Join Our Telegram channel to stay up to date on breaking news coverage

China’s forthcoming Central Bank Digital Currency (CBDC) continues to make headlines almost every day. While many have started to speculate on how the asset will work and its technical details, a new report is postulating that the government could also use it to clamp down on the private sector.

Creating a Level Playing Field for Banks

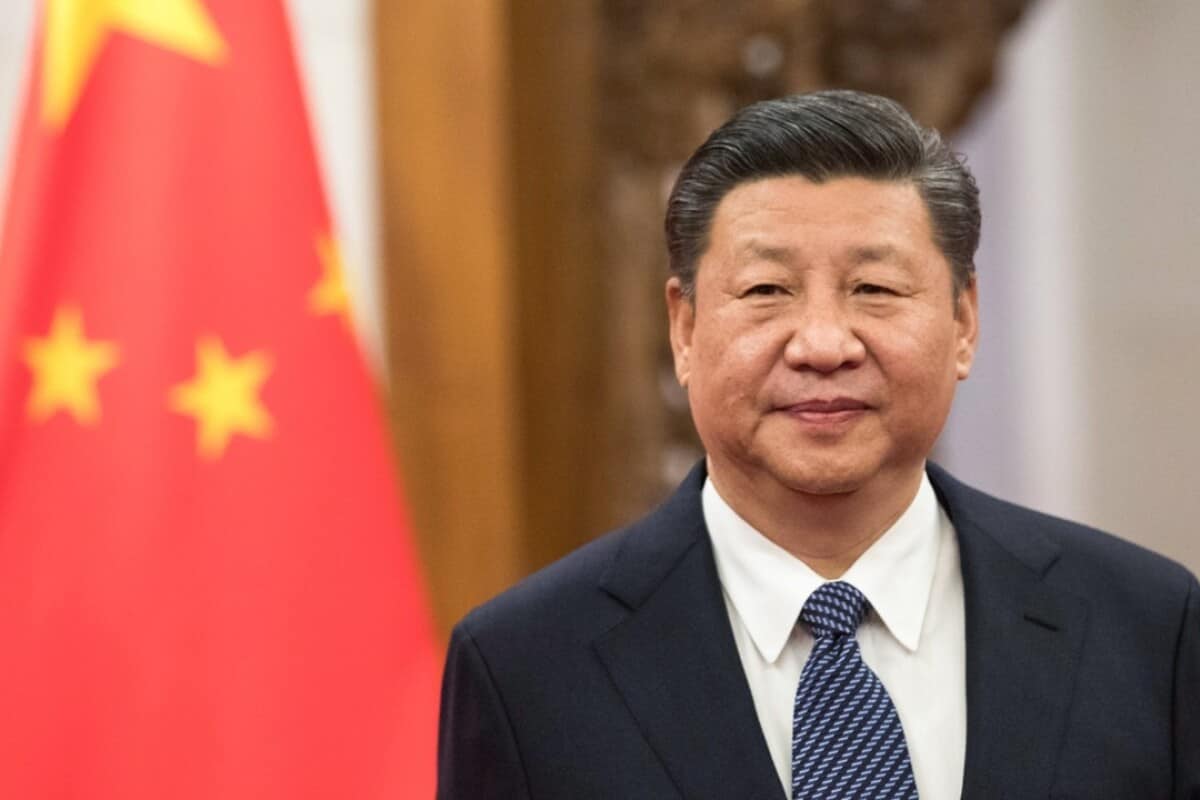

The Financial Times reported that the Chinese government is looking to use its new asset to reduce the chokehold that the Alibaba Group and Tencent have on its digital payments sector. As the report explained, regulators and executives from the two firms have agreed that the Communist Party was targeting the two firms, as their dominance had raised possible antitrust concerns.

Alibaba and Tencent own AliPay and WeChat Pay — the two largest payment processors in China by a mile. Last week, Reuters reported that the two platforms held a 55 and 39 percent stake in the country’s mobile payments sector, respectively. Given that China’s mobile payments sector processed $8 trillion in transactions in the first quarter of the year alone, that’s something.

Competing with these companies is almost impossible — at least, for private firms, anyways. So, the Communist Party is now stepping in. As the Reuters report explained, the Peoples’ Bank of China had requested that the antitrust committee of the State Council investigate both companies for antitrust violations. As the report highlighted, the central bank believed that the firms had used their influence to stifle any competition in the country.

Bringing Down the Giants

Citing officials familiar with the central bank’s strategies, the Financial Times reported that the Peoples’ Bank would use the digital yuan to level the playing field. Now, commercial banks would also be able to process transactions at an identical pace, with possibly even lower fees.

As the news source explained, the head of Asian economic research at a multinational bank claimed that former Peoples’ Bank Governor Zhou Xiaochuan had sat by as AliPay and WeChat Pay became “monsters.” This was despite alarms raised by both local commercial banks and the China Banking Regulatory Commission.

For now, it’s unclear what Beijing is planning for these payment giants. Months back, Jiang Wei, the chair of the China Telecom Blockchain and Digital Economy Joint Laboratory, claimed that both services could co-exist with the Chinese state-backed asset. However, the government has been inviting several top tech companies to participate in tests for the asset.

As of last month, Didi Chuxing, China’s largest ride-hailing service, announced that it had joined the asset’s tests. With its over 550 million users, the company would reportedly front the tests for the asset. The firm was also joining names like TikTok owner ByteDance, Chinese group buying website Meituan-Dianping, and video-sharing website Bilibili.

Two notable exceptions from the tests thus far have been Alibaba and Tencent. Considering their influence in the e-payment space, it would seem only rational to involve them. The South China Morning Post recently suggested that the government was launching the asset to be an alternative to the two services. So, anything is possible.

Join Our Telegram channel to stay up to date on breaking news coverage