Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – January 26

The MACD indicator shows a reversal of bullish momentum as ETH/USD price is seen moving higher within the rising channel.

ETH/USD Market

Key Levels:

Resistance levels: $172, $174, $176

Support levels: $148, $146, $144

ETH/USD, the second-largest cryptocurrency with the current market capitalization of $17.94billion, has been range-bound recently. The coin faced stiff resistance on approach to psychological $165 and settled at $163.19 as at the time of writing. ETH/USD has gained about 1.92% on a day-to-day basis since the beginning of today’s trading.

However, in the early hours of today, ETH/USD buyers have retained control of the market. A few days ago, trading has been a resounding victory for the bears as Ethereum’s price dipped down, breaking below the 9-day moving average in the process but couldn’t go below the 21-day moving average before rebounding. Today, the daily breakdown shows that ETH/USD was following an uptrend movement.

In other words, for a backward movement, the market can be supported at $148 and $146 levels, if the price falls below the previous levels; another support is around $144. But should in case the price exceeds the indicated level by breaking above the channel, the resistance levels of $172, $174 and $176 may be visited. The technical indicator MACD signal lines are already at the positive side, which may likely give more support to the bulls.

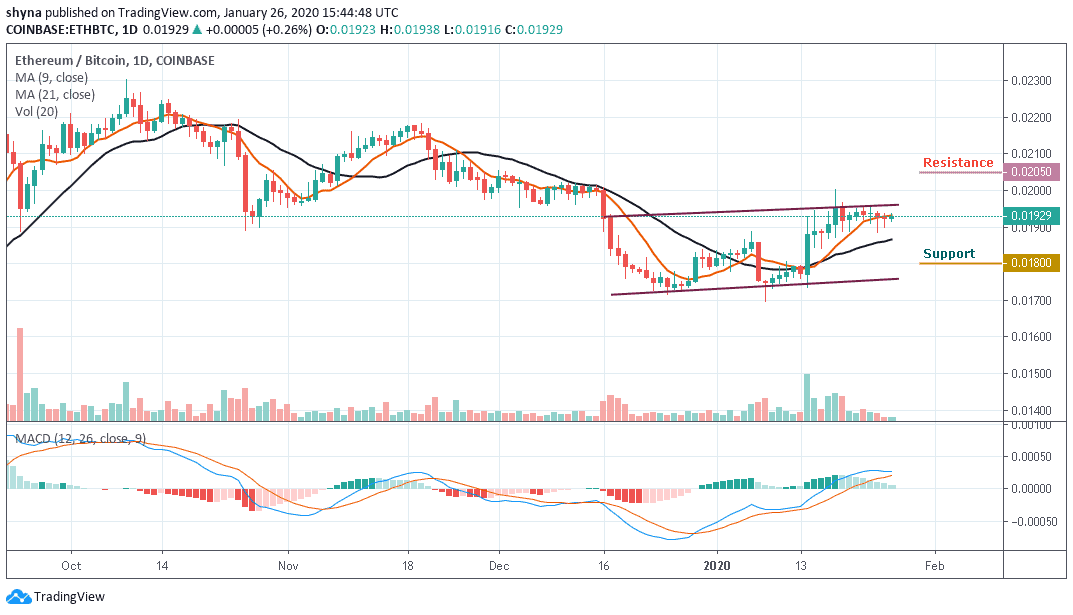

Against Bitcoin, Ethereum has clearly experienced difficulties, especially in the past few days. More so, Ethereum recently broke under solid support at 0.020 BTC and continued to fall through subsequent support level to 0.019 BTC. The critical support level is found around 0.018 BTC and below.

However, if the bulls manage and power the market, traders may soon find the resistance above the channel at 0.0205 BTC and above. Similarly, ETH/BTC is currently consolidating and moving in sideways on the medium-term outlook. We can expect a surge in volatility to occur as the MACD indicator is still within the positive side.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage