Join Our Telegram channel to stay up to date on breaking news coverage

Chainlink is one of the top crypto projects in the industry. The blockchain platform enables the use of real-world data from off-chain sources.

This way, a crypto protocol can gather information from data pools, application program interfaces (APIs), and several other sources aside from its on-chain data.

This unique attribute has made Chainlink the go-to source for all blockchain platforms.

Its LINK token has had a stellar year after increasing more than 300% from its entry price of $11.87 on Jan. 1 to $52.70 on May 10. This has been unsustainable, and LINK slumped with the wider crypto market.

However, the ERC-20 token is rallying in the last 24 hours and is up 3.54% and trading at $19.319.

LINK Price Analysis

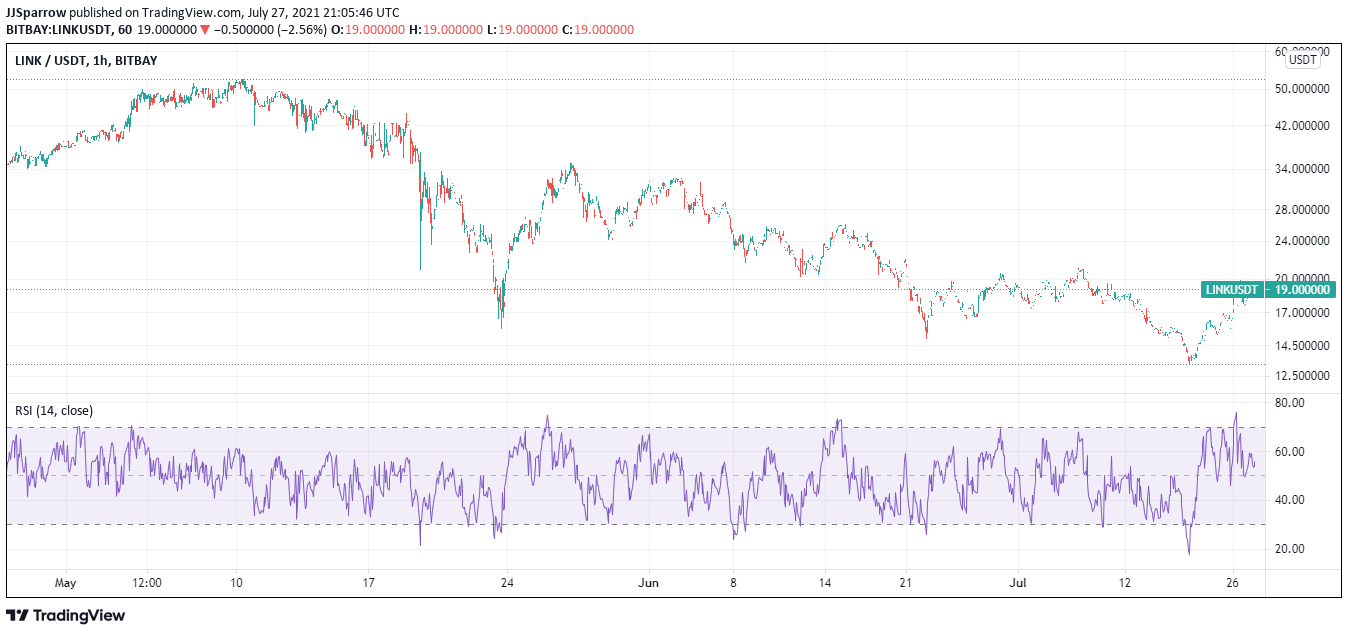

LINK’s current trend is pointing to a bullish market with the digital asset showing a strong will to make it over the $20 mark.

It could cross over this point if it continues its uptrend march and tries to break above the $25 resistance level even as it presently trades above the 20-day moving average (MA) price of $16.790.

A new support level will likely extend to the $20 mark, which will make a new chapter for the decentralized oracle network.

Market signals are clearly in LINK’s favor, with the relative strength index (RSI) standing at 58.77.

This is a good sign to buy LINK as its RSI is above the oversold region and below the overbought region.

Bullish market sentiment could see LINK ride close to the $30 range in the first week of August or face resistance at the $28 range. However, in the event of consolidation, it might find a new support level at $25.75.

Meanwhile, the crypto market is volatile, and a major market correction could see LINK drop lower than expected. This could see it slump to $17 following selling pressure and hit the $10 as a last resort in the event of a bearish showdown.

However, this recent rally could serve as a Launchpad for the decentralized protocol. This is due to the growing adoption and use cases of its oracle services.

According to a recently released report, over 281 crypto protocols have integrated with the Chainlink ecosystem, with average partner integration of 1.4 daily so far this year.

With its integrations now totaling 650, Chainlink has seen a 43% increase in the onboarding of new projects.

Although several of these protocols are still on the fringe of the blockchain ecosystem.

Big wigs like Huobi’s ECO Chain, Alchemix, Hedera Governing Council, and recently Avalanche have turned to Chainlink for their off-chain data needs.

Innovative sports-facing blockchain platform Dotmoovs has also integrated with Chainlink’s Verifiable Random Function (RVF).

Where to Buy LINK

Those who want to buy LINK tokens can do so from the following exchanges:

- eToro

eToro is one of the most reputable crypto exchanges. It offers competitive trading fees and a wide range of features that will help new traders learn from market experts. eToro also supports a variety of cryptocurrencies and crypto trading pairs.

- Binance

The other exchange that supports LINK is Binance. Binance is the largest cryptocurrency exchange, and this gives it a high level of liquidity, making traders faster.

Looking to buy or trade LINK now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage