Join Our Telegram channel to stay up to date on breaking news coverage

MicroStrategy, a publicly-listed company known for its extensive Bitcoin (BTC) holdings, found itself facing a 14% decline in its investment value. This happened on Sunday, June 11, 2023. It prompted a data analyst at blockchaincenter.net to compile metrics revealing an alternative scenario.

The alternative scenario had Microstrategy invested in Ethereum (ETH) instead of Bitcoin (BTC), the company’s portfolio would have experienced a remarkable 54% increase.

Blockchaincenter.net’s Data Set ‘There Is No Second Best’ Reveals Potential Gains if Microstrategy Chose ETH Over BTC

According to the data set titled “There Is No Second Best” from blockchaincenter.net, Microstrategy currently holds a staggering 140,000 BTC. This makes it the largest holder of Bitcoin among publicly listed firms. However, On Sunday, recent statistics indicated that the value of MicroStrategy’s Bitcoin portfolio has decreased by 14%. This has resulted in a loss of $575 million.

Accordingly, the initial investment of $4.206 billion is now valued at $3.631 billion.

The creator of the data set, Holger from blockchaincenter.net, challenged MicroStrategy’s founder, Michael Saylor. Saylor has long championed Bitcoin as the leading crypto asset, stating that there is no second best.

According to Holger’s data, if Microstrategy had invested in Ethereum (ETH) instead, the company would have amassed 3,681,627 ETH. This would have resulted in a portfolio valued at $6.461 billion. The alternative investment would have yielded a staggering $2.255 billion in profit, showcasing the missed opportunity for Microstrategy.

Furthermore, by staking its ether stash, Microstrategy could have earned an additional 326,225 ETH. This would have translated to a staking profit of around $572.5 million at an annual percentage rate (APR) of 4%.

The data set also reveals that if Microstrategy were to trade its BTC for ETH at today’s exchange rates, the company would receive 2,069,232 ETH. This Ethereum portfolio would generate an estimated $182 million per year from staking, surpassing MicroStrategy’s previous operating income.

Despite these revelations, it is unlikely that Microstrategy will switch its focus from BTC to ETH, as Michael Saylor holds Bitcoin in the highest regard. While Bitcoin remains highly coveted among investors, the recent decline in its price has caused some to abandon the token. However, Microstrategy serves as an example of a Bitcoin bull, demonstrating unwavering faith in the asset.

There is only one #Bitcoin. pic.twitter.com/AzcJAycNSX

— Michael Saylor⚡️ (@saylor) June 6, 2023

Performance Comparison – Bitcoin Vs. Ethereum

Comparing Bitcoin and Ethereum, data from blockchaincenter.net shows that Bitcoin experienced a 6.2% decrease in value over the past year. On the other hand, Ethereum saw a remarkable 19.2% surge. However, Bitcoin continues to maintain a higher number of active addresses and transactions. According to data from Messari, the Ethereum network had 722,849 daily active addresses, while Bitcoin had 943,047. In terms of transaction volume, Bitcoin processed transactions with a total value of $3.19 billion, while the Ethereum network processed transactions totaling $1.54 billion.

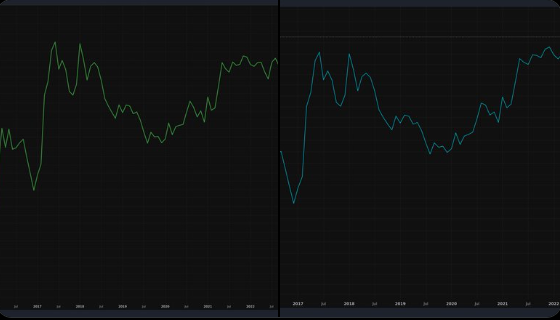

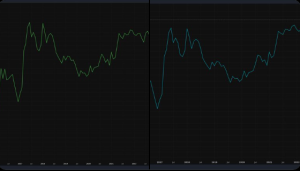

Sorry brozac, but it appears you’re out to lunch. Here’s the chart of ETH marketcap vs BTC (left); and then here’s the chart if we include ETH total value locked (right). As a percent.

Eth has relentlessly gained since launch, and WILL flip. BTC is just a bad NFT platform now. pic.twitter.com/27NIYTnHhy

— Monegro (@BawdyAnarchist_) June 12, 2023

The difference in performance and market perception between Bitcoin and Ethereum can be partly attributed to regulatory concerns surrounding Ethereum. The Securities and Exchange Commission (SEC) categorizes almost all cryptocurrencies, excluding Bitcoin, as securities, causing uncertainty and influencing market dynamics.

While MicroStrategy’s Bitcoin investment may have experienced a decline, the alternative scenario presented by Ethereum’s remarkable growth highlights the dynamic nature of the cryptocurrency market. As the industry evolves, it remains essential for investors to carefully evaluate their investment choices and adapt to the changing landscape.

Related News:

- Microstrategy Says It Bought 7,500 Bitcoin in Q1, Holds BTC Worth Over $4 Billion

- MicroStrategy Stock Price Gains Mirror Bitcoin Price

- New Crypto Banking System Coming Amidst Coinbase and Binance Crackdown

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage