Join Our Telegram channel to stay up to date on breaking news coverage

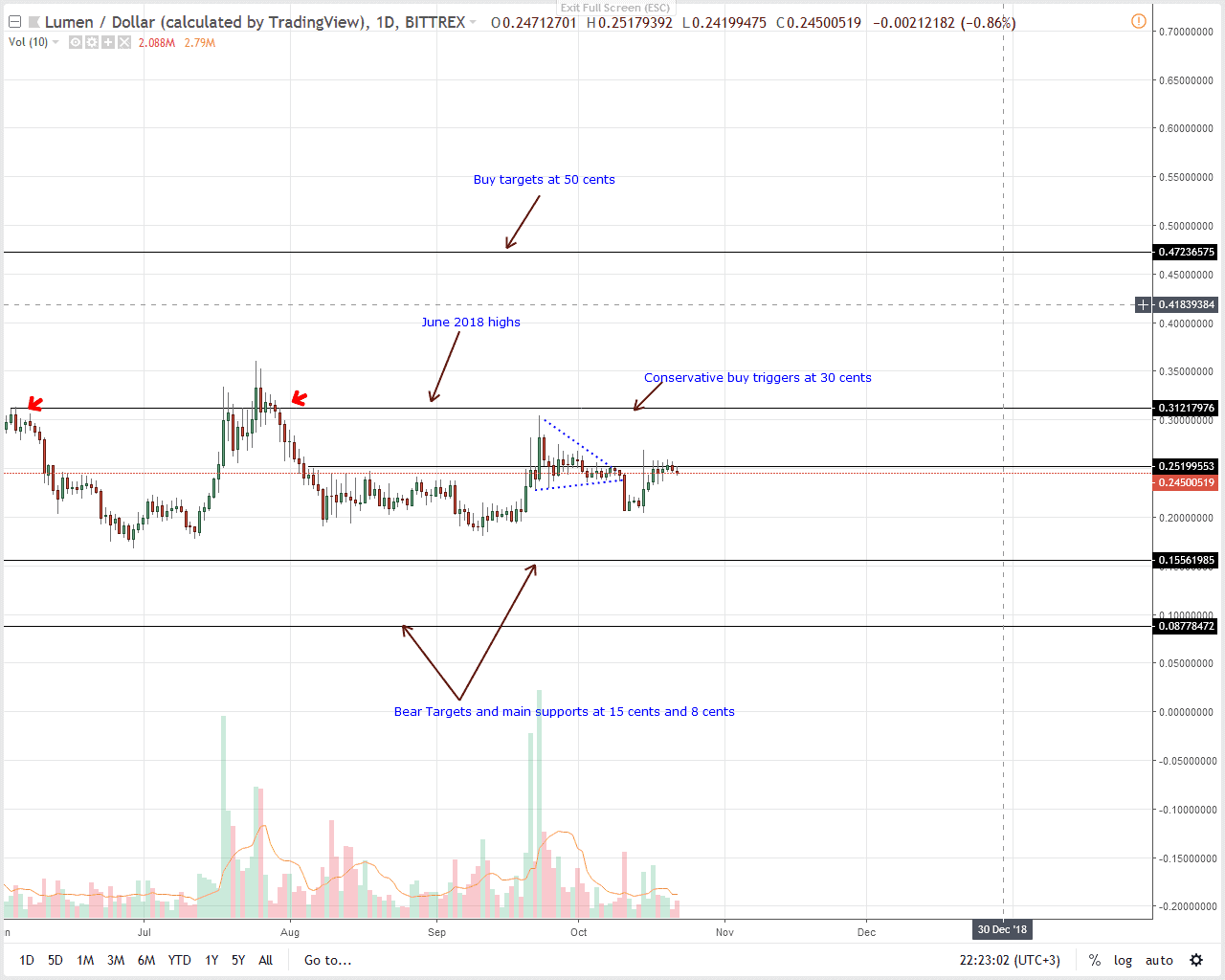

Even with Huobi availing HUSD, most altcoins are struggling to stay afloat under heavy bear pressure. The slide is clear in Stellar Lumens which despite being stable from a long-term point of view can’t simply rally above 25 cents and 30 cents triggering bulls aiming at 50 cents.

It’s even steep in Litecoin where bears are driving back prices towards the main support line at $50. All in all, we retain a bullish outlook and before we suggest buys, we need to see break outs in line with Oct 15 moves.

Let’s have a look at these charts:

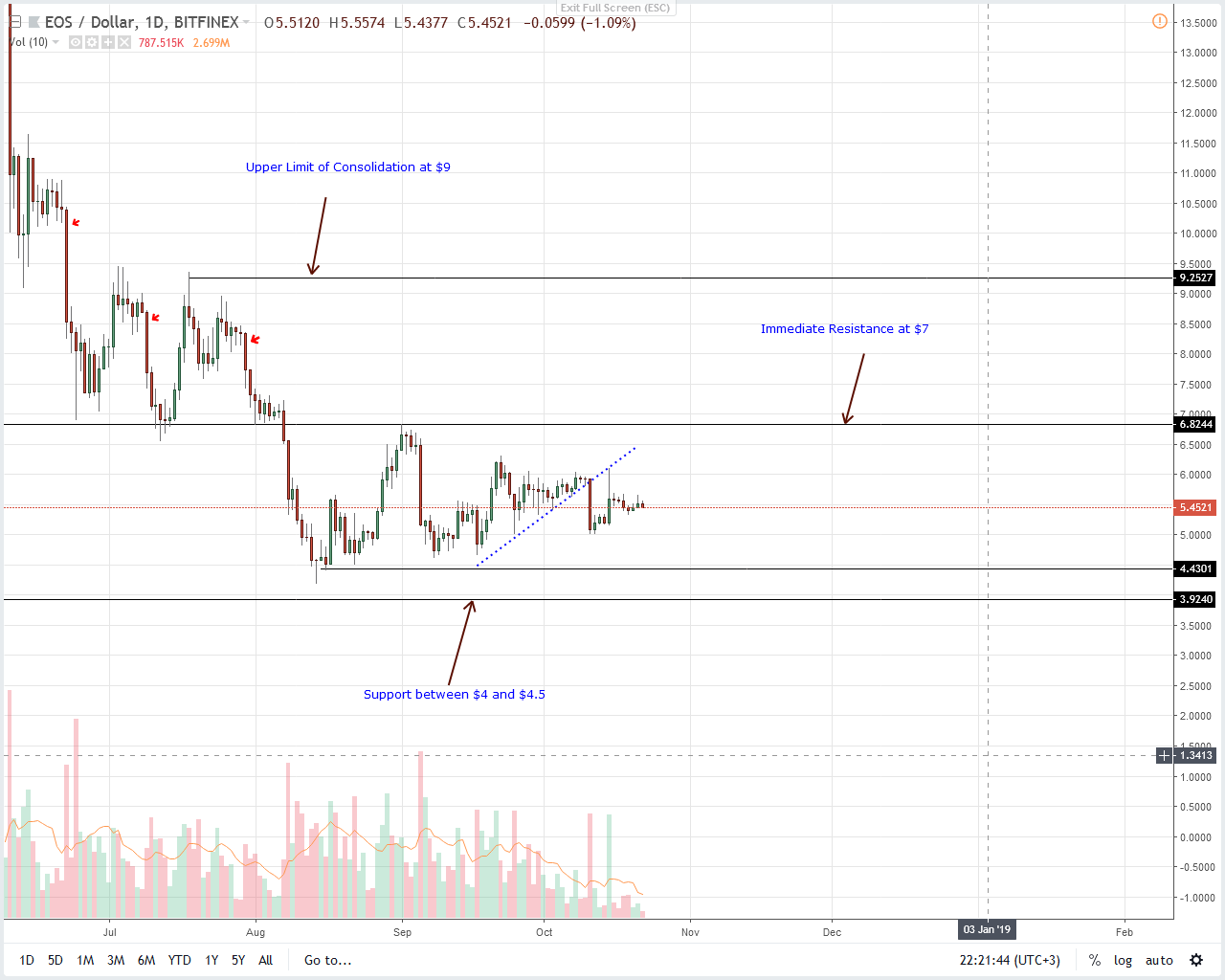

EOS Price Analysis

Statistics show that South Koreans prefer EOS over most coins. Therefore, it is an inconvenience for Huobi, one of the world’s largest crypto exchanges, to freeze the deposit of EOS due to system maintenance. This is days after launching their interoperable stable coin (HUSD). The exchange says HUSD save cost and is easy to use because one can simply switch between different supported coins as TUSD, GUSD, USDC and Paxos Standard (PAX). All stable coin deposits like TUSD will reflect as HUSD providing flexibility since users can proceed and withdraw in any other domination as they wish.

Even with five percent gains in the last week, EOS is stable in the daily chart. Besides, the inactivity means our last EOS price analysis is true and by extension traders should hold a neutral position until after there are surges above $7 or $4 main support line.

The thing is, as long as prices are in accumulation or consolidation, odds are there will be a strong break out in either direction more so if this consolidation continues today. And as similar patterns in the past indicate, the longer the accumulation the stronger the break out. That’s why we are expectant of a bullish break out in line with the trend set on Oct 15.

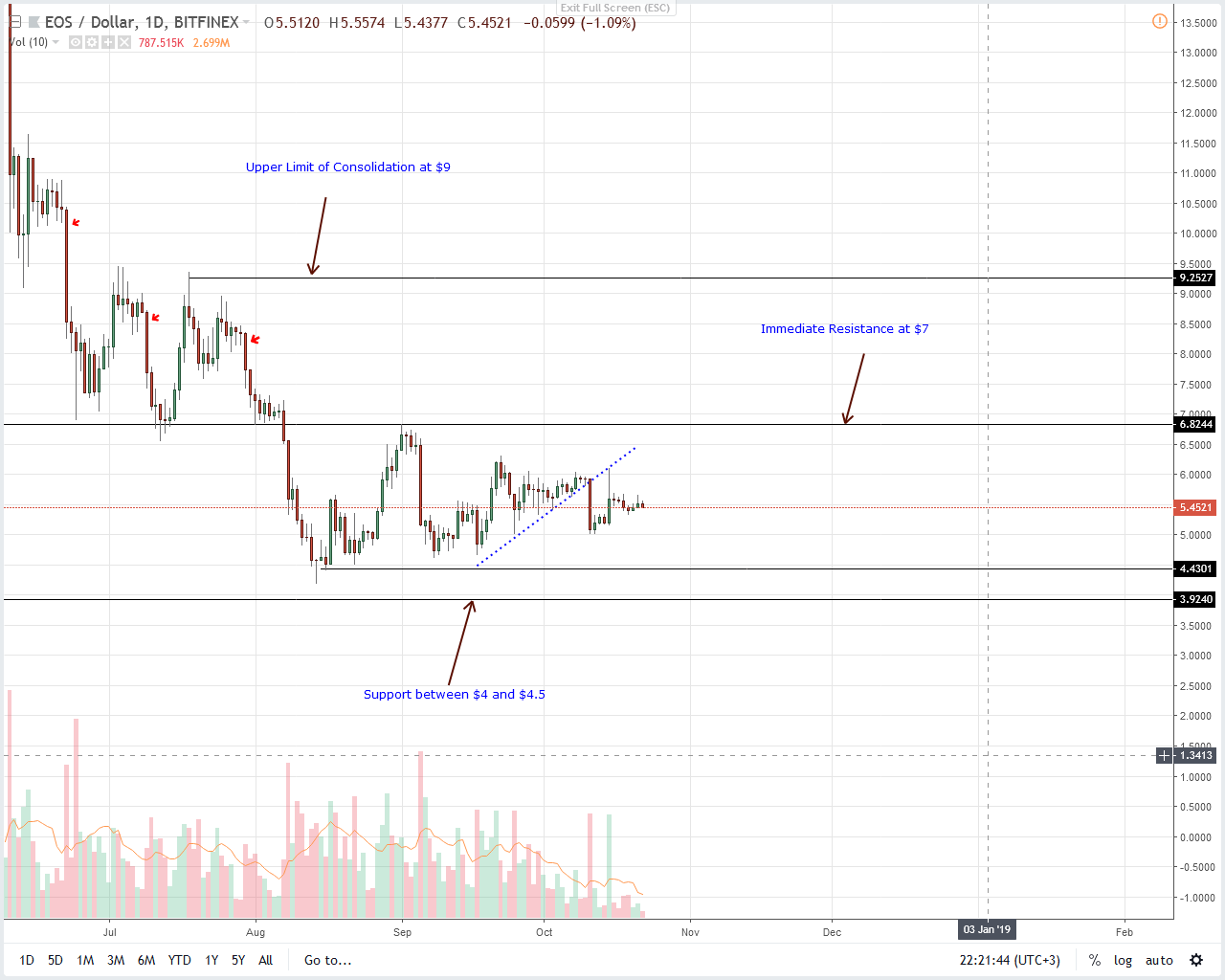

Litecoin Price Analysis

By close of yesterday, it will be 11 days of full accumulation inside Oct 11 high low. Technically this is bearish for Litecoin not just from the trend perspective but mostly because of the failure of buyers to reverse steep losses of Oct 11. As a result, from an effort versus results position, odds are sellers stand a chance thanks to the spike in trading volumes on that day.

However, the counter trend of Oct 15 is valid only if we see moves above $60 and $70 main resistance line. But, should there be declines below $50 and our risk-off trades are taken out once stop are hit, we shall revert back to normal.

Thereafter, if there is a confirmation of that bear move and a whole bar prints below $50, then we shall resume sells on pull backs with first targets at $30.

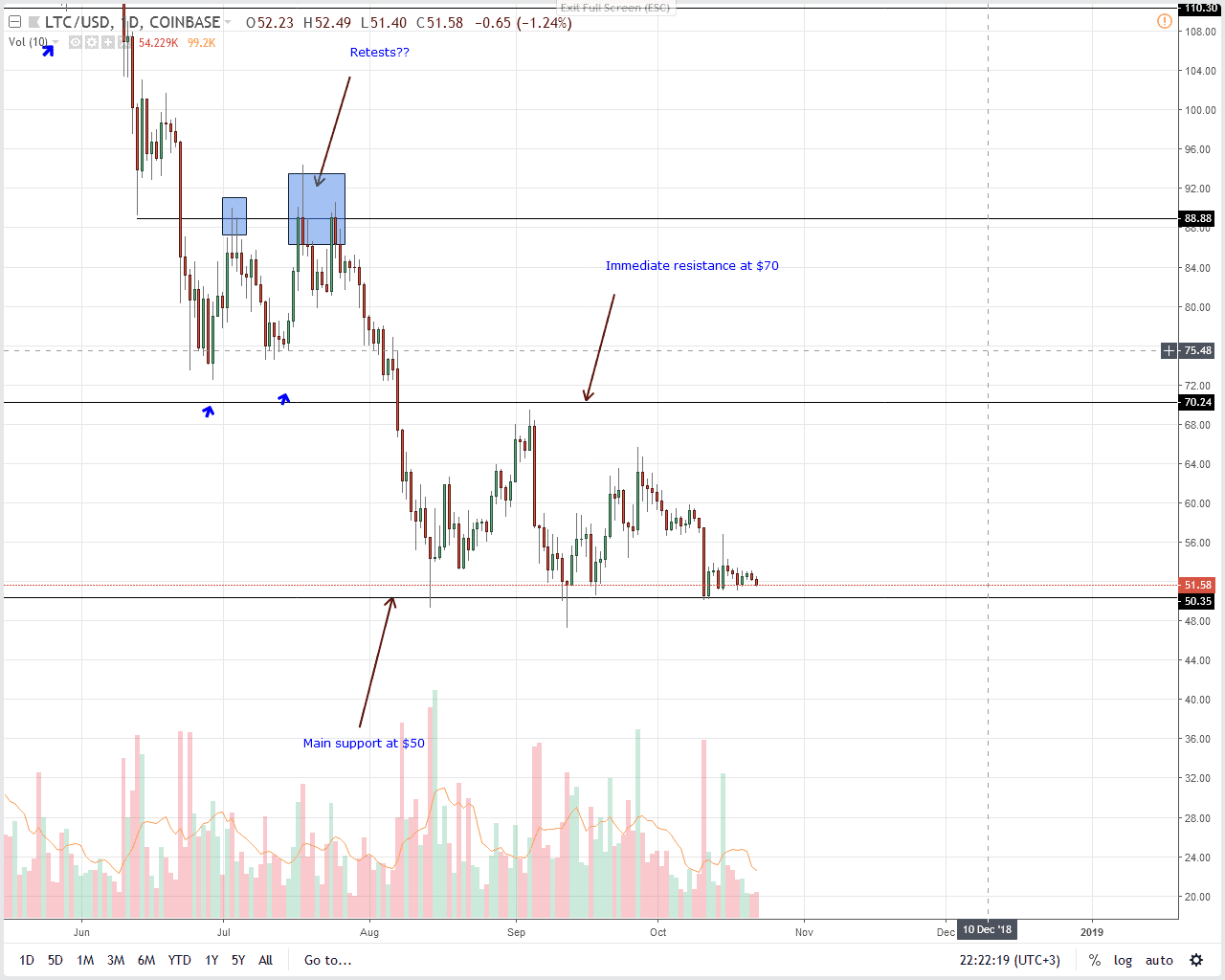

Stellar Lumens Price Analysis

Two things are clear as far as Stellar Lumens price action is concerned. First, XLM is in consolidation mode with clear resistance and support at 30 cents and 15 cents respectively.

Secondly, bears are in charge—from a long-term perspective now that we have been in a bear trend in the last eight months. Now, even if we are overly bullish due to bullish sparks of Oct 15, we need to see confirmation whereby traders drive prices above 25 cents triggering short-term bulls.

This has been our position from onset and the failure of bulls to do so mean odds of sellers driving prices below 15 cents are high. Before that happens, we shall retain a neutral but bullish outlook with technical backings from Fibonacci trading rules.

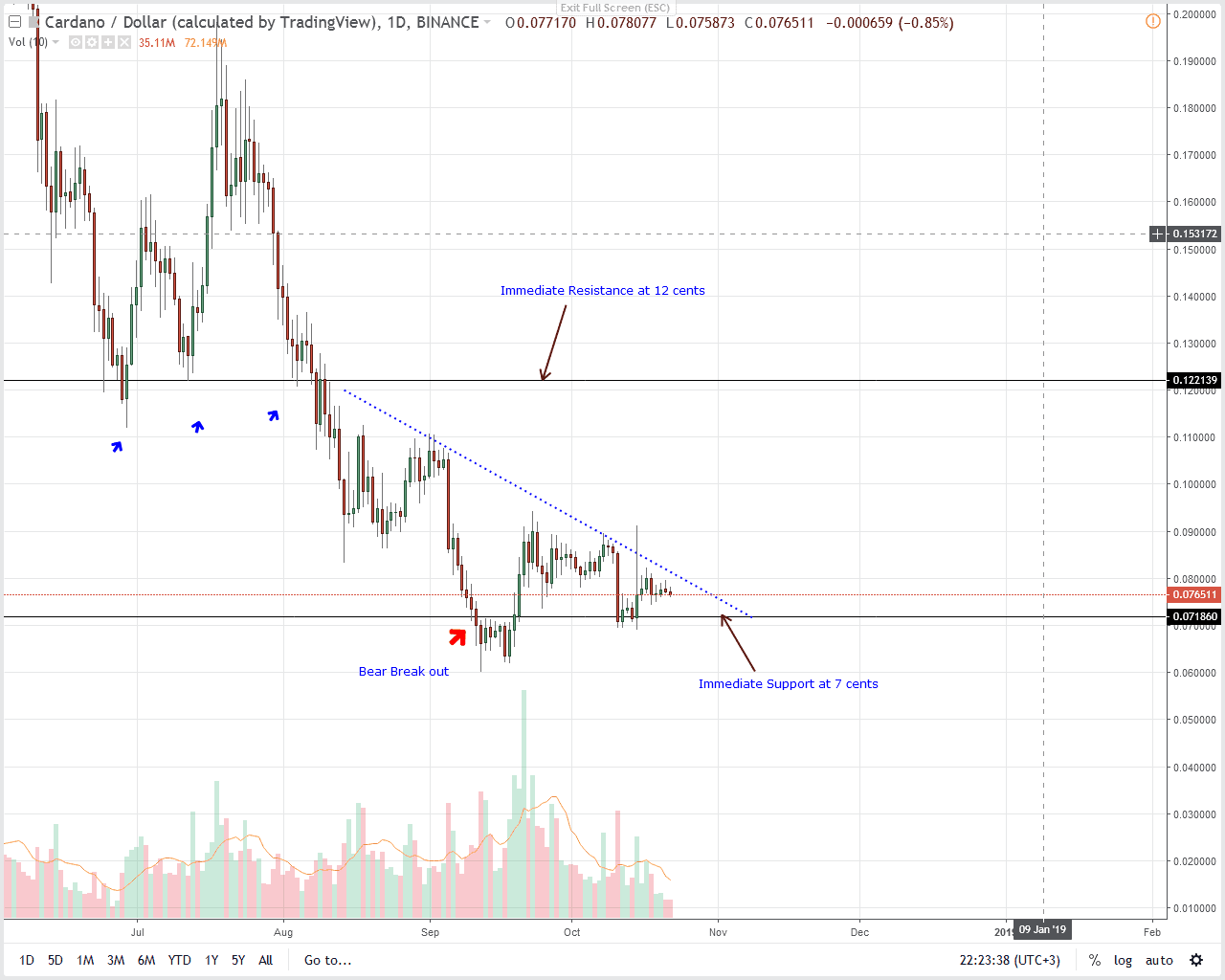

Cardano Price Analysis

Like most coins, it’s clear that Cardano (ADA) is in consolidation with clear support at 7 cents and resistance at 12 cents. The range might be wide but risk off traders would be net long if prices race above 9.5 cents. On matters price action, bears appear to be in control all due to the inability of buyers to build momentum according to the trend direction set by Oct 15 bulls.

While we maintain a bullish outlook, yesterday’s inactivity is damping for bulls but unless otherwise, this should print neutral for traders. From our last Cardano trade plan, we shall switch to bearish if there are strong bearish prints below 7 cents.

On the other hand, gains above 9.5 cents means] bulls could end up boosting prices towards the 12 cents level. In fact they can end up padding the overall reversal towards 20 cents and later 40 cents.

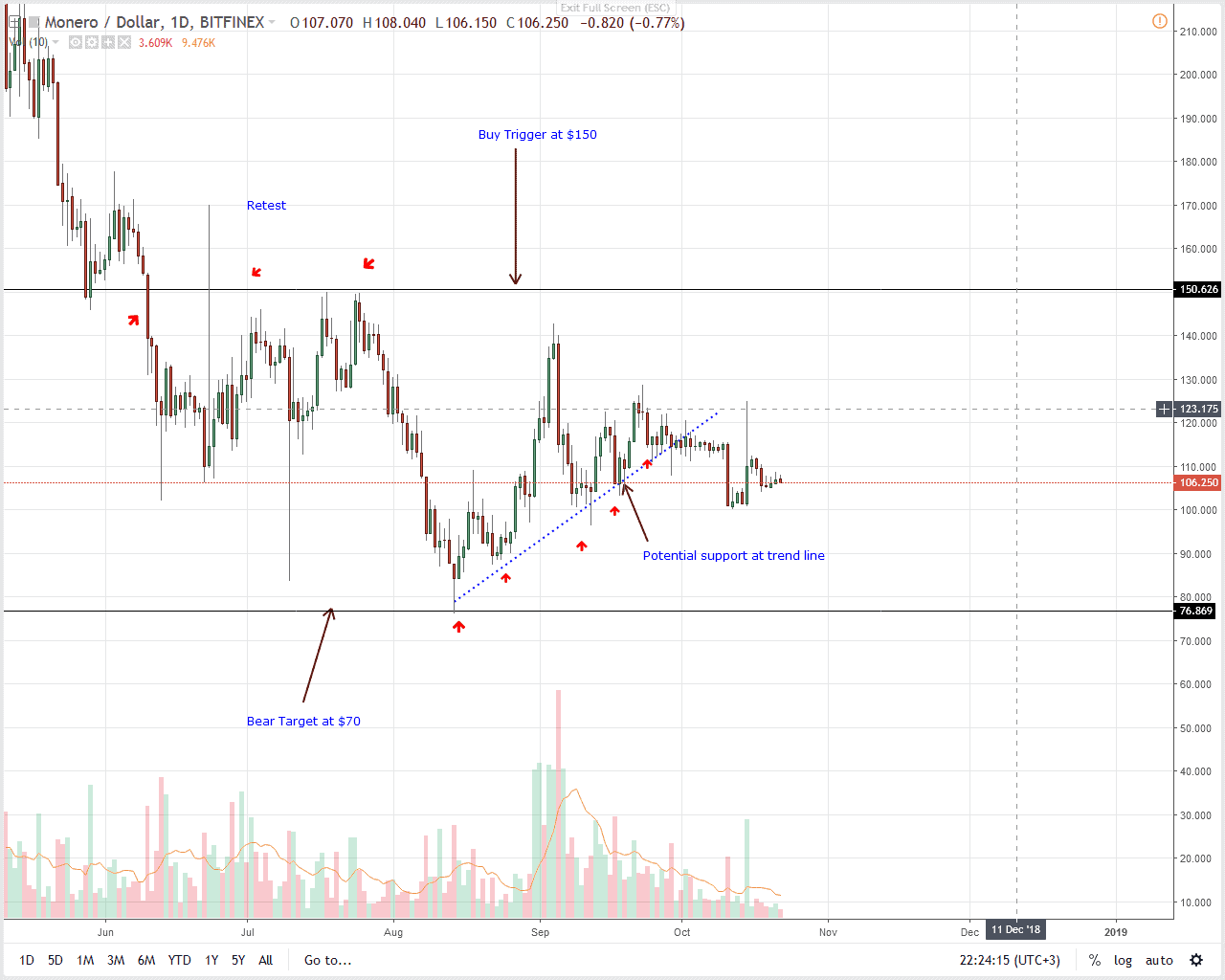

Monero Price Analysis

Price wise, Monero is in a limbo. The counter moves of Oct 11 and 15 translates to neutral because after Oct 15 buy euphoria our stops at $120 were hit as bulls bounced off from the psychological $100 mark. However, the lack of a concise follow through in either direction—above $120 or below $100 mean traders shall take a neutral until after our last Monero trade plan conditions are met.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post EOS Price Analysis: Altcoin Bulls are Loading Up as Prices Stabilize appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage