Join Our Telegram channel to stay up to date on breaking news coverage

Coinbase cryptocurrency exchange has taken a proactive approach to address concerns raised by regulators regarding crypto staking.

In a petition submitted to the Securities and Exchange Commission (SEC), the company explains why staking cannot be categorized as a security. Coinbase published a “Petition for Rulemaking” on March 20, highlighting how securities laws treat activities related to validating proof-of-stake protocols. The petition responded to the SEC’s actions in February when the agency cracked down on Kraken’s staking program.

The SEC charged Kraken with “failing to register the offer and sale of their crypto-asset staking-as-a-service program” and classified it as a security. In the 18-page document, Coinbase argues that not all staking activities should be treated as securities under the law. They emphasized that the stakeholders’ level of involvement and control can vary significantly in different staking models; therefore, a blanket classification of staking as a security measure would not be appropriate.

By communicating its position to the SEC, Coinbase hopes to clarify the regulatory landscape around staking and provide greater certainty for its customers and the broader cryptocurrency industry. The company’s proactive approach shows its commitment to compliance and willingness to engage with regulators to advance the crypto market’s development.

Coinbase Arguments Regarding Crypto Staking and Regulatory Precedents

According to Coinbase, stakers or service providers do not share a joint enterprise. Users have complete control over their assets, including the ability to unstake them, sell them, pledge them, vote with them, or dispose of them in any other way they choose, with no interference from the service provider.

Coinbase argues that core staking services do not meet the “expectation of profit” standard because users’ rewards are simply payments for the services they receive. The company has alerted regulators about the considerable economic impact of their actions on the digital asset ecosystem and urged them to adopt a different approach towards staking services. Following its confrontation with Kraken in February, Coinbase publicly asserted that its staking programs are distinct from Kraken’s.

Furthermore, the company’s CEO, Brian Armstrong, expressed his willingness to defend this stance in court “if necessary.” Despite the SEC’s actions, Coinbase has reiterated to its customers that its staking services will persist and potentially expand.

Additionally, core staking services involve ministerial maintenance rather than organizational efforts, which differ from traditional investing. To guide its current regulatory work with crypto staking, the SEC can refer to several historical precedents cited by Coinbase. These include:

- The 1973 Committee on Special Investment Advisory Services,

- The SEC’s Regulation Fair Disclosure from 2000,

- The Report of an Investigation under Section 21 (a) of the Securities Exchange Act of 1934: The DAO, from 2017.

Kraken Settles with SEC Over Staking-as-a-Service Program

In February 2023, the SEC imposed a $30 million penalty on Kraken, a San Francisco-based cryptocurrency exchange, for violating securities laws by failing to register the sale and offer of their staking-as-a-service crypto asset program. Despite settling the allegations against it, Kraken’s payment does not imply that staking is security.

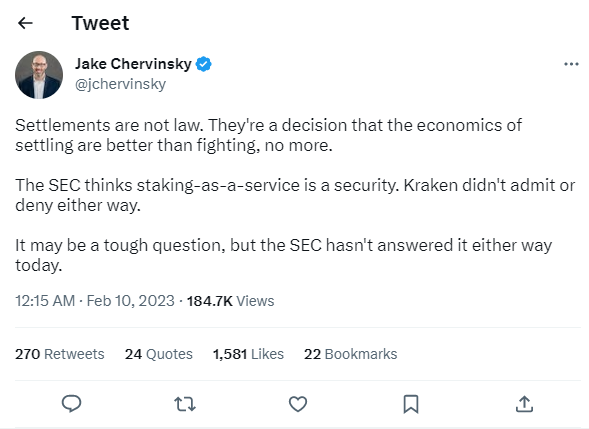

As Chief Policy Officer at the Blockchain Association, Jake Chervinsky notes, settlements are not equivalent to legal decisions. Although the SEC views staking-as-a-service as a security, Kraken did not admit or deny this classification and instead resolved the matter by paying the fine.

More News

Blur Alleged Of NFT Market Manipulation, As NFT Wash Trading Explode 126%

MetaMask And MoonPay Partner To Allow Nigerians Purchase Crypto Via Bank Transfer

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage