Join Our Telegram channel to stay up to date on breaking news coverage

On Sunday evening, major cryptocurrencies faced a setback following remarks made by Federal Reserve Chair Jerome Powell, who hinted at the potential for curbing rate hikes due to banking sector stress.

The impact on the crypto market was evident, with Bitcoin experiencing a decrease of 1.93%, resulting in a price of $26,639. Ethereum also saw a decline of 1.06%, settling at $1,799, while Dogecoin took a hit of 3.10% and reached $0.071.

Cryptocurrency Market Faces Setback as Federal Reserve Hints at Rate Hike Curbing

Throughout the past month, Bitcoin has primarily been in a consolidation phase, showing a slight downward drift but managing to retain its value. This stability has been a relief for investors, as it marks a departure from the extreme volatility witnessed in the previous year. Over the last 30 days, Bitcoin has only dropped by less than 1%, offering investors a much-needed respite.

Within the last 24 hours, some cryptocurrencies managed to perform well despite the setback witnessed on Sunday. Tron experienced a gain of 5.48%, reaching $0.07893, Render Token too registered a massive gain of 11.25% and a price of $2.62. Huobi Token also saw a modest gain of 3%, settling at $3.01. However, the overall global crypto market capitalization stood at $1.11 trillion on Sunday, marking a decrease of 1.89% compared to the day before.

Following the remarks from the Fed, investors in the stock market observed a minor decline in stock futures on Sunday evening due to ongoing discussions regarding the U.S. debt ceiling. The S&P 500 futures experienced a decline of approximately 0.2%, while the Nasdaq 100 futures observed a 0.1% drop.

In the world of options trading, options expert Nic Chahine offered a limited-time opportunity for investors to access his pro-level options picks at a significantly reduced cost. Chahine’s previous options plays had achieved remarkable gains of up to 400%, making this an enticing offer for those looking to enhance their portfolios.

According to market analyst Edward Moya from OANDA, Bitcoin had recently experienced a surge, surpassing the $30,000 mark for the first time since the summer of 2022. Factors such as regional banking concerns and speculation around Fed rate cuts had provided substantial support for cryptocurrencies.

However, these bullish catalysts have since diminished, resulting in a decline of roughly 30% from this year’s rally. The regulatory question surrounding cryptocurrencies remains a crucial factor, and traders are advised to exercise patience.

Crypto trader Tony Vays offered his perspective on the current consolidation phase of Bitcoin, suggesting that it indicates an extended bull market. Vays predicted notable future heights for Bitcoin, with a potential value of up to $300,000.

He presented two scenarios, one more bullish with a lower top at $200,000, and another more bearish with a higher top at $300,000, though the latter would occur at a later time.

Crypto analyst Michael Van de Poppe highlighted a Classic Choppy Pattern observed in Bitcoin, noting a rejection at $27,200 and subsequent consolidation with the CME gap hovering around $26,900.

Van de Poppe emphasized the importance of Bitcoin breaking and sustaining momentum above $27,200. He also identified a strong support level in the range of $26,000 to $26,500 in case of a price decline.

Potential for Volatility on the Horizon as Crypto Markets Turn Green

Bitcoin and other cryptocurrencies maintained relatively stable positions on Monday, with minimal fluctuations in prices, indicating a historically narrow trading range that suggests the potential for increased volatility. Traders are closely monitoring various catalysts that could trigger significant market movements.

Bitcoin’s price experienced an uprise of 2.46% in the past 24 hours, trading at $27,403 at the time of writing. The cryptocurrency has struggled to regain momentum above the psychologically important $30,000 level, which it briefly surpassed last month, marking the first time since June 2022.

David Duong, Head of Institutional Research at Coinbase Global, noted that Bitcoin has found support around the 100-day moving average (DMA) in recent weeks but has lacked strong price action, with sideways trends and lackluster performance. If Bitcoin faces rejection around the $27,200 mark, Duong anticipates a return to the lower price range, with a target of around $24,000.

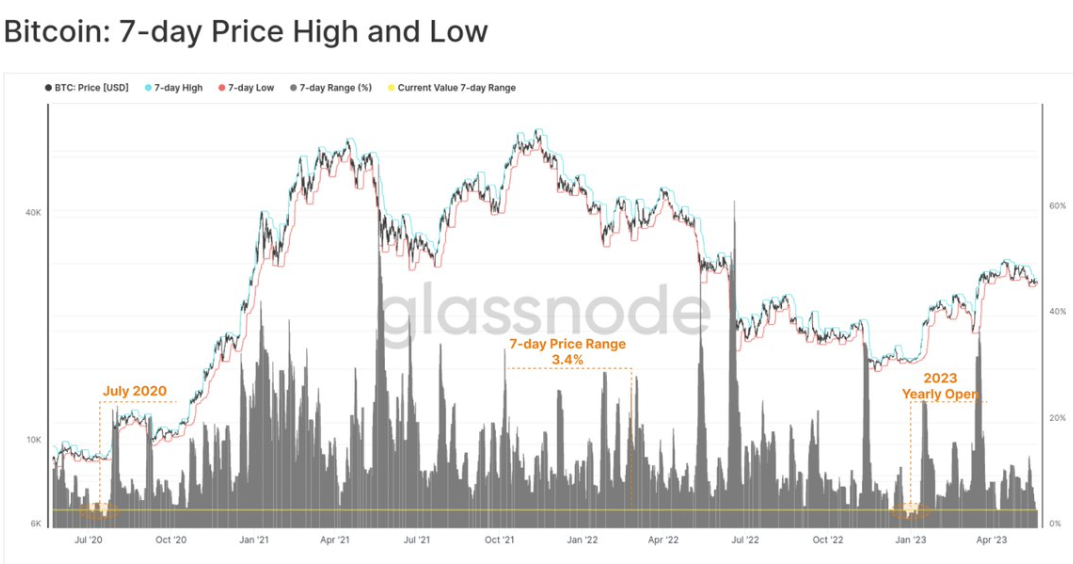

Cryptocurrencies have been trading within an exceptionally tight range over the past week. According to analysts at crypto market intelligence firm Glassnode, Bitcoin’s seven-day price range of 3.4% is among the narrowest recorded in the last three years.

Similar instances in January 2023 and July 2020 were followed by significant market movements, suggesting that high volatility may be on the horizon.

Traders are awaiting catalysts that could initiate substantial price shifts, with at least four factors in focus. Duong mentioned three potential forces: the disbursement of Bitcoin to Mt. Gox creditors, the Argentine central bank’s ruling against crypto operations, and Tether’s decision to allocate a portion of its profits to Bitcoin purchases.

Additionally, broader macroeconomic catalysts play a role, as Bitcoin has shown a correlation with the Dow Jones Industrial Average and S&P 500 in response to U.S. economic data that influences interest rate expectations. Discussions regarding the U.S. debt ceiling have added further uncertainty to the cryptocurrency landscape.

However, the outlook for interest rates remains crucial. Bitcoin’s decline from its peak near $69,000 in late 2021 was influenced by the Federal Reserve’s efforts to combat inflation through rate hikes. Traders are closely monitoring the Fed’s upcoming decision in June, with market expectations indicating a significant chance of another rate hike, despite it previously being unlikely.

The recent economic data and cautious comments from Fed speakers support the possibility of a rate hike in June, according to Mike Crosbie, Acting CEO of stablecoin issuer poundtoken.io. While Bitcoin and Ether have remained in a consolidation phase, signaling market uncertainty, the expected rate hikes in June could provide the crypto markets with greater clarity.

Alternative Investments During These Times of Uncertainty

Bitcoin’s current phase has attracted differing views from the market. On the one hand, you have those showing cautious optimism. And on the other, there are those who are aiming to short BTC in days to come.

That leaves beginner-level market watchers at a disadvantage. So, during these times of uncertainty, better alternatives come in the form of crypto presales.

Tokens like AiDoge, DeeLance, Launchpad XYZ, and others are currently being offered as crypto presales.

These presale cryptos can bring a high level of gains to those who invest early. Being ICOs, these tokens allow one to engage in crypto trades away from the market’s volatility for one. And because of their unique utilities, they have potential upsides as long-term investments.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage