Join Our Telegram channel to stay up to date on breaking news coverage

Key Highlights

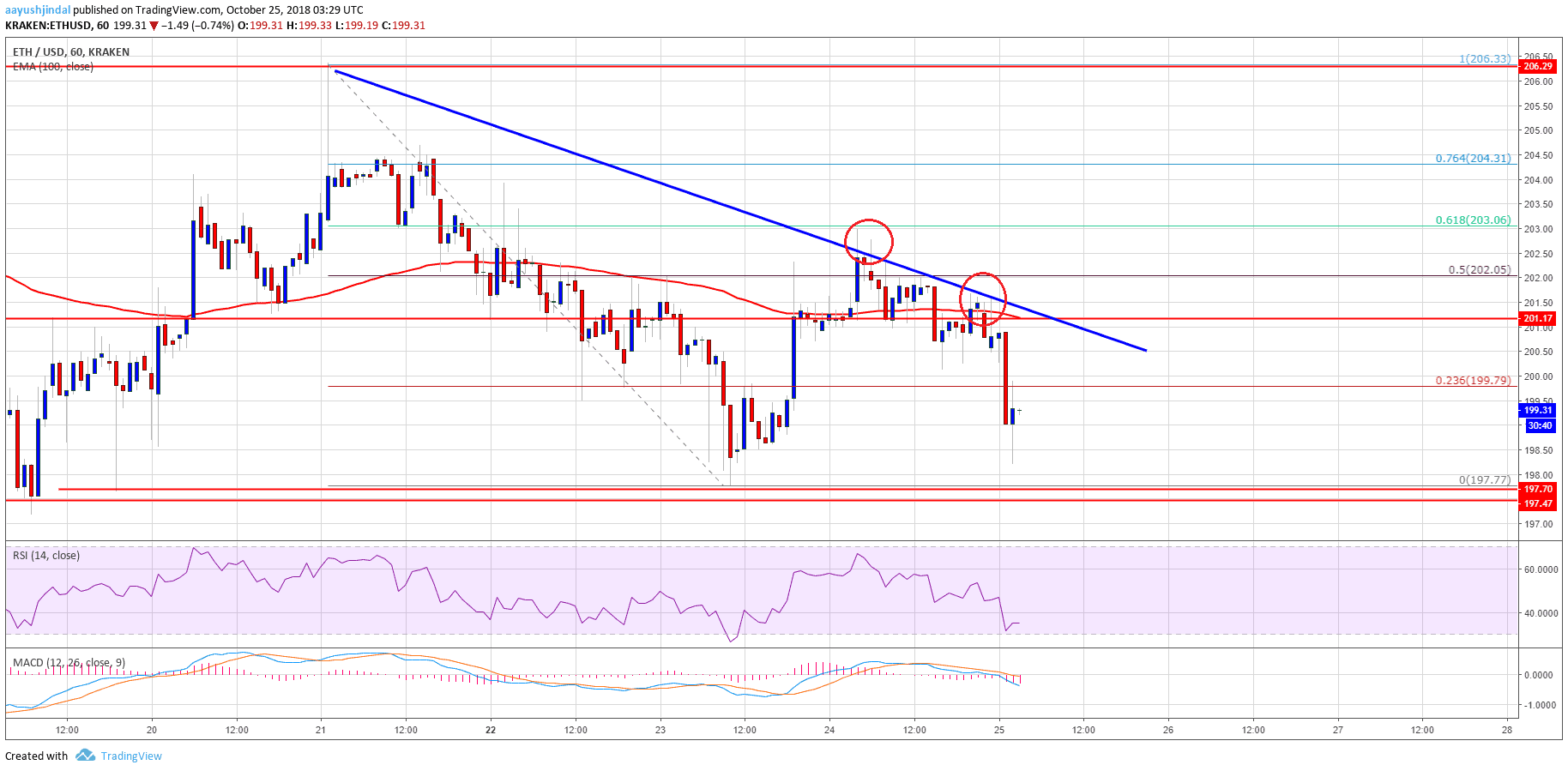

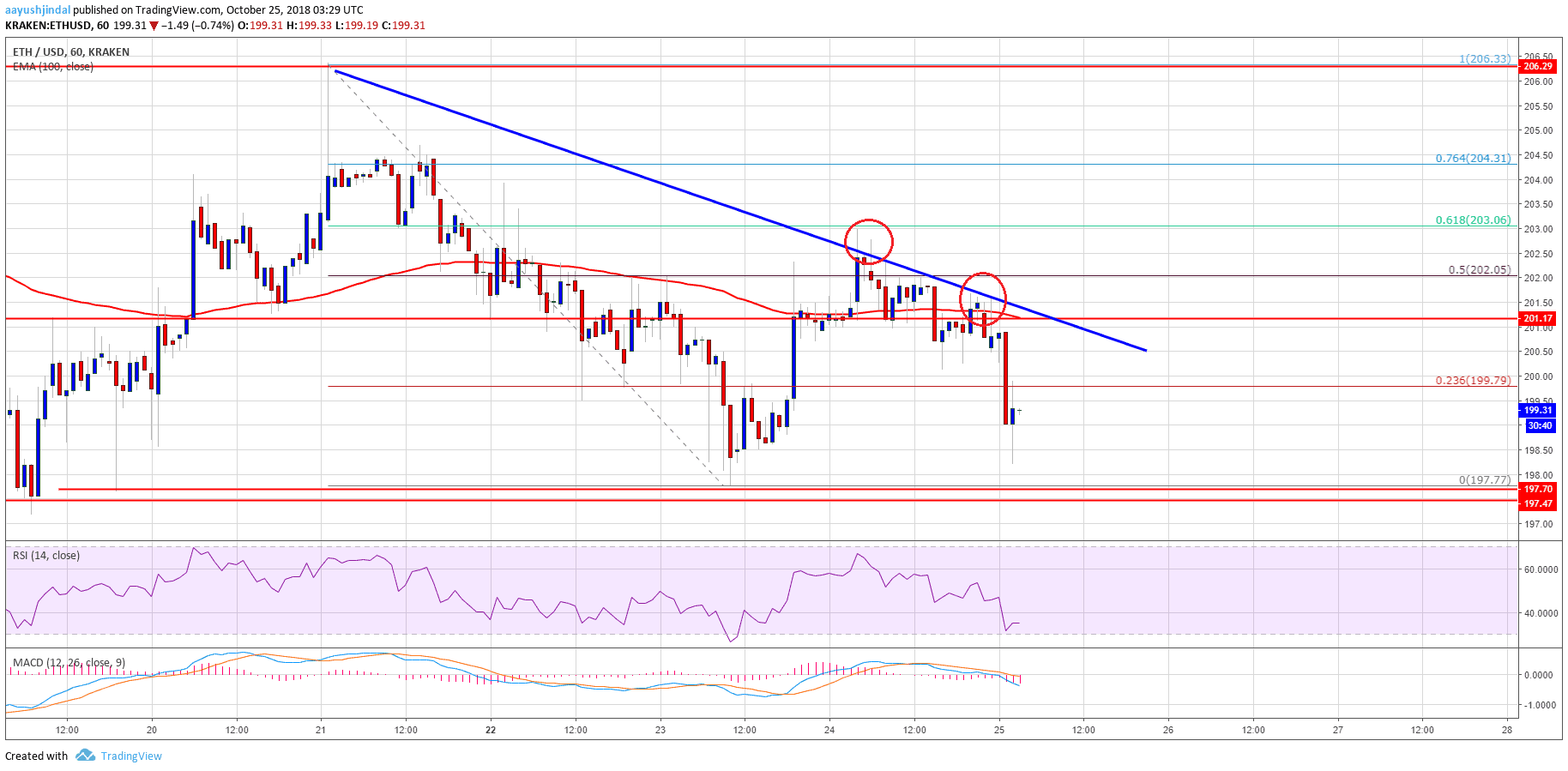

- ETH price failed to move above the $203 resistance and declined recently against the US Dollar.

- There is a new bearish trend line formed with resistance at $201 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair remains supported on the downside near the $196 and $197 levels.

Ethereum price declined towards the range low against the US Dollar and bitcoin. ETH/USD could drop further towards the $197 support level.

Ethereum Price Analysis

Yesterday, we saw a nice upside move above the $200 level in ETH price against the US Dollar. The ETH/USD pair traded above the $202 level and the 100 hourly simple moving average. It even broke the 50% Fib retracement level of the last drop from the $207 swing high to $198 low. However, the price struggled to clear the $203 resistance zone, which acted as a solid barrier.

The price was also rejected near the 61.8% Fib retracement level of the last drop from the $207 swing high to $198 low. As a result, there was a fresh decline and the price moved below the $201 and $200 levels. There was a close below the $200 level and the 100 hourly SMA. It seems like the price may continue to move down towards the $197-198 zone. On the upside, there is a strong resistance formed near $201 and the 100 hourly SMA. There is also a new bearish trend line formed with resistance at $201 on the hourly chart of ETH/USD. As long as the price is below the $201 level, it could drop towards the $197 support area in the near term.

Looking at the chart, ETH price failed to gain traction above $203, resulting in a fresh decline. Going forward, if the price fails to stay above $197, there may well be more losses towards $190.

Hourly MACD – The MACD is back in the bearish zone.

Hourly RSI – The RSI is currently well below the 40 level.

Major Support Level – $197

Major Resistance Level – $201

The post Ethereum Price Analysis: ETH/USD Extends Consolidation Near $200 appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage