Join Our Telegram channel to stay up to date on breaking news coverage

The non-fungible token market received some relief earlier today after the US Securities and Exchange Commission (SEC) ended its probe into Ethereum 2.0, boosting sentiment around the altcoin ahead of the launch of an ETH Exchange Traded Fund later this month.

SEC Lifts Its Probe Into Ethereum 2.0

In a June 19 blog post, Consensys, a blockchain software company working at the forefront of the decentralized web, confirmed that the Enforcement Division of the United States Securities and Exchange Commission has notified it that they have closed its investigation into Ethereum 2.0.

The decision follows a letter we sent on June 7, asking the SEC to confirm that the May ETH ETF approvals, which were premised on ETH being a commodity, meant the agency would close its Ethereum 2.0 investigation.

The closing of the Ethereum investigation is momentous, but it’s…

— Consensys (@Consensys) June 19, 2024

The blockchain software company filed a lawsuit against the SEC in April 2024 to challenge the commissions from further investigating the Eth2. Ethereum 2.0 was an upgrade to the Ethereum blockchain network aimed to improve the scalability, accessibility, and transaction throughput in the network.

The goal behind the lawsuit was to ensure that the Ethereum blockchain network remains a vibrant and indispensable blockchain platform and to preserve access for the countless developers, market participants, and institutions who have a stake in the world’s second-largest blockchain.

The end of the SEC probe into Ethereum 2.0 is a major win for Ethereum developers, technology providers, and other industry participants like the NFT holders. It’s worth noting that many non-fungible tokens that rely on the Ethereum network have suffered huge losses in value and sales volume since the probe on the Ethereum network began.

NFTs Are Now So Back

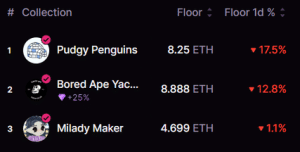

Earlier this year, nearly everybody expected that the non-fungible token collections were heading to the moon or beyond. Unfortunately, the majority of NFTs, especially Ethereum-based NFTs, have suffered a historic bear market. Many top NFTs, like the Bored Ape Yacht Club, which initially commanded a +25 ETH floor price, have seen their floor price dropping to 8 ETH.

Among several factors that have been driving floor prices down include fear, uncertainty and doubt (FUD) and lack of faith in the non-fungible token collections, stirred by the United States Securities and Exchange. These factors had pushed the NFT market to suddenly enter a freefall.

We’re so back 🥳 https://t.co/LY7j3kyDQh

— Rarible (@rarible) June 19, 2024

Now that the SEC has ended its probe on the Ethereum network, many NFTs pegged on the network will probably retest their initial market health. Data compiled by cryptoslam.io, an on-chain crypto data aggregator and non-fungible token explorer, shows that the Ethereum NFT market has recorded positive gains, probably because of this bullish crypto news. In the past 24 hours, ETH NFTs have recorded a sales volume of $7.6 million, representing an 18% surge from the past day.

Related NFT News:

- Polygon’s Sea Dragon Tops In Daily NFT Sales – Hits Over $1.3M

- Andrew Tate Announces Plans To Turn His New $Daddy Coin Into An NFT

- The 2007 Viral Video ‘Charlie Bit My Finger’ Has Been Tokenized As An Ordinal NFT

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage