Join Our Telegram channel to stay up to date on breaking news coverage

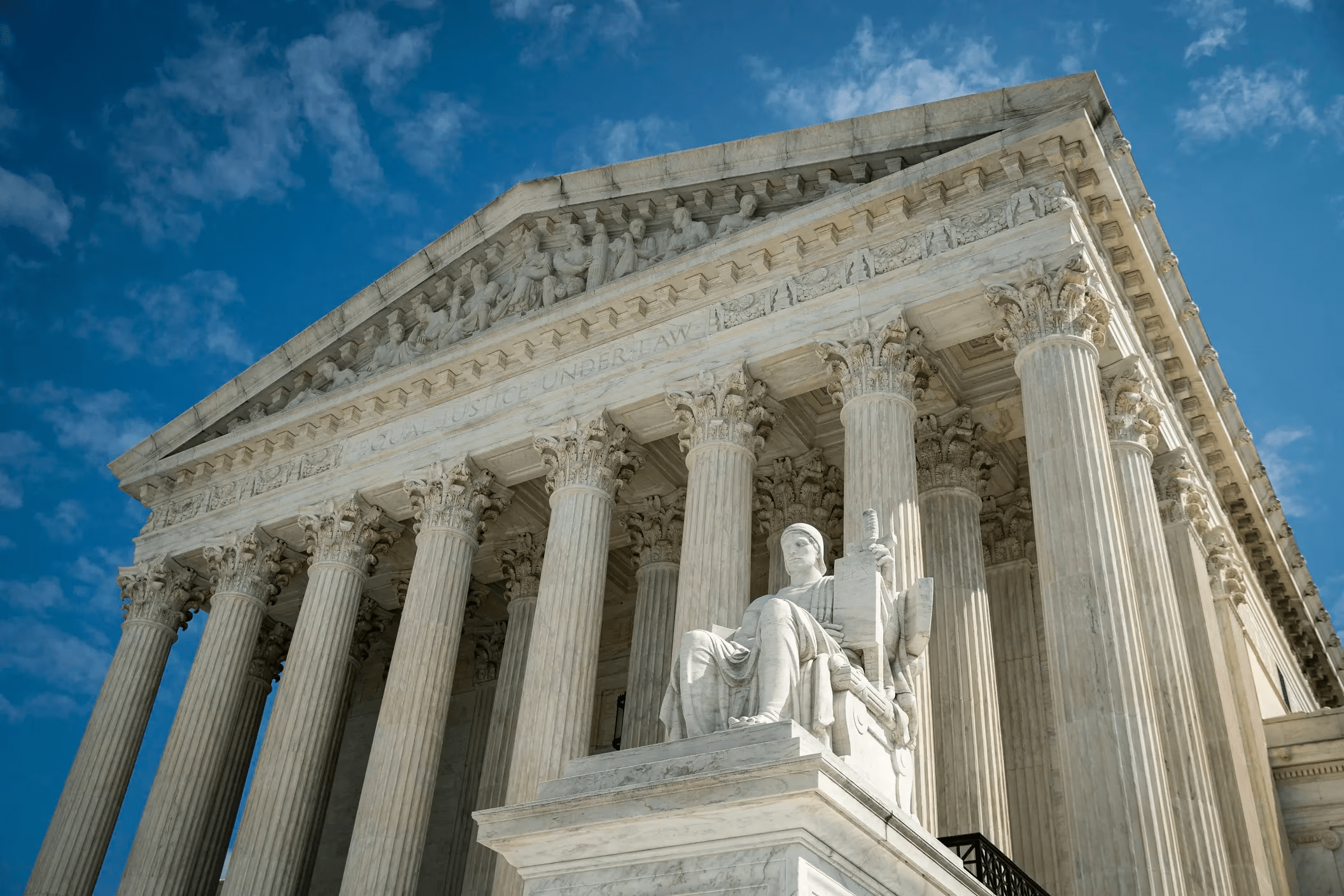

Among major regulatory developments in the crypto space, Coinbase emerged victorious in a supreme court ruling pertaining to an arbitration lawsuit, where the exchange was sued by one of its users. This outcome comes amidst increased scrutiny on cryptocurrency exchanges due to the implementation of more stringent rules and regulations.

Although this doesn’t signify the ultimate resolution of the legal dispute, it does signify a positive outcome for Coinbase and offers a moment of respite amidst the numerous ongoing legal battles the company has been facing across multiple countries. Bloomberg’s announcement tweet stated that the US Supreme Court supported a Coinbase division in a ruling that reaffirms companies’ capacity to direct customer and employee conflicts towards arbitration.

The US Supreme Court sided with a Coinbase unit in a ruling that reinforces the ability of companies to channel customer and employee disputes into arbitration https://t.co/kJULvqs7fA

— Bloomberg (@business) June 23, 2023

What is the Ongoing Legal Battle All About?

The legal battle between Abraham Bielski and Coinbase revolves around an alleged incident of fraud and the responsibilities of Coinbase as an online currency and cryptocurrency exchange platform. Bielski claims that soon after creating his Coinbase account in 2021, an unknown scammer gained unauthorized access to his account and stole about $31,000 from him.

He further asserts that Coinbase ignored his attempts to contact them regarding the fraudulent activity until he resorted to filing a lawsuit. In his lawsuit, Bielski argues that Coinbase should be classified as a “financial institution” according to the Electronic Funds Transfer Act (EFTA). He accuses Coinbase of failing to meet its obligations under the EFTA, which include conducting a prompt and bona fide investigation into fraudulent transfers. Bielski brought the lawsuit on his own behalf and on behalf of other individuals who may have faced similar situations.

Coinbase, on the other hand, sought to enforce the arbitration clause in its user agreement with Bielski. They moved to compel arbitration as a means of resolving the dispute. However, the district court denied Coinbase’s motion, deeming the arbitration clause and delegation clause in the user agreement to be unconscionable. The court found these clauses to be unfairly or oppressively favourable to Coinbase.

Coinbase appealed the district court’s decision to the U.S. Court of Appeals for the Ninth Circuit, but their motion to stay the proceedings was also denied. This is when the exchange moved to the apex court in the hope of getting their appeal heard.

Coinbase Wins Supreme Court Ruling – Moved to Arbitration

The San Francisco-based cryptocurrency exchange emerged triumphant in a class-action lawsuit as the US Supreme Court ruled in its favor, granting the company the right to move the case to arbitration. The decision has had an immediate impact on Coinbase’s shares, which surged by 4% following the announcement.

The Supreme Court’s ruling strengthens the position of businesses, enabling them to utilize arbitration as a means to resolve disputes rather than engaging in lengthy and costly legal battles. This development poses a challenge for users seeking to involve companies in protracted courtroom proceedings.

Justice Brett Kavanaugh, in a written statement, highlighted the potential loss of benefits associated with arbitration if pre-trial and trial proceedings were to continue while an appeal on arbitrability was pending. The court’s majority decision, with a 5-4 vote, affirms the authority of companies to direct customer and employee conflicts towards arbitration. As a result, Coinbase can now pursue arbitration and temporarily halt the progress of the class-action lawsuit within the federal court system.

This Supreme Court ruling carries implications beyond Coinbase, as it sets a precedent for other businesses facing similar legal challenges. It underscores the increasing significance of arbitration as an alternative dispute resolution mechanism in the corporate landscape, emphasizing its potential for efficiency, reduced costs, and less intrusive discovery processes.

Have Coinbase Users Lost Money Before?

There have been previous instances too, where the biggest crypto exchange in the US lost user funds. Coinbase users, however, have often sued the exchange or reached a settlement whenever such an issue arises.

One notable example involves a Coinbase customer named Jared Ferguson, who claimed to have lost $96,000 in a phone hack. According to his lawsuit filed against the cryptocurrency exchange, he stated that 90% of his life savings were wiped out due to a security breach on the Coinbase platform through his phone.

There was another report where over 6,000 Coinbase customers were informed that their accounts were compromised, and funds were removed in May 2021. These incidents highlight the potential risks associated with using cryptocurrency exchanges and the importance of implementing robust security measures to safeguard funds.

While Coinbase claims to have implemented security protocols and measures to protect user assets, it has consistently advised its users to remain vigilant, follow recommended security practices, and take personal responsibility for safeguarding their cryptocurrency holdings to minimize the risk of financial losses.

Related News

- SEC Asked to Report in Coinbase’s Crypto Rulemaking Case in the Next 120 Days

- Coinbase CEO Criticizes SEC’s Crypto Regulation for Impeding American Innovation

- Best Crypto Exchanges

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage