Join Our Telegram channel to stay up to date on breaking news coverage

On the 3rd of October with very strong bullish momentum. This momentum, which was the strongest on the 5th of October began to grow progressively weaker from the 6th of October until it finally changed to a strong bearish market movement on the 10th of October.

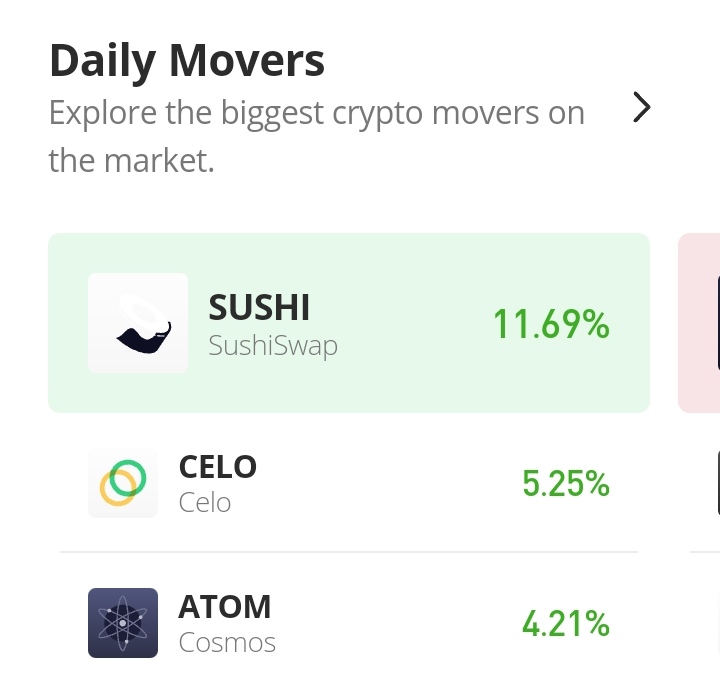

SushiSwap Market Price Statistic:

- SUSHI/USD price now: $1.4021

- SUSHI/USD market cap: $175,703,808

- SUSHI/USD circulating supply: 127,244,443

- SUSHI/USD total supply: 250,000,00

- SUSHI/USD coin market ranking: #138

Key Levels

- Resistance: $ 1.4500 $1.5000, $1.5500

- Support: $1.3500, $1.3000, $1.2500

Your capital is at risk

SushiSwap Market Price Analysis: The Indicators’ Point of View

The bearish price retracement lasted for three days with very strong momentum on the 10th and on the 12th of October. The market formed its new support (for an upward performance of the price) at the $1.177 price level. As the Suhiiswap market finds new support, it was also able to break the $1.3566 resistance level where it was rejected from the 8th to the 11th of September.

In the RSI indicator, both the RSI line and the signal line have moved into the bullish zone. The faster line is measuring 63% while the slower line measures 57%. These two lines are close to each other. In the MACD indicator, weak bullish histograms started to appear from the 10th to the 13th. This bearish advancement has now been cut short in today’s market as a very significant histogram representing today’s trading activities appears on the chart.

SUSHI/USD 4-Hour Chart Outlook

The price pullback in the market is a result of the necessary retracement that should follow any strong bullish market move that has gone into the overbought. Now the downward movement of the market has been stopped due to resistance from the bulls and the price balances at $1.4046. Right now the RSI line moves slightly below the threshold of the overbought zone due to the price retracement.

Join Our Telegram channel to stay up to date on breaking news coverage