Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – September 6

According to the daily chart, Ethereum (ETH) is gaining ground after the sharp sell-off to $316.

ETH/USD Market

Key Levels:

Resistance levels: $415, $535, $555

Support levels: $265, $245, $225

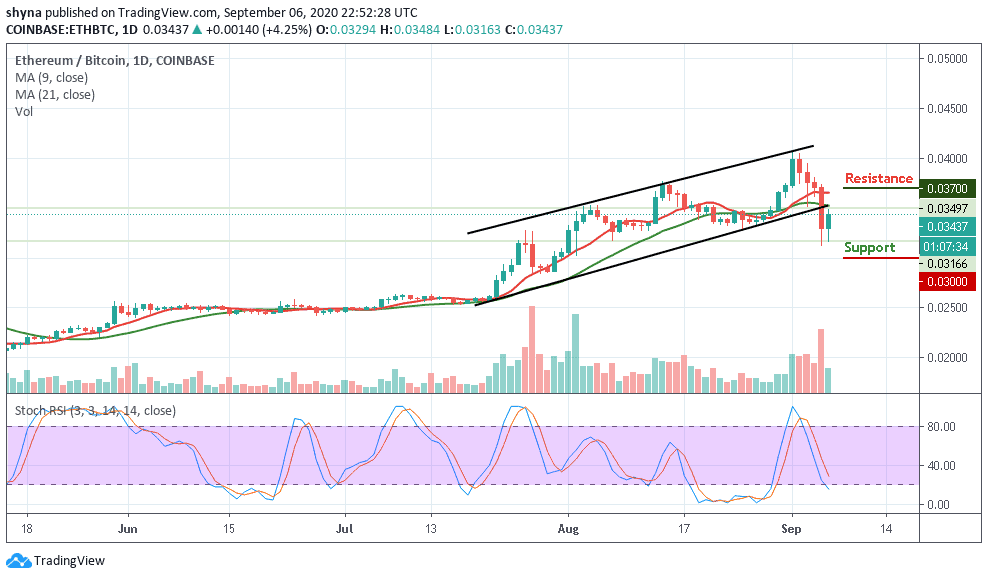

Today, ETH/USD hit the recent low of $316.43 and recovered above the local resistance of $360 but at the time of writing, the second-largest digital asset is trading at $352.33 level with a gain of 5.09% both on a day-to-day basis, moving within the short-term bullish trend with low volatility below the 9-day and 21-day moving averages.

What to Expect from Ethereum (ETH)

On the intraday chart, ETH/USD is trading near the lower boundary of the channel at $352. If the bulls break above the $380 mark, the recovery may be extended towards the psychological barrier of $400. However, the moving averages at 9-day and 21-day may slow down the momentum and discourage the bulls from approaching the critical levels at $415, $435, and $455. On the other hand, a failure to break this barrier may result in a new bearish wave and bring the recent low of $310 back into focus.

Nevertheless, the coin needs to recover above the moving averages which are currently at $400 to elevate the immediate bearish pressure and improve the technical picture. More so, since the beginning of August, this area has been serving as strong support for the coin, which means the bulls may have a hard time taking it out. The support levels are located at $265, $245, and $225 as the stochastic RSI remains within the oversold region.

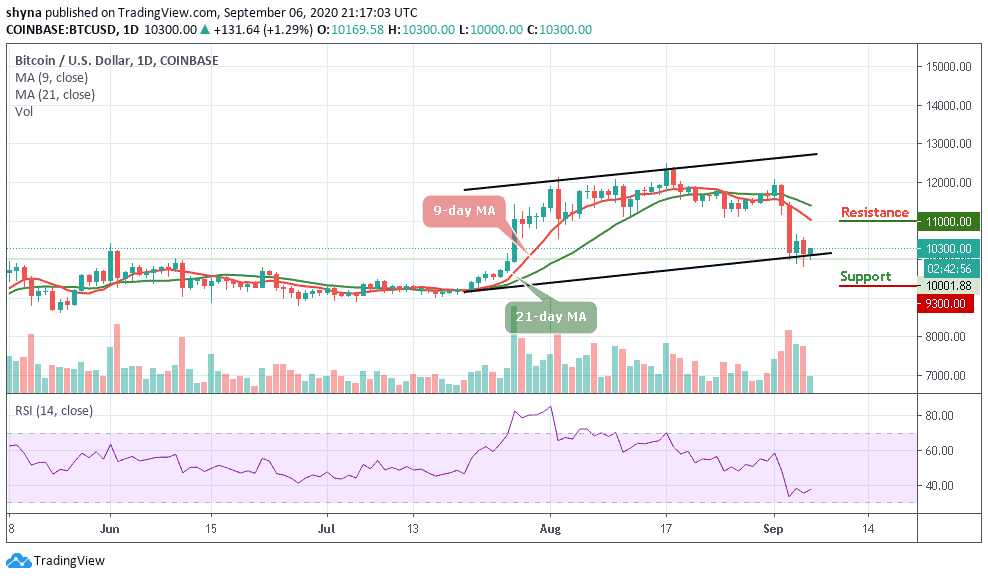

When compares with Bitcoin, the Ethereum price has been experiencing a slight difficulty since a few days ago. The coin recently breaks below the 9-day and 21-day moving averages, hitting the solid support at 3500 SAT. The critical support level is located at 3000 SAT and below.

However, if the bulls continue to power the market as it is now, traders may soon find the resistance level at 3700 SAT and above. At the moment, the stochastic RSI is facing downward, moving towards the oversold region.

Join Our Telegram channel to stay up to date on breaking news coverage