Join Our Telegram channel to stay up to date on breaking news coverage

Investing in altcoins is less risky than Bitcoin during a bear market, according to crypto investment firms.

New Wave Capital told Yahoo that the altcoins with smaller capitalization have tremendous long-term potential. Bitcoin, according to the San Francisco startup, could have more baggage to carry during the next bull run. Traders might feel confident about spreading their portfolio in assets with the most practical long-term goals in mind. However, the company agreed that Bitcoin is still the most resilient asset during a bear market.

“In a bear market, everyone moves away from altcoins, and they go back to what has been traditionally more resilient, which is bitcoin,” said CEO Eric Campbell. “They think it’s a safer asset. But when we come back to another bull market in the future, we think people will go back to altcoins.”

New Wave currently features a diverse range of altcoins in its investment portfolio, including Etherum, XRP, Bitcoin Cash, Civic, and Litecoin. The list gets assessed every quarter based on a risk survey and algorithm.

Strong Use Cases

While Bitcoin undoubtedly remains the king of cryptos, several altcoin projects have emerged as alternatives to the first digital currency’s technical limitation. Ethereum, for instance, serves the purpose of creating and launching decentralized apps and smart contracts on the top of a public blockchain. Monero, at the same time, offers users with full privacy, something that Bitcoin provides but partially.

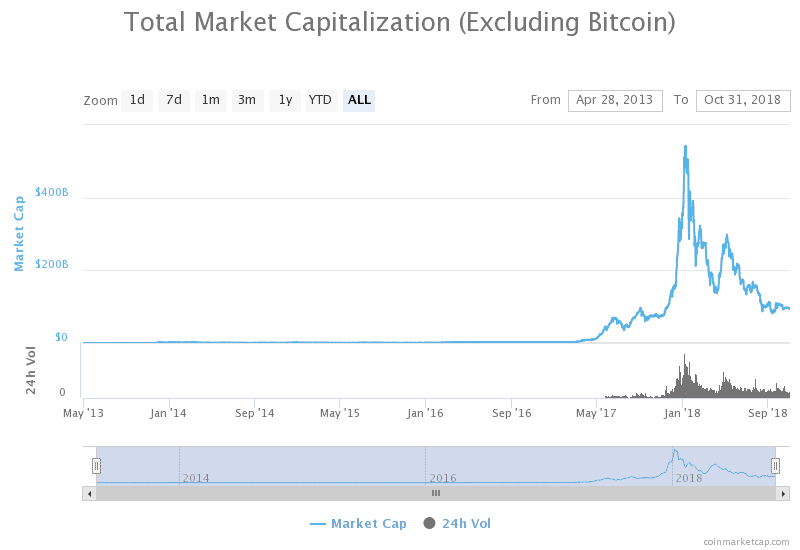

Nevertheless, Bitcoin is among the least affected cryptocurrencies during this year’s bearish sentiment. The coin has lost 54 percent of its value compared to its closest alternatives. Ethereum, again, for instance, has dropped 74 percent against the US Dollar this year. XRP is also down 78 percent, alongside Bitcoin Cash and Litecoin with their 82 and 78 percent losses, respectively.

Regardless of their weak yearly performances, these projects serve long-term goals related to blockchain’s integration into mainstream industries. Analysts rest their bullish perspectives about altcoins on a fundamental demand and supply theory. Against a limited supply, the demand for these fractionable value units is likely to go up. XRP, for instance, is proving itself to be a digital currency for cross-border transactions. It is the coin’s basic use case which, upon more adoption, could yield profits in the long run.

New Wave’s co-founder Albert Cheng thinks it is the prime reason why their advisory firm is looking into more Bitcoin alternatives.

“When a market is bearish, there’s a flight to quality, and that’s bitcoin today,” he told Yahoo. “But our service is intended to drive long-term thinking. And if people are holding their portfolios for a long time, I think it’s prudent to have exposure to multiple coins. True paradigm shifts take a long time.”

Image from Shutterstock

The post Crypto Investment Firms Advise Buying Smaller Cap Altcoins During Bear Market appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage