Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – April 4

The Ethereum steady bullish action is breaking above the $2000 barrier; although, eyes currently glued on $2100.

ETH/USD Market

Key Levels:

Resistance levels: $2300, $2400, $2500

Support levels: $1800, $1700, $1600

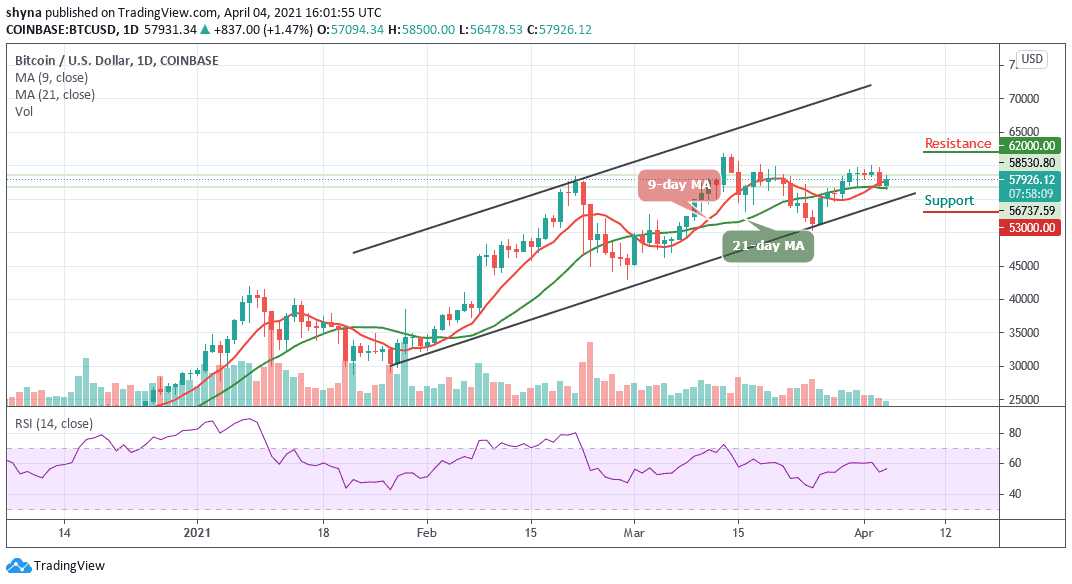

ETH/USD is seen refreshing to a new high after touching the daily low of $1980 to breaches above $2000 while currently trades at $2075 with a bullish crossover and trend in the intraday. At the time of writing, ETH/USD keeps moving above 9-day and 21-day moving averages. Meanwhile, higher support at $1900 is expected to be a stepping stone for a comeback past $2000 and the majestic rally eyeing a $2100 resistance level.

What to Expect from Ethereum (ETH)

For Ethereum, parallel trade can only take over if the $2000 subsidy is maintained at all costs. Currently, the technical indicator RSI (14) is moving above the 60-level at the moment by sending bullish signals which can finally encourage more buyers to enter the market.

Meanwhile, in as much as the red-line of 9-day MA remains above the green-line of 21-day MA, the coin may continue to do well and the price could hit the resistance levels at $2300, $2400, and $2500 respectively. More so, if the technical indicator decides to make a quick turn back to the lower side, then, there may be a quick bearish drop which may likely roll the market down to the support levels of $1800, $1700, and $1600.

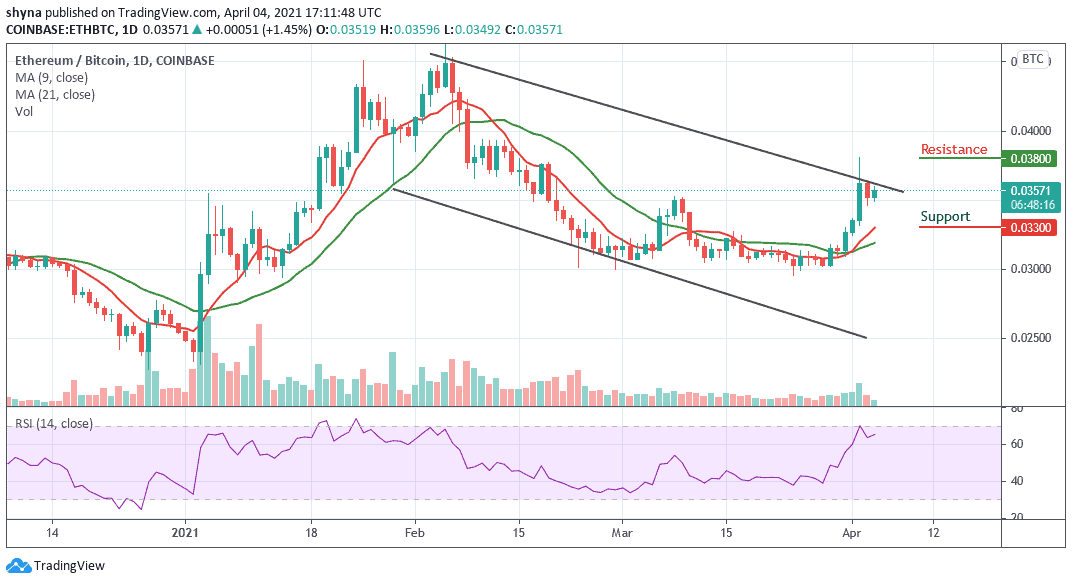

Against BTC, Ethereum is trading above the 9-day and 21-day moving averages as the price is now above the 60-level. For the fact that the market remains in the descending channel, the pair seems to be moving towards the upper boundary of the channel.

Meanwhile, if the buyers push the market price above the channel, ETH/BTC may likely reach the resistance levels of 3800 SAT and 4000 SAT. On the other hand, higher selling pressure may likely cancel the bullish pattern and this could attract new sellers coming into the market with the next focus on 3300 SAT and 3100 SAT support levels.

Join Our Telegram channel to stay up to date on breaking news coverage