Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – June 12

In the early hours of today, the price of Ethereum is seen rising from $225 to $233 level.

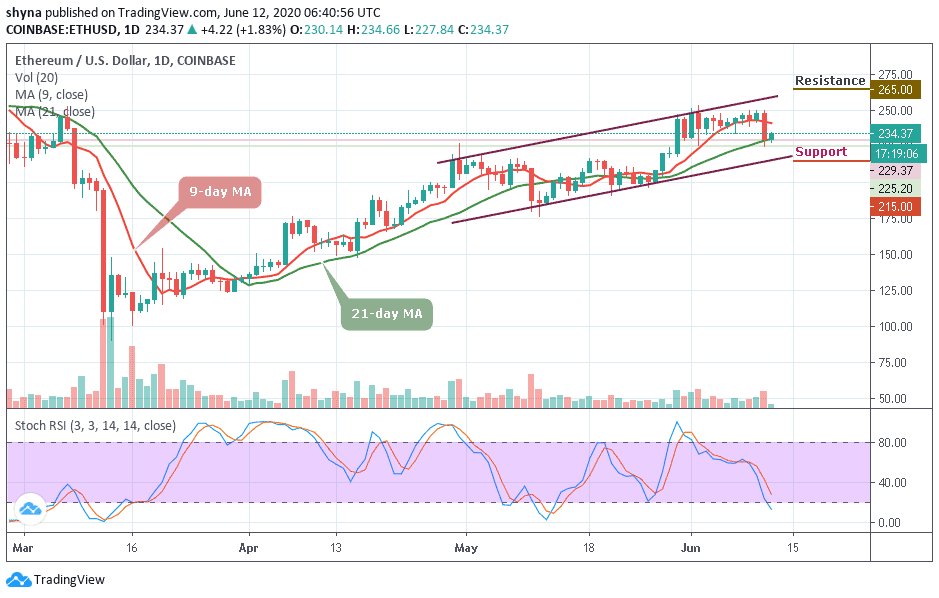

ETH/USD Market

Key Levels:

Resistance levels: $265, $270, $275

Support levels: $215, $210, $205

At the moment, the market is rising as ETH/USD could not climb much higher from the $225 level within the ascending channel. Yesterday’s decline was largely attributed to the fact that ETH/USD plummeted pretty significantly. ETH/USD is moving above the 21-day MA but it can rise higher and break above the 21-day moving average at around $250. If ETH/USD falls and drops beneath the support of $225, the coin may turn bearish.

However, if the sellers continue to add downward pressure to ETH, initial support is expected at $215. Beneath this, support can be found at $210 and $205. On the other hand, if the bulls can defend the $225 level and allow ETH to rebound, an initial resistance may be located at $250. Above this, additional resistance is expected at $265, $270, and $275 levels.

More so, the stochastic RSI is facing the oversold zone showing that the previous bearish momentum may soon fade. If the technical indicator manages to make a quick turn-back, then the bulls stand a chance to allow Ethereum to rebound. However, if it penetrates beneath, the cryptocurrency may resume a downward spiral.

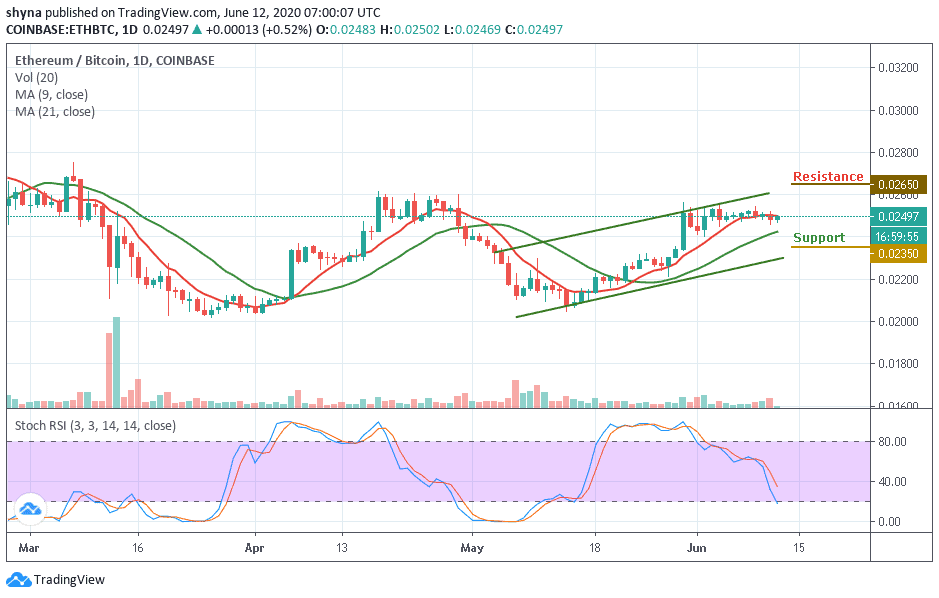

Comparing with Bitcoin, the market price remains with the channel as the coin moves sideways. ETH/BTC is currently trading at the level of 0.0249 BTC and the bulls couldn’t push the price above the 9-day moving average. Looking at the chart, if the market begins to drop below the 21-day moving average, the next key supports may likely be at 0.0235 BTC and below.

However, considering the upside, a possible bullish movement may continue to push the market price above the moving averages, when this is done, the resistance level of 0.0265 BTC and above may be visited. Meanwhile, the stochastic RSI is moving towards the direction of the oversold zone and this indicates a bearish momentum in the market.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage