Join Our Telegram channel to stay up to date on breaking news coverage

Canaan Creative, the cryptocurrency mining equipment maker that went public last year, has announced that it made a substantial net loss for the 2019 fiscal year.

The company filed its unaudited financial results for the fourth quarter and full year of 2019 with the united Securities and Exchange Commission (SEC) earlier this week. In it, the Chinese firm explained that it made $204.3 million in total net revenues for the year. The figures were down from 2018 when the firm recorded about $385 million in net revenues.

Canaan’s Woes Grow with Unsatisfactory Results

However, the company’s net loss stood at $148 million regardless. The weak numbers were mainly attributed to the firm’s rocky Q4, where it made $151.1 million in losses – compared to just $10.6 million in Q4 2018.

Losses for Q4 2019 also amounted to $96.7 million, as opposed to a $1.6 million profit in the same period of 2018.

In the fourth quarter, Canaan saw a 66.8 percent increase in net revenues, which represented $66.5 million. It explained that its growth had been driven primarily by the improvements in its sales of computing power, which amounted to 2.9 million terahashes per second in Q4 2019. The number increased by 88.6 percent from the same period in the previous year, thus giving a bit of hope for a possible resurgence in 2020.

So far, the SEC’s registration on the firm’s possible outlook has shown that it will first and foremost need to overcome the challenge to the coronavirus before it can begin on the path to full profitability.

Even before the virus hit, Canaan was already in a bit of a tough situation. The firm’s share price has dropped by 64 percent since its Initial Public Offering (IPO) in November, and it’s now facing a class-action lawsuit from investors who claim that its IPO registration documents included several deliberately misleading pieces of information.

The Coronavirus Continues to Affect the Mining Sub-Industry

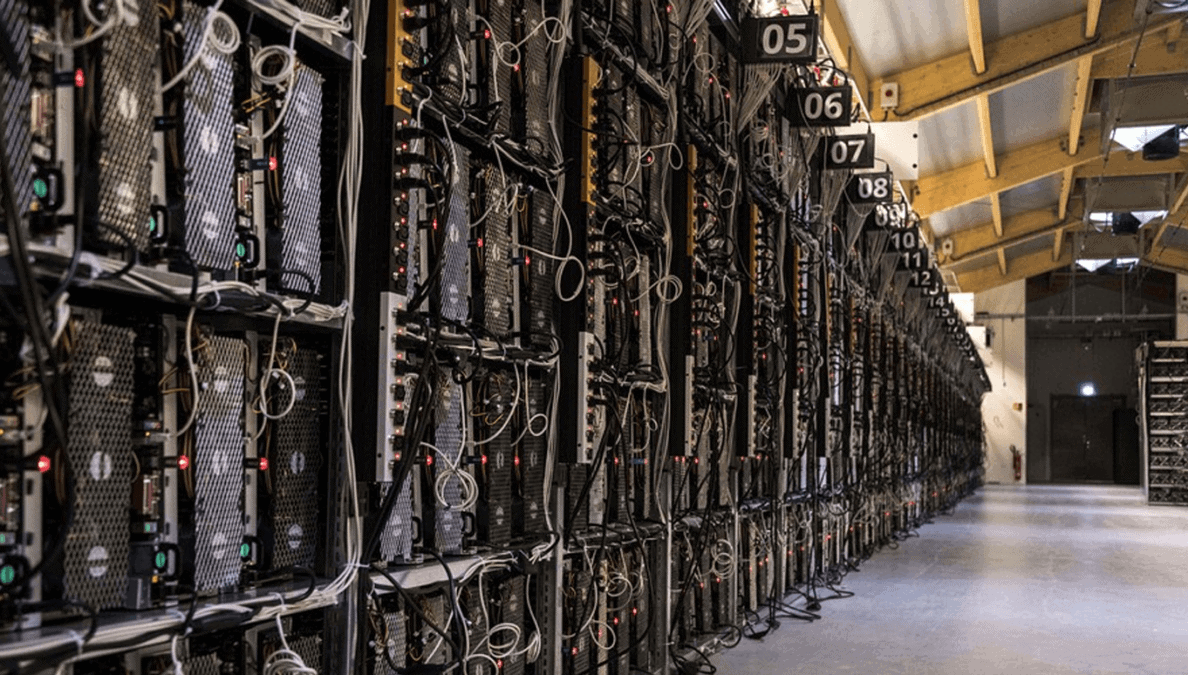

For now, the mining space has been one aspect of the crypto industry where the virus has hit significantly. Earlier this week, Canadian mining outfit Bitfarms announced that it would be trimming its staff in order to remain compliant with government guidelines on the virus.

As the company explained at the time, it will hope to maintain its profitability and sustain its operations for as long as the virus lasts. While it didn’t give any details concerning how many workers will be cut, for the time being, it explained that this was the best way to move forward at the time.

However, Riot Blockchain, another mining firm that’s listed on the NASDAQ, has provided a more in-depth analysis of how this virus could affect the mining space. Last month, the firm filed its Form 10-k report with the SEC that the virus will affect its foreign customers, and in good time, its core business as well.

As Riot explained, it has already faced several operational disruptions as a result of the virus – including and most especially the restriction in workers’ movement and working schedule. Border closures have also affected the firm’s foreign partners and third-party consultants while putting a strain on its ability to repair obsolete or malfunctioning mining equipment for now.

Join Our Telegram channel to stay up to date on breaking news coverage