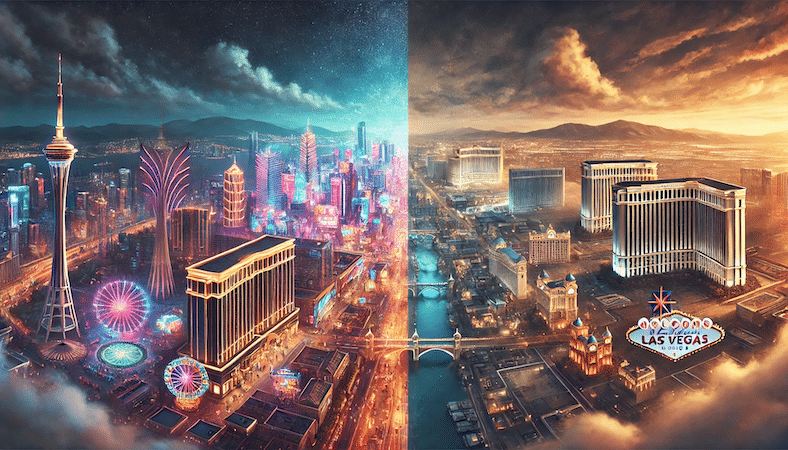

While Macau’s gaming market continues to gain momentum, analysts express concern about the Las Vegas Strip’s struggle to regain its footing. The declining revenues on the Strip highlight challenges as Nevada’s premier gaming destination faces difficult comparisons with its strong late-2023 performance. Despite the contrasting trajectories, experts see potential for both markets in the long term.

Las Vegas Strip Faces Persistent Revenue Declines

For four consecutive months, the Las Vegas Strip has reported year-over-year declines in gaming revenue. In October, gaming revenues on the Strip dropped by 3.1%, amounting to $692.1 million. A significant factor was the decline in baccarat hold, which fell from 15.3% to 11.9%. Consequently, baccarat winnings experienced a 23% year-over-year decrease, while the total baccarat drop shrank by 2%.

Analysts at CDC Gaming Reports and Deutsche Bank anticipate this downward trend to persist in the coming months. The elevated baccarat hold rates of 19% and 22% in November and December of 2023 create tough benchmarks for comparison. Carlo Santarelli, a Deutsche Bank analyst, pointed out that the unusual calendar advantage of September 2023 ending on a Saturday further inflated last year’s revenue figures.

Santarelli remarked:

We expect year-over-year gaming-revenue declines in both months, and we believe hold around F1 was as expected – less favorable than 2023.

Adding to the challenges are weak visitation numbers, which have impacted hotel performance. Revenue per room and average daily rates on the Strip saw respective declines of 10% and 8% in October. Analysts predict this trend will extend into November, as current room rates suggest continued softness in the market. However, in contrast to the Strip’s struggles, the locals’ casino market remains resilient, demonstrating the strength of non-tourist-driven gaming operations.

Macau’s Recovery Gains Momentum

Macau’s gaming industry paints a brighter picture, continuing to show signs of robust recovery. In November, gross gaming revenue (GGR) reached MOP$18.4 billion ($2.29 billion), slightly below market expectations. However, analysts remain optimistic about December, predicting a 3% year-over-year increase in GGR to $2.39 billion and a 0.4% sequential improvement on a per-day basis.

According to Santarelli, year-over-year comparisons are becoming increasingly difficult as the market stabilizes. Despite this, the region benefits from relaxed travel restrictions, heightened VIP activity, and increased participation in the mass-market segment. These factors collectively propel Macau’s recovery forward. The fourth quarter is tracking 10.4% higher than the previous year, reaching 79.5% of pre-pandemic levels in 2019.

Looking ahead, experts forecast continued growth for Macau’s gaming industry through 2025. The easing of travel barriers and shifting consumer preferences position the region as a leader in the global gaming landscape.

About Macau

Macau, often referred to as the “Las Vegas of Asia,” has a rich history intertwined with its status as a global gaming hub. Once a Portuguese colony, Macau became a Special Administrative Region (SAR) of China in 1999, maintaining a high degree of autonomy under the “one country, two systems” principle. Known for its cultural blend of Chinese and Portuguese influences, Macau is a UNESCO World Heritage site with historical landmarks such as the Ruins of St. Paul’s and Senado Square. Its transformation into a gaming powerhouse began in 2002 when the government ended the monopoly held by Sociedade de Turismo e Diversões de Macau (STDM) and allowed foreign operators like Sands, Wynn, and MGM to establish casinos. Today, Macau is the world’s largest gambling market, surpassing Las Vegas by a significant margin. In 2019, its gross gaming revenue (GGR) reached a staggering $36.6 billion, dwarfing the $6.5 billion generated by the Las Vegas Strip that year.

The gaming industry is the backbone of Macau’s economy, contributing over 50% to its GDP and employing a significant portion of the population. With six licensed casino operators, Macau boasts over 40 casinos, including iconic establishments like The Venetian Macao and Galaxy Macau. The industry thrives on its unique status as the only place in China where casino gambling is legal, attracting millions of tourists annually, particularly from mainland China. In 2023, Macau saw a resurgence in its gaming revenues, recovering from the COVID-19 pandemic’s impact. November 2023 recorded a GGR of MOP$18.4 billion ($2.29 billion), and analysts project continued growth into 2024. The region’s recovery has been driven by relaxed travel restrictions, increased mass-market participation, and robust VIP activity, with quarterly GGR tracking approximately 80% of pre-pandemic levels. Macau’s blend of heritage, strategic location, and gaming expertise continues to solidify its status as a premier destination in the global gambling industry.

Why Las Vegas is Declining

Experts believe that Las Vegas is experiencing a downturn in both revenue and visitor numbers due to several interrelated factors. The rise of online gambling platforms has significantly altered consumer behavior, offering the convenience of gaming from home and thereby reducing the appeal of traditional casino destinations like Las Vegas. The global online gambling market was valued at $63.53 billion in 2022 and is projected to grow at a compound annual growth rate of 11.7% from 2023 to 2030, indicating a substantial shift towards digital gaming options.

Additionally, the expansion of legalized gambling in other U.S. states has intensified competition. States such as Indiana have introduced online gambling platforms, attracting local bettors who might have otherwise traveled to Las Vegas. For instance, bet365 launched its services in Indiana in January 2024, providing residents with accessible sports betting options. This trend diminishes Las Vegas’s unique draw as a premier gambling destination.

Economic factors also play a crucial role. A softening national economy affects discretionary spending, leading to declines in visitor volume, gaming revenue, and hotel occupancy. Projections indicate that Las Vegas may face downturns in these areas through 2025 and 2026 due to broader economic conditions.

Moreover, Las Vegas’s shift towards high-end, luxury offerings has altered its traditional appeal. The closure of budget-friendly options like The Mirage, set to be replaced by a high-rise Hard Rock hotel, exemplifies this transition. While aiming to attract wealthier tourists, this strategy may alienate average visitors seeking more affordable experiences, potentially contributing to the decline in visitor numbers.

Diverging Paths, Shared Potential

The contrasting performance of Las Vegas and Macau underscores the unique challenges and opportunities for each gaming hub. While Macau appears to be thriving, the Las Vegas Strip faces a more uncertain short-term future. Analysts suggest that strategic adjustments will be necessary for Las Vegas to regain momentum.

However, despite these differences, both markets exhibit long-term promise. Evolving consumer behavior, global economic trends, and local strategies will play critical roles in shaping their trajectories. As the gaming industry adapts, these two iconic destinations remain pivotal players in the sector’s global narrative.