Join Our Telegram channel to stay up to date on breaking news coverage

The Chainlink price has jumped by 13% in the past week and is trading at $14.66 as of 5:30 a.m. EST.

Chainlink (LINK) is currently retesting a support level as it looks to break above the $16.5 resistance level.

Retest is in progress

Can it hold?#LINK #Crypto #Chainlink https://t.co/dfqgzi14zH pic.twitter.com/olt0wCYeT7

— Rekt Capital (@rektcapital) November 13, 2023

Chainlink Price Analysis

The 2-hour LINK/USD charts show that the MACD is moving towards the green zone as bearishness fades away from the Chainlink price. The MACD indicator is also on an upward trajectory, indicating bullish action on the Chainlink price.

According to the 30-minute LINK/USD charts, the 5-period moving average has exceeded the 15-period moving average to form a golden cross. This shows buying pressure on Chainlink as bulls now look to push a pump on the Chainlink price. Looking at volatility, the Bollinger Bands are far apart, showing high volatility levels on the Chainlink price. In addition, the trading volume has also surged by 10% in the last 24 hours.

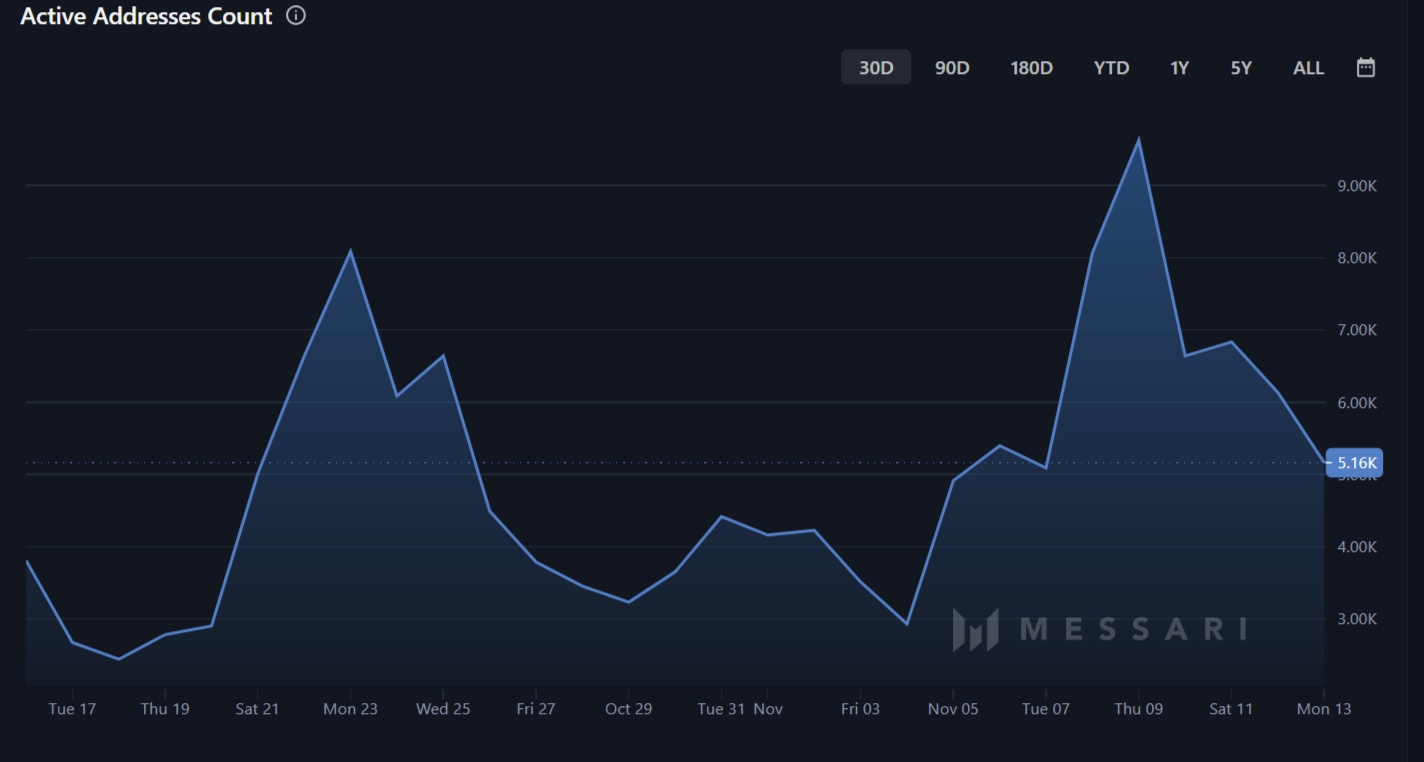

These levels will likely fall as the number of active addresses on Chainlink reduces, showing reduced enthusiasm for the token. The Chainlink address count fell by 4% in the last seven days.

Meanwhile, as the Chainlink price looks to skyrocket, the new Bitcoin ETF Token, currently in its presale, could be poised for even better gains as the asset capitalizes on anticipation of spot Bitcoin ETF approvals.

Bitcoin ETF Token Presale Surpasses $500,000 In Funding

The newly launched Bitcoin ETF Token has generated over $500,000 in funding as FOMO (Fear of Missing Out) sentiment grows.

Stage 2 of the Bitcoin ETF Token presale will conclude in just under two days, and Stage 3 will see the token’s value rise from $0.0052 to $0.0054.

Given the prevailing optimism regarding ETF approvals and the potential bull cycle owing to the Bitcoin halving event, now is an opportune time to acquire Bitcoin ETF Tokens.

🌐Grayscale Bitcoin Trust aims for a spot #ETF transformation, narrowing its discount to the slimmest since inception.

Recent legal strides and @BlackRock $BTC ETF entry fuel optimism. Are you bullish on the future of #Crypto ETFs?#BitcoinETF has also now raised over $500K!🪙 pic.twitter.com/HaKz0g6BLw

— BTCETF_Token (@BTCETF_Token) November 13, 2023

The Bitcoin ETF Token features a burn mechanism that reduces the token supply and supports its price. All transactions involving Bitcoin ETF Tokens will burn 5% of the tokens, potentially burning up to 25% of the token supply upon its launch.

These burn events are triggered by real-world milestones related to Bitcoin ETFs, such as initial approvals and launch dates. This puts the Bitcoin ETF Token’s long-term price at an advantage over the Chainlink price as it holds massive prospects of a price explosion.

Additional performance triggers for BTCETF tokens are in place. When BTCETF trades reach $100 million, the transaction tax will decrease from 5% to 4%. Following the approval of the first spot Bitcoin ETF, the sales tax will be reduced from 4% to 3%.

There’s no need to wait for the launch of an ETF. Investing in Bitcoin ETF Token today positions your cryptocurrency portfolio for potential gains as news and developments unfold.

Spot ETFs may wield an influence akin to the early days of gold-based vehicle ETFs, potentially unlocking billion-dollar opportunities in mainstreaming digital assets.

Staging and burning mechanisms within BTCETF serve to preserve and enhance the value generated by ETFs. So, as you watch out for the Chainlink price, remember to participate in the presale.

Related News

- Inspired by BlackRock’s Ethereum ETF Plans, Bitcoin ETF Token Investors Rush To Seize Final Opportunity At Bargain $0.005 Price Point

- How To Buy Bitcoin ETF Token – BTCETF Presale Review

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage