Join Our Telegram channel to stay up to date on breaking news coverage

Cardano (ADA) has been experiencing a bearish trend since reaching a multi-month high of $0.4213 on February 16. The past week has been particularly challenging for the digital currency, with a significant price decrease as it struggles to maintain its position amidst the current sell-off across the broader crypto markets, along with negative PR.

This recent negative attention stems from allegations made against its founder Charles Hoskinson on Reddit, which could potentially impact Cardano’s reputation and price further.

The controversy began with an open letter posted by a Reddit user named Demesisx, who accused Hoskinson of having alt-right sympathies and making misleading statements about Cardano’s technology. Hoskinson refuted these allegations and defended himself in a post of his own.

Despite Hoskinson’s response, some investors remain concerned about the potential negative impact on Cardano’s reputation. Additionally, Hoskinson’s previously falsified education claims have also been confirmed, adding further fuel to the controversy.

However, it remains to be seen whether these controversies will have a lasting impact on Cardano’s price, as macroeconomic factors impacting the wider market, network upgrades, and adoption for real-world use cases could ultimately be more significant factors.

Cardano’s Price Movements

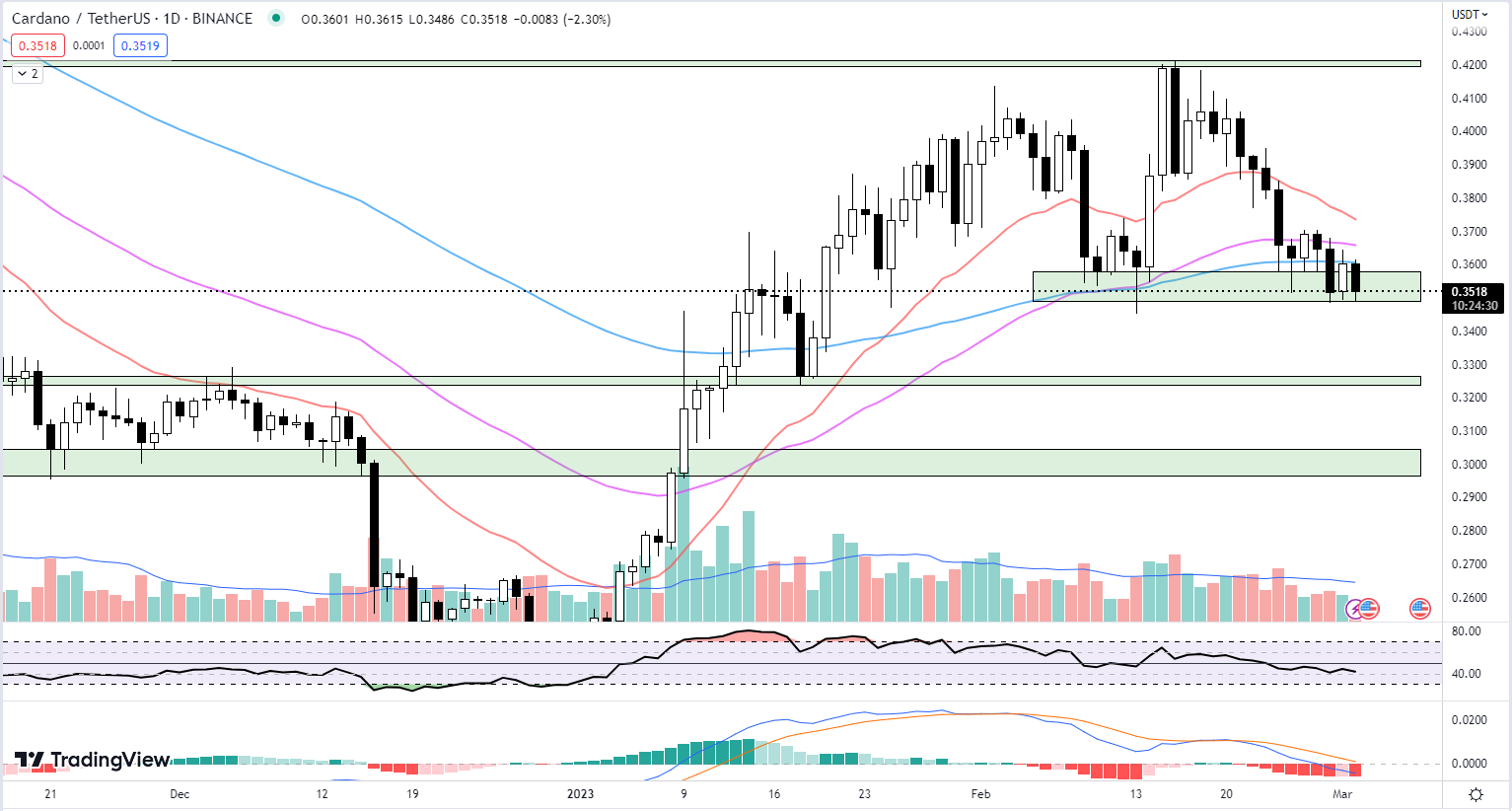

Cardano experienced a brief bounce off the $0.35 support level before closing last week at $0.37. However, as of writing, the cryptocurrency is once again retesting the $0.35 support level and has dipped below it at $0.3462 as of writing, marking a 4.16% daily decrease and a 9.74% decrease in the weekly timeframe. The current market structure appears bearish, with a potential rejection from the EMAs in the daily chart. If the price falls through the support, it could trigger a significant selloff.

Technical Analysis and its Impact on Cardano’s Price Movements

Exponential Moving Averages

Cardano’s 20-day EMA is currently at $0.373, while the 50-day EMA is at $0.366, and the 100-day EMA is at $0.361. The current price of Cardano is below all three EMAs, indicating a bearish trend in the short, medium, and long term.

Relative Strength Index

Cardano’s RSI is currently at 41.32, indicating a neutral to an oversold condition. An RSI reading of below 30 is considered oversold, and above 70 is overbought.

MACD Indicator

The MACD Indicator for Cardano shows a negative histogram. The previous day’s MACD histogram was -0.0053, and the current day’s MACD histogram is -0.0055. The growing negative histogram suggests that Cardano’s price outlook is bearish.

Volume

The volume for Cardano is currently at 43.719M, lower than the previous day’s volume of 67.65M. The volume moving average is at 100.76M, indicating a lower-than-average trading volume for the past two days.

Cardano’s Price Key Levels to Watch

A breakdown from the $0.345 level can bring Cardano’s price down to the $0.323 to $0.327 support area, which was the first pullback level in January. The lower support levels to consider are the range between $0.296 to $0.305. In the event of a market turnaround, resistance is at $0.37, with subsequent resistance levels at $0.4 and $0.42, where it recently initiated a bearish trend. A higher resistance level is located at $0.44.

The crypto’s technical indicators suggest a continuation of the bearish trend in the short, medium, and long term, since Cardano’s price is below all three moving averages. The RSI reading suggests a neutral to oversold market, while the negative MACD histogram supports a bearish trend. The lower-than-average trading volume also suggests a lack of interest in Cardano.

If the bears continue to gain momentum, Cardano’s price could drop to a new weekly low, and the crypto could be at risk of a drastic selloff in the short term. However, if the bulls react to the current support level once again, there may be an increase above last week’s closing price, signaling a continuation of the short-term bullish trend that has been in play since the start of the year.

In short, Cardano’s price is currently facing a significant challenge amidst the latest sell-off across the crypto industry paired with negative PR. While its price movements have been bearish, there is still hope for the cryptocurrency if it can hold its ground and stay above the support levels until the market recovers. It remains to be seen how the market will behave, however, and investors and traders should continue to keep an eye on Cardano’s price movements and key levels to make informed decisions.

Related:

Move-to-Earn Crypto Sweeps the Market with $4.9 Million Raised in Presale – How to Buy Early?

LTC Price Prediction: LTC Rallies Despite Crypto Market Slump

Solana Price Bulls Try Their Luck At Last Line Of Defense – Here’s Why A 100% Rally Is On The Cards

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage