Join Our Telegram channel to stay up to date on breaking news coverage

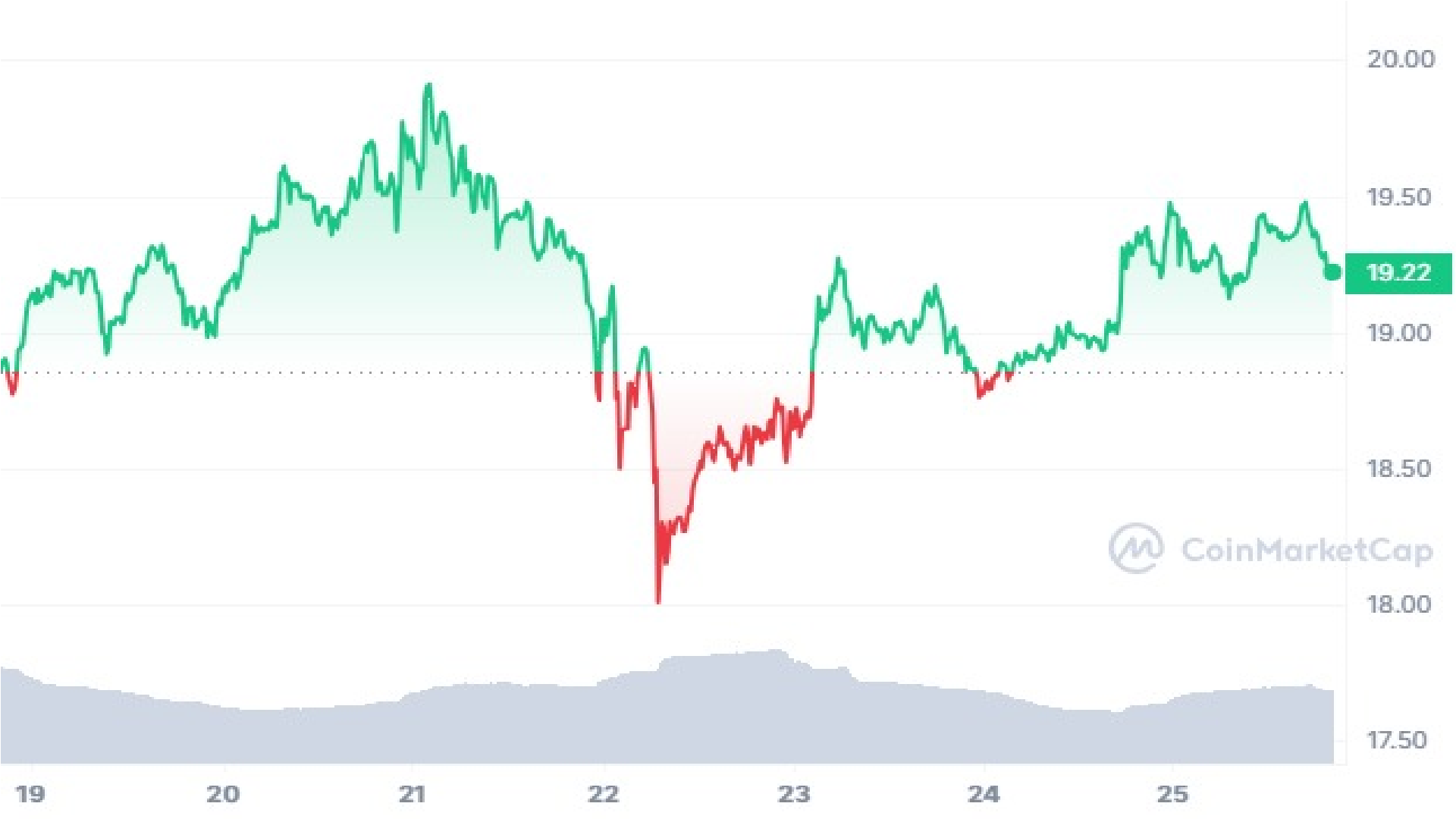

News of a BlackRock Ethereum ETF fueled a surge in ETH forked altcoins, leading to Ethereum Classic surging above the $18.00 resistance level and raising hopes for further price gains.

The notable increase in trading volume and price recovery indicates the participation of significant market players taking long positions, bolstering the strength of the recent upward movement in the $ETC cryptocurrency.

BlackRock, the asset management giant, made an official filing for a spot Ethereum exchange-traded fund on Thursday, November 16, reinforcing its commitment to cryptocurrency investments amidst growing investor optimism for ETF approvals.

The proposed iShares Ethereum Trust, awaiting approval for listing on Nasdaq, aims to provide investors with exposure to Ethereum, the second most popular cryptocurrency, without direct ownership.

While past SEC approvals have focused on futures-based crypto ETFs, the SEC’s concerns about fraud and manipulation in the spot crypto market raise questions about the regulatory approach to BlackRock’s potential Ether ETF.

The outcome could significantly impact Ethereum’s regulatory standing, potentially aligning it with Bitcoin from the SEC’s perspective.

Ethereum Classic Brief Overview

Ethereum Classic emerged as a hard fork of Ethereum in July 2016, aiming to preserve the original Ethereum blockchain in its unmodified state. It functions as a smart contract network capable of hosting and supporting decentralized applications (DApps), with its native token being $ETC.

Ethereum Classic’s primary objective is to maintain Ethereum’s original blockchain structure without altering it to address the DAO hack. As a voluntary organization, $ETC’s developers have no intention of transforming the network into a profit-driven entity.

$ETC employs the proof-of-work (PoW) consensus mechanism, akin to Bitcoin, where miners are rewarded with newly minted $ETC coins for validating new blocks on the blockchain. Unlike Ethereum’s planned transition to proof-of-stake (PoS), $ETC has no plans to switch its mining algorithm.

Ethereum Classic’s development continues with multiple developers working on future enhancements, particularly scaling solutions, to address the network’s capacity limitations.

$ETC Crypto Price Prediction

Ethereum Classic price today is $19.22 with a 24-hour trading volume of $276.10 million and market cap of $2.78 billion. The $ETC price increased 1.93% in the last seven days. The Relative Strength Index (RSI) stands at 55.26, signaling a neutral position in the $ETC market.

While the $ETC crypto price faced resistance around $22.00, the lack of bullish momentum led to a retracement to test the breakout level. Simultaneously, the 200-day EMA and 50-day EMA are reversing upward, suggesting a potential positive crossover.

In case of a price retracement, the EMAs may serve as strong support for the bulls. The $ETC price prediction indicates ongoing recovery with the possibility of reaching new swing highs in the coming months.

Currently, Ethereum Classic price is attempting to break the $20.16 hurdle, and a successful breach could result in a rapid ascent toward $25.00.

For a comprehensive analysis of Ethereum Classic’s price prediction, watch the video above, and subscribe to his YouTube channel for additional crypto-related content. Jacob Crypto Bury also runs a Discord channel with 17,000 members, providing trading tips and insights into upcoming crypto presales.

Bitcoin ETF Token Presale Surges as Spot Bitcoin ETF Approval Looms

The buzz around the potential approval of a spot bitcoin ETF by the SEC has been a hot topic in the crypto industry since BlackRock initially filed for it in June this year. Analysts from Bloomberg, JPMorgan Chase, and other sources consider the approval of at least one spot bitcoin ETF by January next year highly likely.

A new crypto presale, Bitcoin ETF Token (BTCETF), is banking on the anticipation of Bitcoin ETF approval to usher in a new era of growth and adoption in the crypto space.

As an ERC20 token tied to these regulatory events, $BTCETF is a deflationary cryptocurrency hosting five token-burning events, triggered by predetermined milestones linked to the release of the first Bitcoin Spot ETF.

Milestones include the official ETF announcement, its release, $BTCETF surpassing a $100 million market cap, and Bitcoin reaching $100K. Following each milestone, Bitcoin ETF Token burns 5% of its 2.1 billion token supply, with a total of five milestones set for a gradual reduction of the token supply.

Additionally, Bitcoin ETF Token imposes a 5% trading tax, decreasing by 1% after each milestone. Currently available at $0.0058 per token during the presale round, $BTCETF has raised over $1.6 million.

#BitcoinETF Stage 5 is coming to an end in 3 days!

Keep an eye out! 🚨 pic.twitter.com/oHN10pbLnb

— BTCETF_Token (@BTCETF_Token) November 25, 2023

Early presale participants have the opportunity to stake $BTCETF and benefit from substantial annual staking yields, with over 169 million tokens staked at the time of writing. It’s crucial to note that as more tokens are bought and staked, the APY will decrease, making early staking a potentially more rewarding option.

Keep up with the latest developments surrounding the spot Bitcoin ETF approval and $BTCETF project by following Bitcoin ETF Token on X and joining their Telegram channel. To take part in the $BTCETF token presale visit btcetftoken.com.

Recent Posts

- Bitcoin Breaks $37,000 Barrier & Bitcoin ETF Token Presale Gains Momentum Amid BTC Spot ETF Anticipation

- New Cryptocurrency Releases, Listings and Presales Today – LiquidLayer, AETERNUS, Magical Blocks

- Grayscale Bitcoin Trust Faces $2.7 Billion Outflow Threat On Bitcoin ETF Conversion That May Trigger Severe Bitcoin Price Drop: JPMorgan

- Could XRP Experience Significant Growth in the Next Bitcoin Halving?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage