Join Our Telegram channel to stay up to date on breaking news coverage

ADA Price Analysis – August 1

The beginning of the month has been slow for Cardano, but it is likely to pass soon. ADA could start rising during the second week of August and exceed the value of $0.070.

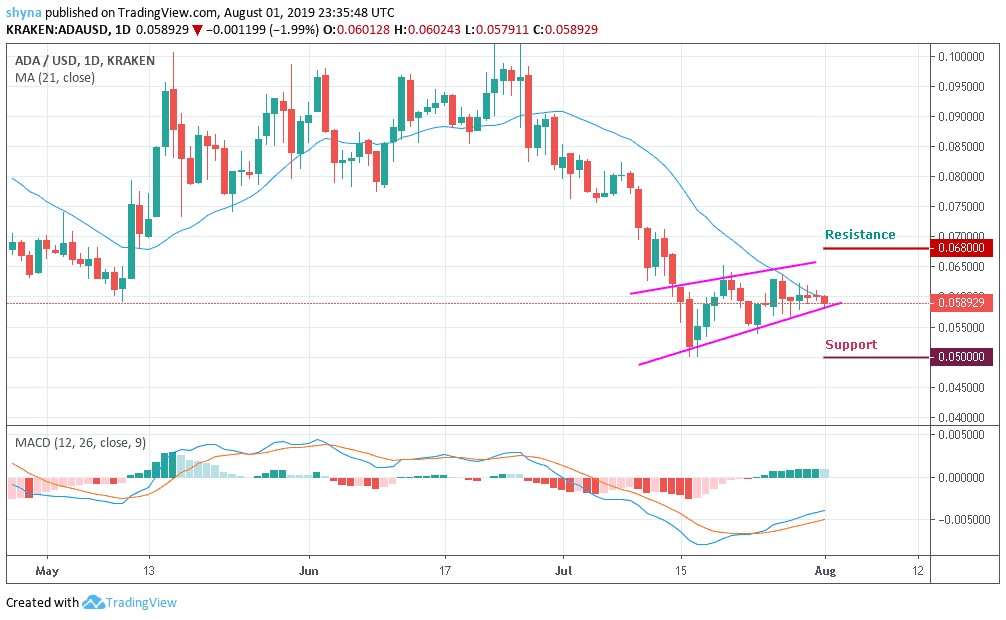

ADA/USD Market

Key Levels:

Resistance levels: $0.070, $0.075, $0.080

Support levels: $0.040, $0.035, $0.030

The first day of the month, ADA token again fell from $0.061 to its current value of $0.058 today as of August 1, 2019. The coin has shown a downward trend of more than 3% at the opening of the current market, but the price could increase up to $0.065 by the end of the week or maximum at the beginning of next week.

However, the current market performance can now move gradually. The coin could not get out of the $0.062 loop and continues to trade between $0.058 and $0.062. But that could change from next week as ADA/USD surpasses $0.065 and will move towards the resistance levels of $0.068, $0.070 and $0.072 before the end of the month. The MACD indicator goes to the positive side and the support levels to watch are $0.050, $0.048 and $0.046 respectively.

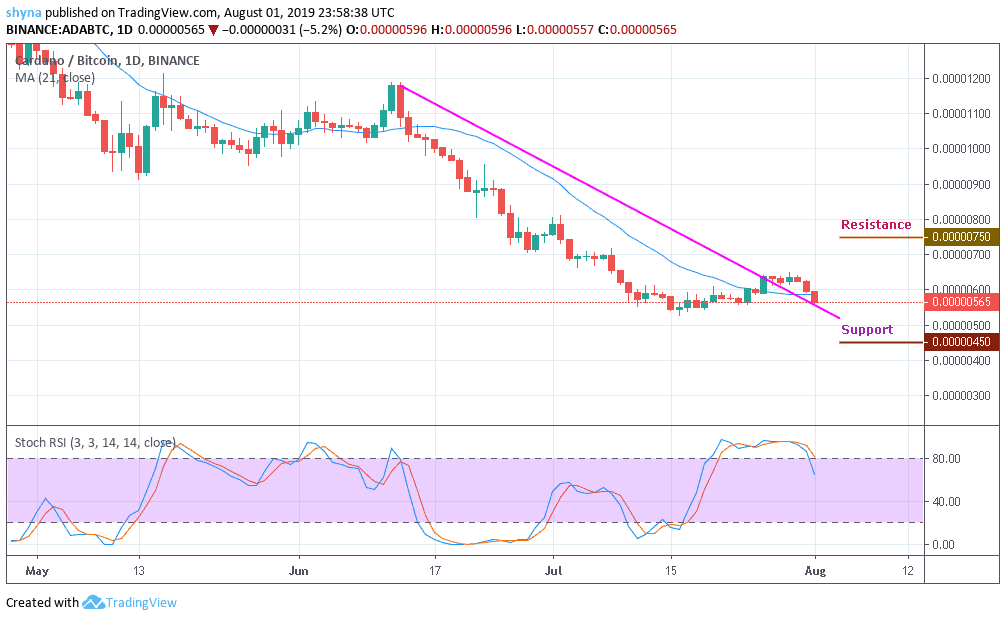

ADA/BTC Market

Taking a look at ADA against BTC, we can see that the coin has not been stable over the past days. Price action has recently managed to break below the support level at 590SAT and currently had managed to reach 566SAT before the price falling again.

Furthermore, looking at the price from above; the nearest level of resistance is above 750SAT, while further resistance lies at 800SAT and 850SAT. More so, from below; the nearest level of support now lies at 450SAT while below it lies the 400SAT and 350SAT. The Stochastic RSI is about recovering from the overbought zone, indicating bearish trend in the nearest term.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage