Join Our Telegram channel to stay up to date on breaking news coverage

Compound Labs had to suspend its market cETH market operations for at least a week after a bug was introduced in its latest update.

The latest update was initially intended to look into improving the pricing data for Compound’s cETH token. However, the upgrade experienced an issue that led to the team freezing this synthetic asset, before the situation resolves in a week.

While the Compound Labs team has been consistently reassuring its customers that their funds are not at risk, there are several underlying concerns within the investor community.

Let us find out what exactly happened at Compound Labs’ update error and what’s the most feasible solution to it.

What Exactly Happened?

In a recent governance proposal to update its price feeds, Compound Labs has been affected by a bug.

The error has “temporarily frozen” the Compound Ether (cETH) market, which led to pausing the cETH transactions, to which Compound Labs has clarified that the “funds are not immediately at risk”.

Compound Labs took to Twitter to announce the bug on 31st September 2022, Wednesday, that came from Proposal 117: Compound Oracle Upgrade v3.

The proposal was executed only a couple of hours ago to update the Oracle contracts on the Compound protocol to a new version that uses Uniswap V3 instead of V2 for price feeds.

“An hour ago, Proposal 117 was executed, which updated the price feed that Compound v2 uses.”

“This price feed, while audited by three auditors, contained an error that is causing transactions for ETH suppliers and borrowers to revert”, the Compound Labs handle tweeted informing its customers about the error.

In response to this error, the developing team came up with a plan to move to the previous price feed via Proposal 119: Oracle Update. The new proposal was created less than an hour after Proposal 117 had been executed but has to undergo a week-long governance process before taking effect.

Further, according to a quote given by security solutions architect Michael Lewellen of OpenZeppelin, the code bug came from the “getUnderlyingPrice” function, which hadn’t updated the price of the cETH tokens, which would return the empty bytes and caused the call to be reverted.

Millions Frozen Due To Upgrade

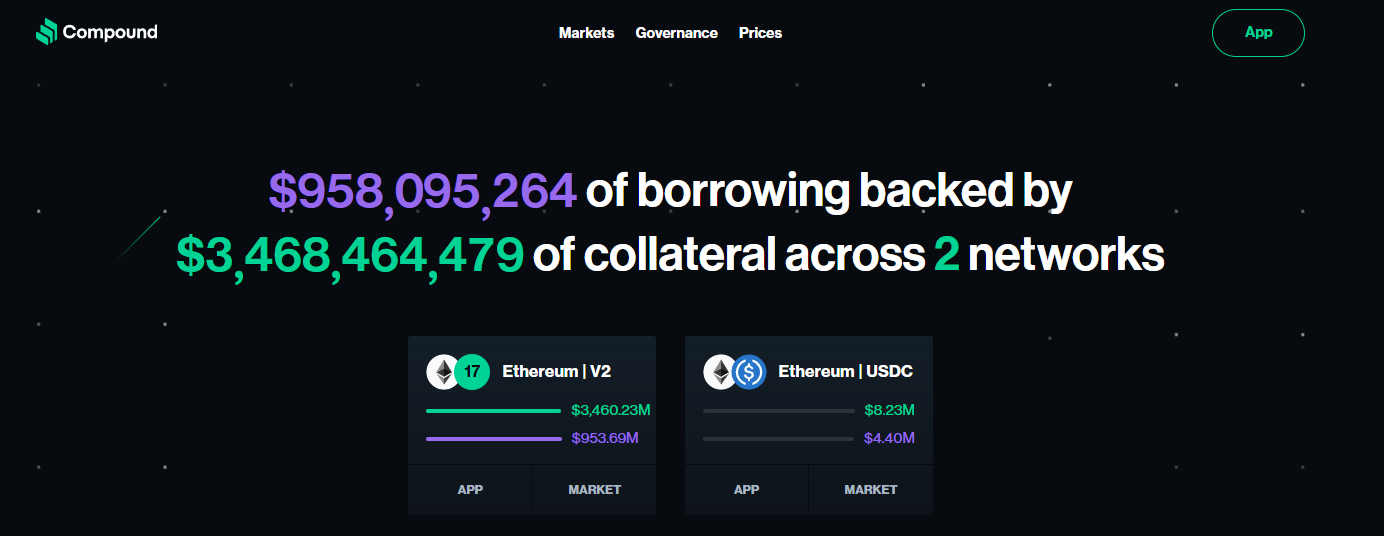

As the bug caused an issue with the price feed, Compound Labs announced the suspension of its Compound Ether (cETH) market. The bug caused the transactions to revert.

This led to the Compound team deciding to freeze the cETH market temporarily to address the issue and initiate damage control. An hour after the upgrade was implemented, Compound did issue a statement about the undergoing work to get the market up and running in no time.

The platform’s cETH market is around $830 million, and right after the update, it was rendered unusable.

Nothing To Worry About?

While the hack might have showcased a bit of vulnerability for Compound Labs, the organization has been repeatedly mentioning the fact that there are no funds at immediate risk due to this error.

Echoing the same sentiments, Lewellen from OpenZeppelin added, “The primary issue right now is a temporary denial of service for the cETH market which will be resolved by the new governance proposal. No funds are at risk at this time. The rest of the cToken markets on Compound V2 and all of V3 remain functional.”

He further added, “any users that deposited ETH and obtained cETH for opening borrow positions must be aware that they might get instantly liquidated whenever the fix proposal executes if by that time the price of ETH has dropped significantly.”

Adding to this, the CEO of Compound Labs, Robert Leshner, also added that users can still repay any debt and add collaterals to not liquidate. “any users that deposited ETH and obtained cETH for opening borrow positions must be aware that they might get instantly liquidated whenever the fix proposal executes if by that time the price of ETH has dropped significantly.”

What’s Next?

The failure to implement the update correctly is termed a routine issue and nothing more than that. The fundamentals of the platform still remain intact. Moreover, what’s even more impressive is the turnaround time with which the Compound Labs development team took up the issue.

Proposal 117 wasn’t a controversial one, rather, it got around 700,000 votes from 245 different wallet addresses, which were in favour of the price upgrade.

According to DeFiLlama, Compound happens to be the third largest decentralized lending platform, with a $2.67 billion total value locked (TVL). The news hasn’t affected Compound (COMP) so far, which sits at $4.39 at the time of writing.

Read More

- How to buy Ethereum

- How to earn interest on crypto

- Best Crypto Interest accounts

- How to Stake Crypto

Join Our Telegram channel to stay up to date on breaking news coverage