Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – September 6

The daily chart reveals that the Bitcoin (BTC) bounced off the critical support at $10,000 and added more than $200 to its current value.

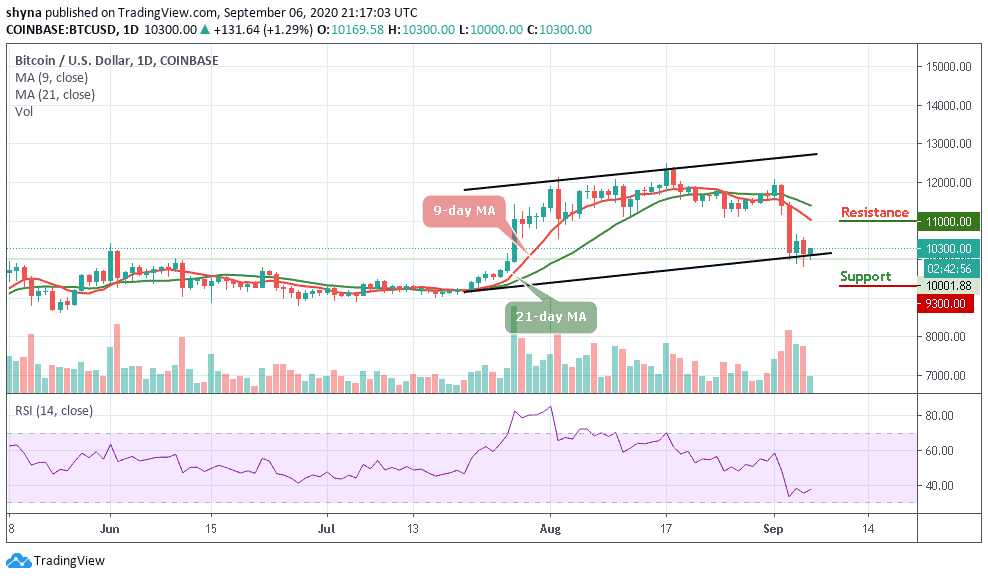

BTC/USD Long-term Trend: Ranging (Daily Chart)

Key levels:

Resistance Levels: $11,000, $11,200, $11,400

Support Levels: $9,300, $9,100, $8,900

BTC/USD is currently trading around $10,300 with a 1.29% gain in the past 24-hour. According to the daily chart, since the beginning of today’s trading, the Bitcoin price fights to stay above the important level of $10,000. More so, for BTC/USD to remain above $10,200 for the past 12 hours today, it has made many traders feel that the $10,000 support level could be pretty strong.

Where is BTC Price Going Next?

BTC/USD touches the daily low of $10,000 today, if the number-one crypto breaks below this level, it could test the next support lines at $9,800 and $9,600. Alternatively, Bitcoin has to reclaim the first resistance at $10,350 to head upwards. If successful, the primary cryptocurrency could aim at $11,000, followed by $11,200, and $11,400 resistance levels.

However, looking at the RSI (14) in the daily range, BTC/USD is not done with the downside. Despite the drop suffered, the RSI (14) is not yet in the oversold region. This means that there may still be a room that could be explored by the bears. If this happens, the critical supports at $9,300, $9,100, and $8,900 may be visited.

On the upside, recovery may not come easy. Therefore, traders must be aware that support will have to be sort for above $10,300 while the other seller congestion zones to keep in mind include $11,000, $11,200, and $11,400 resistance levels.

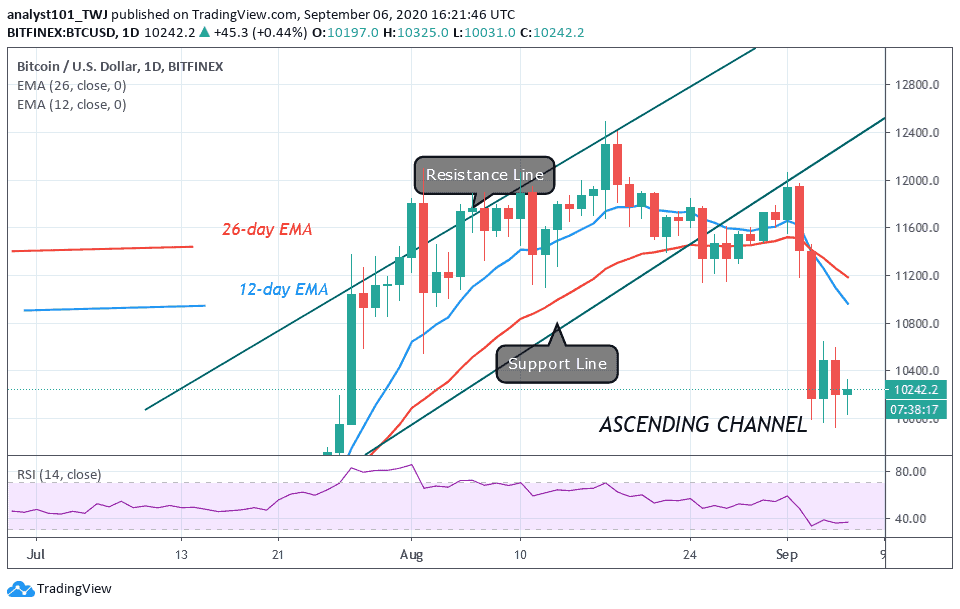

BTC/USD Medium – Term Trend: Bearish (4H Chart)

From a technical point of view, on the 4-hour chart, the technical indicator RSI (14) has moved out of the oversold region and this supports the option of some bullish correction. Meanwhile, adding to the above, there is a little bit of bullish divergence on the RSI (14) as the signal line moves above 40-level.

However, if the Bitcoin price breaks above the 9-day and 21-day moving averages, the market price may likely reach the resistance at $10,800 and above. On the contrary, if the current market value drops below the 9-day MA, it may likely slide towards the supports at $9,800 and below.

Join Our Telegram channel to stay up to date on breaking news coverage