Join Our Telegram channel to stay up to date on breaking news coverage

It is no secret that the crypto environment is expanding and developing rapidly, and that an increasing number of retail traders are moving into the market, which is causing a surge in the whole community, but is that surge a positive addition?

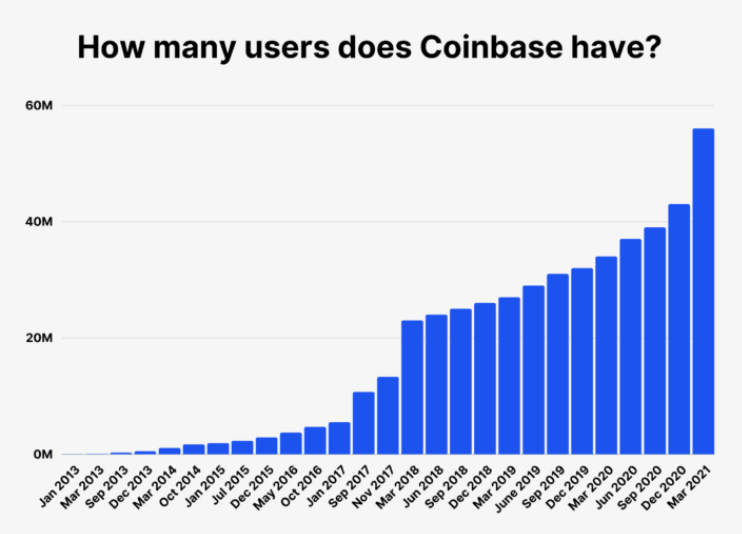

Since 2012, according to Coinbase data, this has been one of the top crypto currency exchanges worldwide. Within the first several years, this site registered its first million users. Since the outbreak of the epidemic, Coinbase has seen tremendous growth, and this rapid expansion is showing no signs of losing steam.

We have all seen that “95% of novice traders lose money,” and this is what insidebitcoins will be discussing in this article : why do new traders lose money, and how can we as a community effectively mitigate the consequences of such significant losses for those who lack experience?

Being a part of several crypto social groups, as many of you reading this right now are, it is all too common to see a novice trader question in a comment: “When should I purchase/sell this coin?”

More often than not, someone will reply with an entry target… excellent, or is it?

So the new guy buys in at the suggested target, it trends up, then boom, its down and this poor guy has no idea what went wrong.

We can all agree that learning something new requires an investment, whether it be time or money. Blindly following someone’s signals without understanding it is like crossing the road without looking…some times, you’ll make it, Most of the time you will be hurting.

What should novice investors do on day one?

Lets look at a few simple steps that will help you on your journey through the jungle of the crypto world.

-

Find a community driven hub.

Finding ‘your crowd’ can be very empowering, not only will you learn a lot faster, you can also gain confidence as you learn, eventually eliminating emotional based trades (more on that later on).

Take a peek at this article which gives the best groups to join – https://insidebitcoins.com/buy-cryptocurrency/best-crypto-discord-groups.

-

Learn some basic technical analysis (TA) and terminology.

The best way to feel out of place in a new environment? Not knowing what’s being discussed.

Technical analysis can be frustrating, not knowing why a certain coin trended one way or another can make you place bad trades.

-

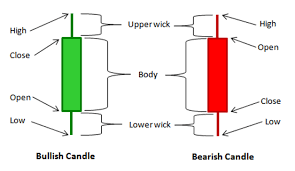

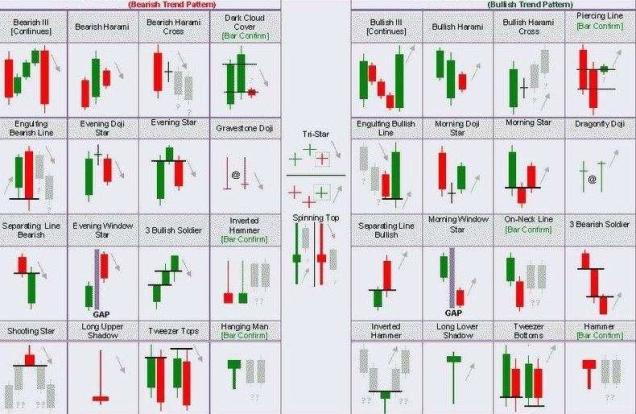

The first thing we need to look at are candles and what information they provide you.

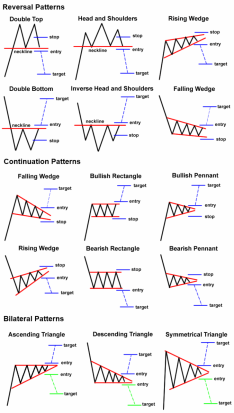

Candles will form patterns, which will aid you in establishing the trend (bullish, up trends, bearish, down trends)

Here are some of the most popular examples.

Next we want to understand about support and resistance levels (S&R). These are key areas on charts where historical data shows what is known as Confluence.

Support is a price point below the current market price that indicate buying interest. Resistance is a price point above the current market price that indicate selling interest. To identify S&R, place a horizontal line in such a way that it connects at least 3 price action zones, well-spaced in time.

-

Get Trading View. Its probably the most used tool by traders.

“What’s TradingView? We’re a charting platform and social network used by 30M+ traders and investors worldwide to spot opportunities across global markets.”

-

Get a DEX account (Decentralised Exchange).

This will allow you to buy and sell tokens. It should be noted that different DEX will list different tokens, sometimes you will need to use more than one. In addition, a DEX is NOT the same as a wallet!

-

Indicators, which to choose and how to understand them.

This is a personal choice. Some of the standard indicators will serve you well, like RSI, MACD, VOL… they are easy to read and it does exactly what it says on the tin!

You may find yourself trying out different ways of trading, this is where modified indicators can be a game changer! The Stochastic RSI on Trading View is very popular, used by many top traders and influencers on youtube.

-

Risk Management.

Losses are reduced with the use of risk management. Additionally, it can prevent traders’ accounts from losing all of their funds. The risk arises when traders incur losses, so traders have the potential to profit on the market if they can control their risk.

It is a crucial but sometimes disregarded need for effective active trading. After all, without a sound risk management plan, a trader who has made substantial profits might lose it all in only one or two disastrous deals. So how do you create the ideal methods to reduce market risks?

“Plan the trade and trade the plan.” Planning ahead can often mean the difference between success and failure.

Take-profit (T/P) and stop-loss (S/L) points are two important methods that traders may plan ahead while trading. Successful traders are aware of the prices they are willing to buy and sell items for. They may then compare the resultant returns to the likelihood that the stock will achieve their objectives. They close the deal if the adjusted return is high enough.

On the other hand, failed traders frequently start a transaction with no concept of the points at which they would sell for a profit or a loss. Emotions start to take over and direct their transactions, just like lucky—or unlucky—streak gamblers. People frequently cling onto losses in the hopes of recovering their money, while gains might tempt traders to act recklessly.

Determining take-profit and stop-loss points

The price at which a trader will sell a stock and accept a loss on the transaction is known as a stop-loss point. This frequently occurs when a deal does not turn out as a trader had hoped. The points are intended to stop the belief that “it will come back” and to stop losses before they get out of control. For instance, traders frequently sell a stock as quickly as they can if it breaks below a crucial support level.

A take-profit point, on the other hand, is the price at which a trader will sell a stock and benefit from the transaction. At this point, the potential upside is constrained by the inherent dangers. For instance, if a stock is nearing a significant resistance level after a large move upward, traders may want to sell before a period of consolidation takes place.

After day 1, what then?

So you followed the above steps, found a great community, built your strategy / your plan. What’s next? YOU KEEP LEARNING. Every day strive to learn more about the playing field in which you are now proud to be a part of. Lean on your community, ask questions and get better at trading.

Understanding the signals people offer should now be easy for you, and together we will all profit.

Join Our Telegram channel to stay up to date on breaking news coverage