Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price plunged 20% in the last 24 hours to trade at $2,326 as of 05:04 a.m. EST even as trading volume skyrocketed 238% to $54 billion.

This comes as Jump Crypto, the crypto division of Jump Trading, transferred 120,000 staked Ether tokens worth around $314 million. The firm has shifted hundreds of millions of dollars worth of crypto to exchanges in recent days, which has sparked speculation that it may be preparing to sell its holdings.

The mass transfer comes five weeks after Kanav Kariya stepped down as Jump Crypto’s president amid rumors the firm is exiting crypto.

Can Ethereum Price Rebound?

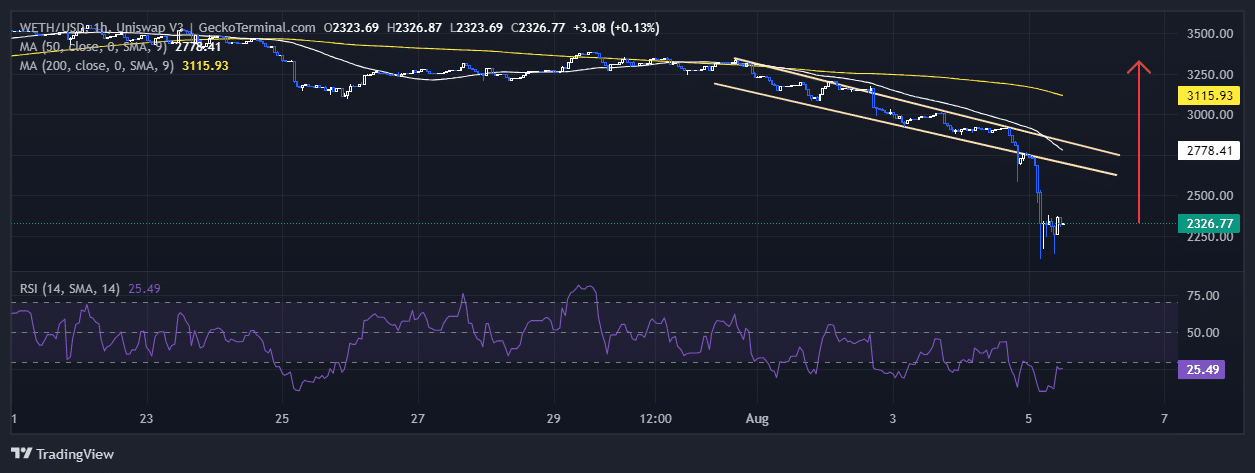

The Ethereum price has been on a downtrend since the start of August, as it plunged from the $3,250 resistance zone. ETH has since been trading within the falling channel pattern.

However, today, ETH has dived below the lower boundary of the channel, plunging to the $2,250 support zone, according to data from GeckoTerminal.

The price of Ethereum now trades below both the 50-day and 200-day Simple Moving Averages (SMAs), further supporting the continued bearish trend of the token.

Moreover, the Relative Strength Index (RSI) on the 1-hour chart trades at 25, which shows that the asset is under intense selling pressure and is currently undervalued.

With the asset being undervalued, this now acts as a buying signal. If investors start buying, the token may rise back to the channel, with the price of Ethereum now targeting $3,300 in the long term.

Conversely, if the bears continue exerting more pressure, ETH could plunge further to hit 2,200, which acts as a cushion against downward pressure.

As Ethereum price bleeds, the Olympic Games-themed meme coin The Meme Games ($MGMES) is going from strength to strength.

Olympic Themed The Meme Games – The Best Crypto To Buy Now?

Blending the excitement of the Olympics with the crypto world, The Meme Games allows users to bet on meme characters in fun, competitive events.

The Meme Games introduces a gamified experience where users can bet on meme characters like Dogecoin ($DOGE), Pepe ($PEPE), DogWifHat ($WIF), Brett ($BRETT) and Turbo ($TURBO) as they compete in Olympic Games-style events.

Believe it or not, this is what peak performance looks like. ⛵🌊#Paris2024 #Crypto $MGMES $PEPE pic.twitter.com/s1WoewVbqD

— The Meme Games (@MemeGames2024) August 4, 2024

Gaining rapid popularity, The Meme Games has already raised over $338,000 in its presale and is poised to make waves with its DEX listing on September 10.

The project also offers an impressive 639% annual percentage yield (APY) for those who buy and stake $MGMES tokens, further enhancing its appeal.

That’s why influential crypto analyst and YouTuber Austin Hilton, with 272k subscribers, predicts that $MGMES “will be huge.”

The Meme Games is an exciting new option for a thrilling and rewarding crypto experience, and offers the chance for investors to win a 25% token bonus when they join. New buyers enter a chose meme coin into a race and have about a 20% chance of winning 25% of their original investment.

You can also enter multiple times to increase your chances of winning. The more you invest in the presale, the higher your odds of securing this reward.

You can buy $MGMES tokens for $0.00915 each. But buy soon to lock in the best deal as a price hike will come in less than two days.

To join the presale, buy $MGMES from the official website here using ETH, BNB, USDT, or a bank card.

Related News

- Best Meme Coins to Invest in: Top Picks for Exponential Gains! 🚀

- Best Crypto to Watch in 2024: Top 5 Cryptocurrencies with High Potential

- How to Make Money with Cryptocurrency – 8 Best Ways

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage