether (stETH) to spark investor interest in the second-largest token by market capitalization, propelling its price higher.

$ETH flashes above $2K after a successful #EthereumUpgrade pic.twitter.com/5CBNTmFFmv

— ErmoFi (@ErmofiNews) April 13, 2023

This article draws on technical and on-chain data to dive into Ethereum’s price action following a successful Shapella upgrade that saw it reach a high of $2,142 for the first time in 11 months. The Upgrade appears to have resulted in a “bullish unlock” as was previously predicted by IntoTheBlock at the beginning of the year.

The Shapella Provides ETH With Hindwinds

The Ethereum Shanghai upgrade was successfully implemented, marking a new era of staked Ether withdrawals. The upgrade incorporates modifications to the execution layer – the Shanghai upgrade, the consensus layer- the Capella upgrade, and Engine API.

The execution layer’s Shanghai upgrade is a significant achievement in the Ethereum roadmap. It allows stakers to withdraw both their staked tokens (stETH) and any earned staking rewards they may have earned.

According to IntoTheBlock’s newsletter by Pedro Negron, allowing users to withdraw their staked tokens simplifies the staking process, making it more appealing to potential users. There are several interesting metrics following the Shanghai upgrades as summarised below:

- 117,261 ETH worth $234 million at current rates, has been deposited into staking over the last 24 hours, according to data from Nansen.

- Accounting for withdrawals made in the past 24 hours, the net balance of staked Ether is -71,166 ETH.

- There are 850,536 ETH currently in the queue waiting to be processed for the full exit.

- 17,304,039 ETH are currently actively validating the network with a total of 18,597,079 ETH on the Beacon Chain including rewards.

- Lido is the second biggest platform engaged in Ether staking at 25%, after others categorized as independent stakers coming in first place at 30.6%, followed by Coinbase, Kraken, and Binance respectively.

- 63.3% of the ETH waiting to be withdrawn by entities belongs to Kraken.

Note that only validators that have provided 0x01 credentials are eligible to process full and partial withdrawals. Thus tracking the number of validators with 0x01 credentials allows the data analytics platform to track the number of validators waiting to withdraw in the near future.

Therefore, 83.2% of Validators with 0x01 withdrawal addresses have updated their 0x01 credentials. 16.8% have not updated so they can’t be considered for withdrawals yet.

The successful implementation of this upgrade has likely boosted investor confidence in Ethereum’s future prospects, leading to increased demand and higher prices for ETH.

Ethereum Price Crosses Above $2,000 – Is $3,000 Next?

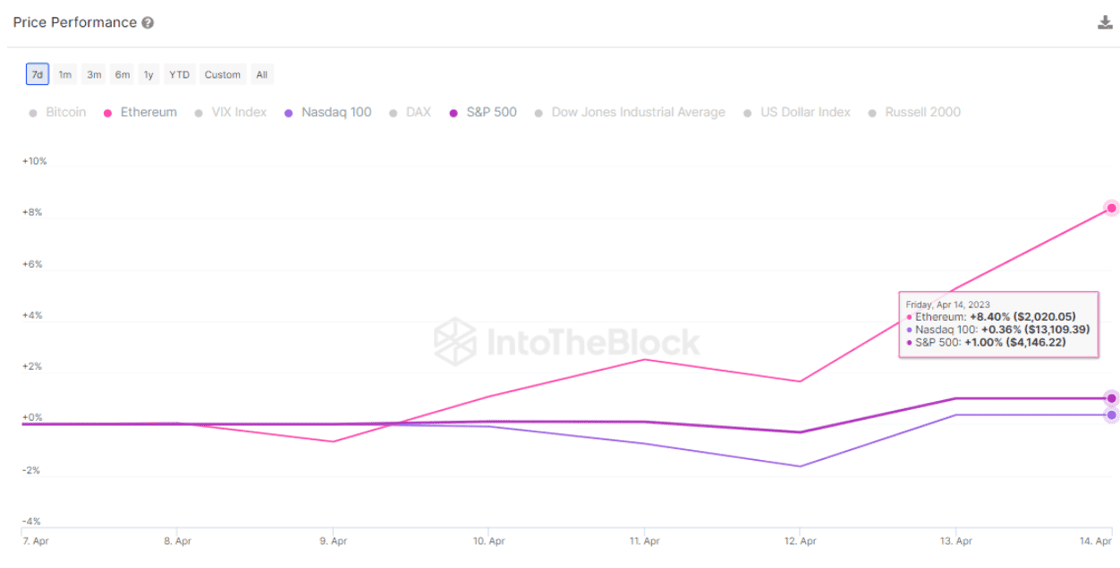

Ethereum climbed above $2,000 on April 13, levels last seen in May 2022. Data from IntoTheBlock shows that the 30-day correlation between the Nasdaq 100 and ETH has decreased over the last week from 0.88 to 0.64.

Ethereum-Nasdaq Correlation

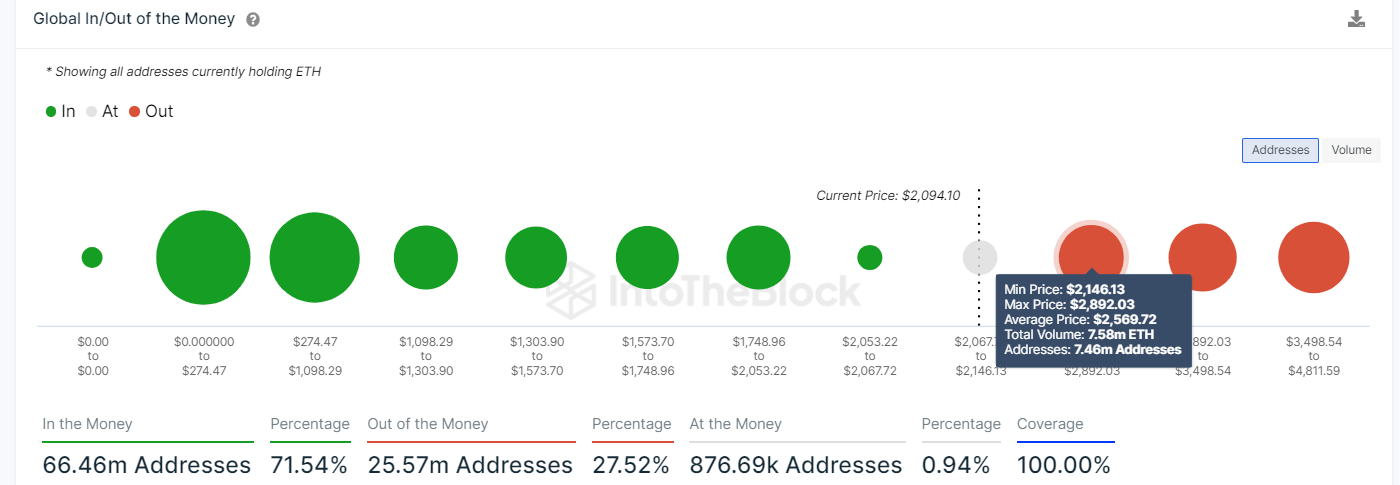

As a result of the recent price surge, 71.54% of addresses are now holding profitable positions. According to IntoTheBlock’s Global In/Out of the Money (GIOM) model, the next significant level at which a large number of addresses have traded lies within the range of $2,146 to $2,892.

Ethereum GIOM Chart

This is where approximately 7.58 million Ether were previously bought by roughly 7.46 million addresses. These suppliers could stifle Ethereum’s uptrend if they opt to take profits either at current prices or when the price reaches this supply zone.

This supplier congestion zone coincided with a significant liquidity zone stretching from $2,150 and $2,900 as seen on the daily chart below. This area was a major roadblock for the Ethereum price.

ETH buyers were required to overcome a number of barriers sitting within this region, starting with immediate resistance provided by the lower limit of the liquidity zone at $2,150. Additional roadblocks emerge from the $2,500 psychological level, and then the $2,800 barrier.

Above that, Ethereum price may rise to reach $3,000. Such a move would represent a 44.16% uptick from the current price.

ETH/USD Daily Chart

The up-facing moving averages and the position of the Relative Strength Index (RSI) in the positive region validated the positive outlook for Ethereum. The price strength at 70 suggested that there were more ETH buyers than sellers who were controlling the recovery,

Also supporting the positive narrative for the Ethereum price was the TRIN (Arms) index which was valued at 0.87. This value was below 1, suggesting that there were more buyers than sellers in the market.

Moreover, both the GIOM model and the daily chart above showed that Ethereum enjoyed robust support on the downside, compared to the resistance it faced on its way up.

On the daily chart, these were areas defined by the 50-day Simple Moving Average (SMA) at $1,760, the 100-day SMA at $1,670, and the 200-day SMA at $1,483.

These support areas are robust enough to absorb any selling pressure threatening to pull the Ethereum price lower.

On the other hand, the overbought conditions displayed by the RSI implied that the current correction could be extended to areas around $1,900. Traders could expect ETH to take a breather here before making another attempt at recovery.

Noteworthy, the next major upgrade that is coming for the now proof-of-stake Ethereum network is Ethereum Improvement Proposal (EIP) 4844 (referred to as Proto-danksharding. This update is aimed at addressing two critical issues for the blockchain: improving transaction speed and reducing transaction costs.

These are essential issues that must be addressed to achieve scalability and enable the Layer 1 blockchain to handle a higher volume of transactions. As the network continues to evolve, these upgrades will play a significant role in enhancing the overall functionality and usability of the Ethereum blockchain.

Promising Alternatives To ETH

It is anticipated that the Shapella Ethereum upgrade will continue to attract more investors to invest in ETH, with hopes of capitalizing on the gains to $2,000 to push the price to $3,000. Nevertheless, investors may want to explore some of the best altcoins with promising returns for optimal portfolio diversification opportunities.

One of these is Love Hate Inu’s presale, which has raised $4.38 million since its launch less than a month ago, selling LHINU tokens in stages 1, 2, 3 and 4 of the presale.

Hey #LoveHateInu Gang!👋🏼

Our #Presale raise has surpassed $4.3 million!🤑🎉

Thank you so much to all our voters and future creators!🙏🏼

Join us today and become a part of the best #MemeCoin ever!💯

Get yourself some $LHINU and cast your vote!🗳️💰https://t.co/Pu2Bo8WOUy pic.twitter.com/pVfW69BNPN

— Love Hate Inu (@LoveHateInu) April 17, 2023

Last week, Love Hate Inu revealed Carl Dawkins – advisor to the UK All Party Parliamentary Group on Crypto and Digital Assets, known for his success with the top 10 ranked meme coin Tamadoge, as CEO after the raise crossed the $3 million mark.

With the raise currently above $4 million, it truly shows the high level of interest investors have in the first-ever meme coin based on a vote-to-earn (V2E) model that lets users vote on a wide range of issues, earning crypto in the process.

Love Hate Inu is a top-of-the-line voting token with the ability to allow everyone, without the fear of judgement or prejudice, to express their opinions on vibrant topics—and while doing so, they can earn rewards and eek a living.

Visit Love Hate Inu here for more details on how to participate in the presale.

Related News:

Join Our Telegram channel to stay up to date on breaking news coverage