Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – November 15

Similar to Bitcoin, the Ethereum price is facing a fresh round of selling. ETH/USD price remains at a risk of more downsides if it breaks the $180 support zone.

ETH/USD Market

Key Levels:

Resistance levels: $195, $200, $205

Support levels: $172, $167, $162

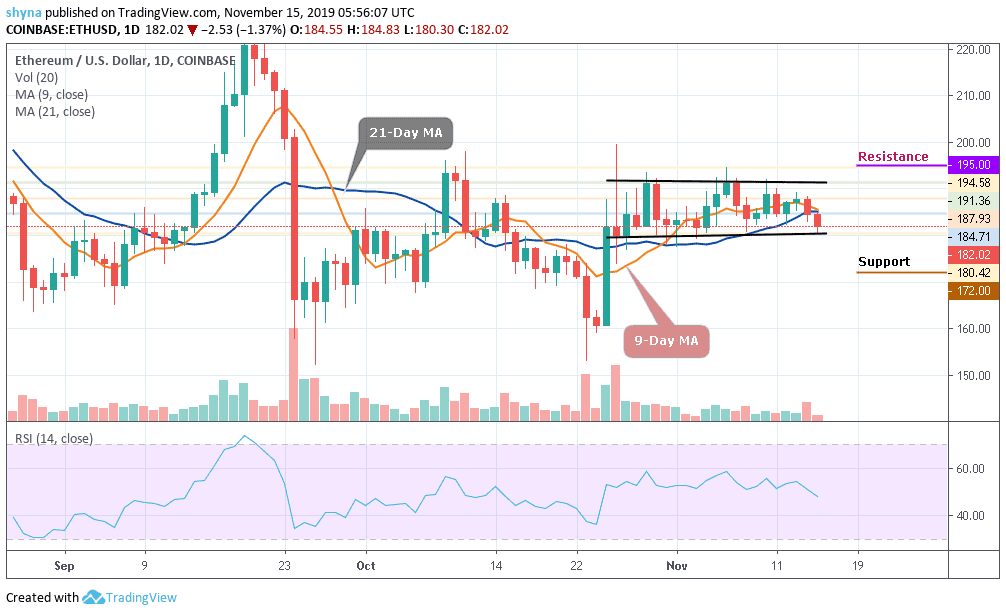

For quite some time now, Ethereum had been stuck around the trading price area of $187 and $188, after falling from $195 and then $190 price levels. A couple of days ago, ETH/USD price was around its usual resistance level at $187.93, from where it rose to the following at $188.36. Towards the day-end, ETH mounted as high as $189.43 just to start plunging yesterday and today and have a falling wedge pattern formed.

However, ETH/USD is trading below the moving averages of 9 and 21 days at $182 as at the time of writing, having trying to recover from the intraday low of $180.42. The second-largest crypto, with a current market value of $ 19.9 billion, has lost 1.60% of its value since the beginning of today and has remained virtually unchanged from day to day.

Similarly, the Ethereum price continues to follow the downtrend but still within the channel and any attempt to break below the channel, the bears may have potential support at $172, $167 and $162 levels. Conversely, if the bulls push the price above the moving averages and maintain the upward movement across the channel, the buyers may likely find resistance at $195, $200 and $205.

Meanwhile, the RSI (14) has changed from moving in the same direction to move below level 50, which indicates that the bears are in control for now.

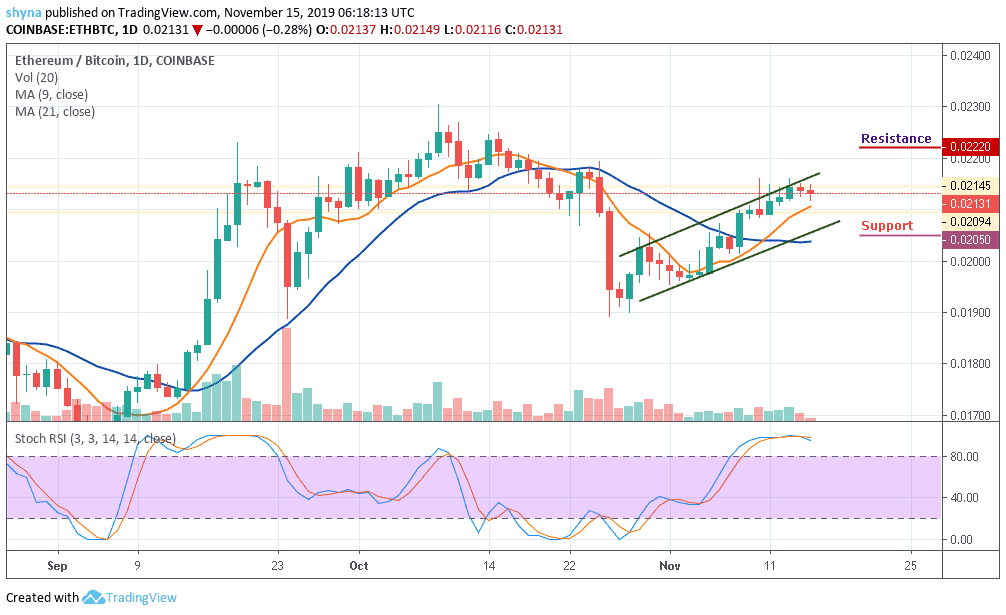

Comparing with Bitcoin, the market price remained in the ascending channel but the bears are trying to take over the market. ETH/BTC is currently trading at the level of 0.0213 BTC and the bulls couldn’t push the price above the channel. Looking at the chart, if the market continues to drop, the next key supports may likely be at 0.0205 BTC and below.

However, on the upside, a possible bullish movement may likely push the market above the ascending channel, when this is done, the resistance level of 0.022 BTC and above may be visited. The stochastic RSI is within the overbought zone and this is to indicate that the market will continue to fall once it faces down.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage