Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrency legislation in the United States has been a long, hard-fought battle with nary an end in sight. However, the industry saw some significant progress on that front earlier this week, as Congress appears ready to anoint permanent industry regulators.

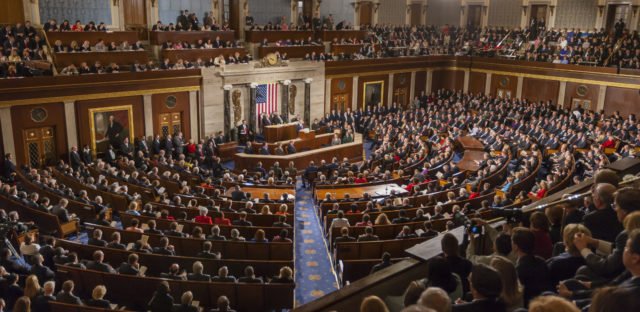

On Thursday, the United States House of Representatives welcomed two crypto-related bills on its floor. Both looked to clarify digital assets’ roles in the country’s financial landscapes differently.

SEC and CFTC to Play Big Brother

The first bill is titled the Security Clarity Act. Introduced by Rep. Tom Emmer (R-MN), the bill essentially tries to restrict regulators like the United States Securities and Exchange Commission (SEC) from cracking down on digital assets based on their Initial Coin offering (ICO) contracts. Most prominently, it established differences between an investment contract and an asset sold following the provisions of “an investment 22 contract, whether tangible or intangible.” The bill

While the bill could have significant implications on the SEC and its enforcement going forward, the second bill appears to have been the star of the day. Titled the Digital Commodity Exchange Act, the bill was put forth by Rep. Mike Conaway (R-TX), with support from several names across the Blockchain Caucus.

Conaway server as a ranking member on the House Committee on Agriculture. His proposed legislature categorized all cryptocurrency exchanges as “digital commodity exchanges.” These marks a significant distinction from many other similar bills in the past, which struggled to find the right classification of cryptocurrencies – and, as such, their exchanges.

The Commodity Futures Trading Commission (CFTC) classifies digital assets as commodities. While Conaway’s bill looks to define them under a separate moniker, it does identify them similarly to the financial watchdog.

Just One Approval

Amongst other things, the new bill requires crypto exchanges to register with the CFTC. It marks a departure from the current regulations, which merely include getting a money transmitter license and registering with state financial regulators wherever possible (for instance, in New York and Texas).

Conaway’s bill wants exchanges to only seek approval from the CFTC. If passed, it would remove state financial regulators from the process entirely and present a unified regulatory regime. It could be a saving grace for many exchanges that haven’t penetrated into top U.S. markets like New York.

The New York Department of Financial Services has built a reputation as a difficult regulator for crypto firms in recent times. Crypto firms will need to get a Virtual Currency License (BitLicenses), which will depend on their compliance with some stringent identity verification and data collection requirements on exchanges.

However, there’s also the question of what the CFTC’s requirements will entail for exchanges if it ends up as the sector’s sole regulator. Conaway’s bill also specifies that exchanges would only be able to list digital assets that aren’t deemed susceptible to manipulation.

“The proposed legislation builds on the existing commodity market practices required of Futures Commission Merchants (FCMs) to protect customer assets,” a summary of the bill said, adding that exchanges will need to separate customer assets and hold them in licensed digital asset custody services.

Join Our Telegram channel to stay up to date on breaking news coverage