Join Our Telegram channel to stay up to date on breaking news coverage

Recent quarterly earnings reports from several publicly traded crypto-related companies showed higher sales and a rise in profitability in Q2 2023.

As the market emerged beyond the crypto winter, the businesses profited from increased market prices and a steady drop in bearish momentum.

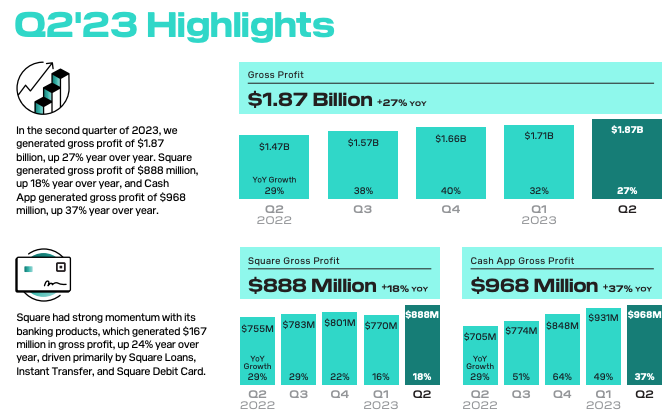

Block Records 27% Year-on-Year Increase

Payments technology provider Block Inc. released second quarter 2023 earnings with a gross profit of $1.87 billion, a 27% year-over-year gain.

The firm has shared that Bitcoin accounted for $2.4 billion of its overall $5.5 billion Q2 net sales. The revenue comes from Block’s Cash App, a mobile application for crypto transactions.

“The year-over-year increase in Bitcoin revenue and gross profit was driven by an increase in the quantity of Bitcoin sold to customers, partially offset by a decrease in the average market price of Bitcoin compared to the prior-year period,” the company mentioned in a statement to investors.

The company, owned by former Twitter CEO Jack Dorsey, reported a 34% growth in Bitcoin income compared to the $1.8 billion reported in Q2 last year.

Block also revealed that no Bitcoin impairment loss had been recorded in the duration.

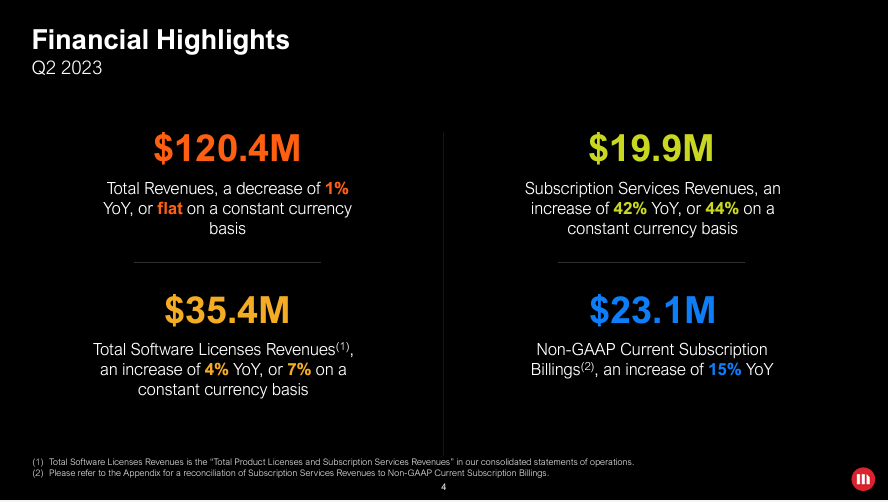

Coinbase Outperforms Analysts’ Forecasts

On August 3, the first American cryptocurrency exchange to go public, released its quarterly earnings report, exceeding initial projections to declare $663 million in net income.

Analysts had predicted a loss of $0.76 on $634 million in revenue, but Coinbase instead revealed a loss of $0.42 per share on $708 million in revenue.

“One year ago, in Q2 2022, we started reducing our expense base to operate more efficiently. One year later, we’re proud to say that our quarterly recurring operating expenses have dropped nearly 50% Y/Y,” the company’s Q2 2023 letter to shareholders reads.

$COIN Coinbase moving higher after Q2 earnings surprise to the upside! 🪙

~EPS: $(0.42) vs $(0.78) est

~SALES: $707.91M vs $643.36M esthttps://t.co/1t8PcL8IY1— TrendSpider (@TrendSpider) August 3, 2023

In Q2, the crypto exchange’s non-trading revenue surpassed its trading revenue for the first time, totaling a net of $335.4 million.

Despite the demise of FTX and falling cryptocurrency prices, the exchange had maintained its upbeat pace by the end of 2022, increasing revenue by 22% sequentially.

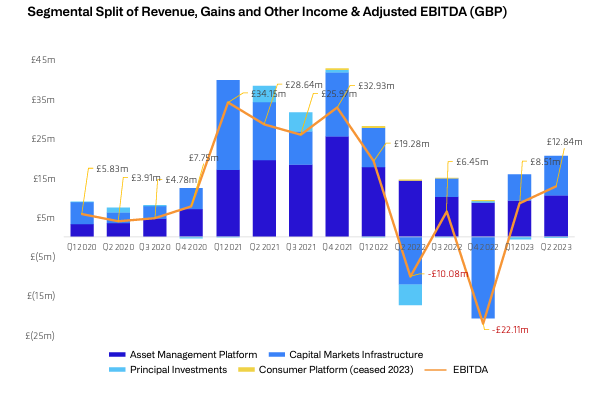

CoinShares Offsets Fee Decline with Increased Operations

European crypto company CoinShares reported a 33% increase in revenue over the previous year.

The reputable digital asset manager announced remarkable financial results for the year’s second quarter on August 1, 2023.

Despite challenges, CoinShares was able to offset a 25% year-over-year decline in asset management fees ($13.52 million) with a significant increase in capital markets operations ($12.76 million).

Additionally, CoinShares made $6.76 million in earnings during the quarter instead of a net loss of $0.77 million in Q2 2022.

During this time, CoinShares unveiled “Ledger Lens,” a tool allowing investors to instantly confirm the support of the group’s exchange-traded products.

MicroStrategy Turns Profitable Again

In contrast to a $1.1 billion net loss in Q2 last year, MicroStrategy reported a net income of $22.2 million this year.

A significant reason behind the difference was a smaller $24.1 million digital asset impairment loss in the quarter compared to last year’s enormous $917.8 million loss.

MicroStrategy founder and chairman Michael Saylor revealed via X that the business had spent almost $14.4 million to buy an additional 467 Bitcoins (BTC) in July. With this most recent purchase, it owns 152,800 BTC worth close to $4.43 billion at the time of writing.

The business also disclosed that Bitcoin and the MSTR shares of MicroStrategy outperformed several other indexes and assets.

In July, @MicroStrategy acquired an additional 467 BTC for $14.4 million and now holds 152,800 BTC. Please join us at 5pm ET as we discuss our Q2 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

MSTR has hiked by over 254% since it adopted the Bitcoin strategy in August 2020. As per Google Finance, the share price of MSTR was $145.02 on January 3. It is $376.97 as of the time of this writing.

Robinhood Turns First Profit Since IPO

American financial services company Robinhood [HOOD] reported a net income of $25 million in Q2 2023 compared to a $511 million net loss in the first quarter.

This is the first time it has turned profitable since going public in 2021.

Robinhood reports its first profit since going public. Here's what you need to know and my analysis 👇

Robinhood reported revenue of $486m and a net income of $25m. Monthly actives are down to 10.8m from 14m a year ago. Transaction revenues were down at $194m, but net interest… pic.twitter.com/fl7nhhyma5

— Simon Taylor (@sytaylor) August 4, 2023

“In Q2, we reached a significant milestone by achieving GAAP profitability for the first time as a public company. Guided by our bold product road map, we’re continuing to innovate for our customers, grow assets, gain market share, and change the industry for the better,” Robinhood CEO Vladimir Tenev noted.

However, the company showed a fall in revenue across crypto, equities, and transaction-based revenue. Crypto trading revenue decreased 18% from $38 million in Q1 to $31 million in Q2.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage