Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – July 30

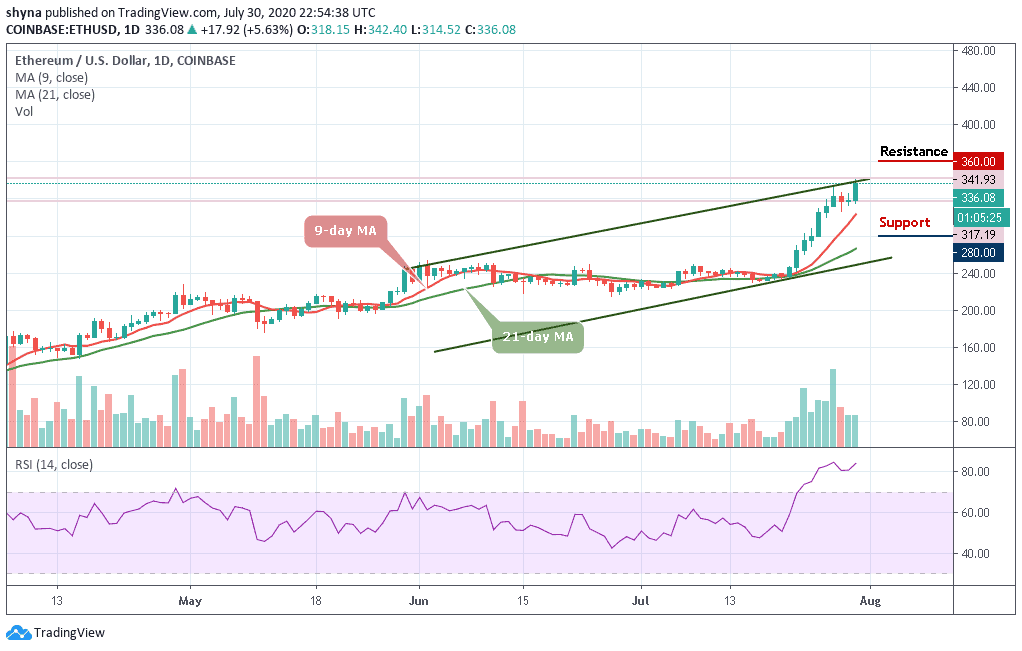

ETH/USD has been seeing under a super healthy bullish trend for the past few days.

ETH/USD Market

Key Levels:

Resistance levels: $360, $380, $400

Support levels: $280, $260, $240

For the past few days, ETH/USD has been surging immensely since breaking above the previous phase of consolidation at $247 and pushing above $300 to reach as high as $341 today. However, ETH/USD seems to be struggling with specific resistance at $341. However, the Ethereum price also spiked lower two days ago to bounce into the $306 support.

Currently, the price of the coin is changing hands at $336.08 level and the bulls are performing too well in pushing it above the upper boundary of the channel one more time. In other words, any reversal to the south may likely welcome the resumption of the bears into the market which could probably drag the coin towards the critical supports at $280, $260, and $240.

Nonetheless, the RSI (14) remains above the 80-level within the overbought zone, which indicates the continuation of the bullish trends and further resistance may be found at $360, $380, and $400 levels.

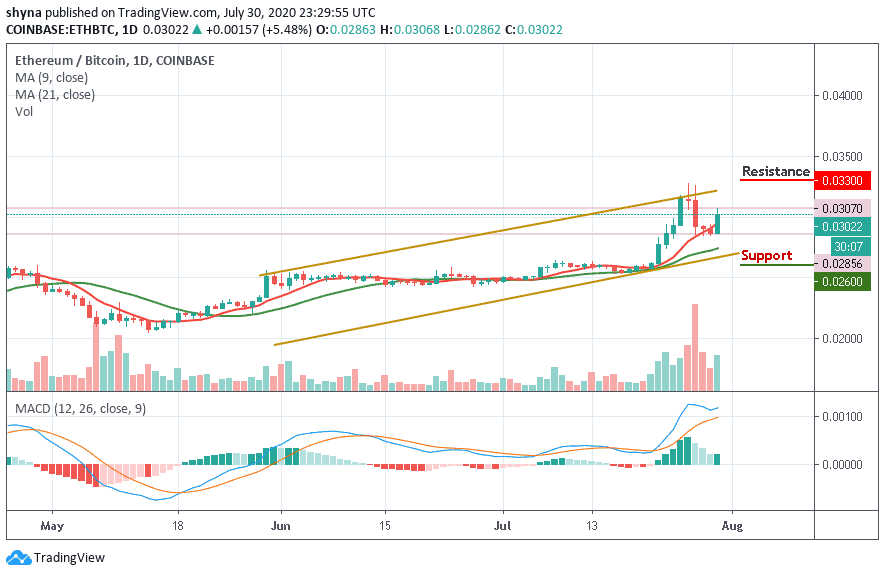

Comparing with BTC, ETH is currently changing hands at 0.0302 BTC after witnessing some bearish moments in the last four days but the current trend of the coin is still the same as the bulls are currently pushing the coin above the 9-day and 21-day moving averages.

Moreover, if the bulls could forge ahead, breaking above the channel could meet the resistance level at 0.0330 BTC and above. However, Ethereum is currently consolidating and may start moving sideways on the medium-term outlook. Meanwhile, the technical indicator MACD still remains within the positive side, which suggests the market may be a little overextended and may need to pull back slightly.

Join Our Telegram channel to stay up to date on breaking news coverage