Join Our Telegram channel to stay up to date on breaking news coverage

For someone who has been in the NFT industry and for people who haven’t as well, ‘buy the dip’ is a common thing to hear.

Buying the dip has become one of the most common strategies or the go-to techniques for many first-time investors and new entrants in the NFT space. However, there are many questions that stand when it comes to the effectiveness and logical soundness of buying the dip.

In the simplest of terms, it means waiting for the price of an NFT to fall and buying something at a lower price, with an expectation for it to rise further in the future.

Before one gets into NFTs and buys the dips, you should know about how this strategy works and what are the risks associated with the same. It’s pretty volatile and short-term, making it seem like a risky notion. Apart from the price of an NFT dipping, there are factors like the upcoming market forces, predictions dependent upon the market’s timing, and more.

Hence, instead of getting influenced by speculations, let’s understand what goes behind buying the dip, and should even do it.

What does ‘buy the NFT dip’ mean?

When someone says ‘buy the dip’ in an NFT world, they are simply referring to buying a collectible when its price has fallen. This refers to buying the collectible for a discount and increasing the chances of gains when the price of that NFT rises back.

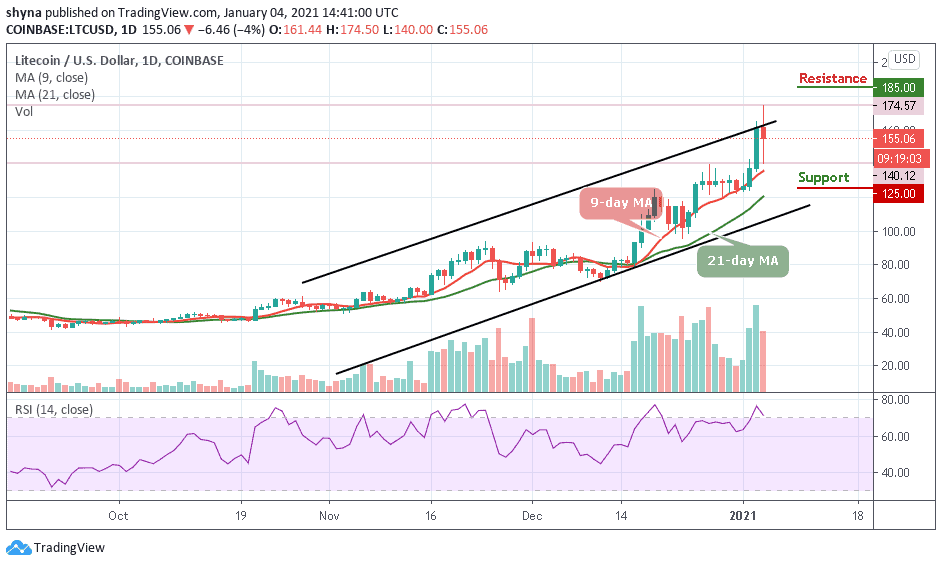

Dips are mostly reliant upon short-term price movements in the market and betting on the timing of the market. Buying the dip is something that is quite popular with paper hand investors and with people who have entered with a short-term investment goal.

In most cases, the larger the dip, the more you stand to gain if and when the collectible springs back to its original price.

Although, if a collectible has dipped way beyond its original price, there might be chances that it doesn’t rise up again. It is recommended to understand the fundamentals of the NFT project, its trading volume, and more.

It is situations like these that make buying the NFT dip a risky strategy at times.

How Does Buying The NFT Dip Work?

When it comes to buying an NFT, during its price dip, it just involves keeping a portion of your cash ready to invest as and when the market falls.

Once the prices have fallen, the NFT collectible you’ve been eyeing becomes available for a lot lesser than usual. This is when you can use your accumulated cash, to buy more of that NFT.

Doing this will ensure that your average cost and can enhance your returns in the coming future. This is if and when the NFT rises and reaches a higher valued price. But, you can’t predict that. That is where the entire buying the dip thing becomes difficult.

Timing the market is one of the skills that most experts even fail at. Hence, apart from predicting the dip, you have to be pretty confident about the specific NFT’s ability to bounce back stronger, and better. Seeing a dip might sound good during the moment after it falls, but predicting the dip size is also equally imperative.

Does It Work?

Buying an NFT when it dips, has more external factors rather than controllable internal factors that you can look into. Apart from predicting when an NFT might dip, you need to ensure that it has the fundamentals and the metrics to rise up back again.

Say, you bought an NFT in a dip, and it continues to dip further. This negates the effectiveness of your dip strategy all in all. Buying low and selling high might sound like the most common and effective strategy for NFTs, but it involves higher market timing fees, and a lot of risks when compared with long-term investing.

While you are working on buying the dip, here are some ways you can bring down the risk involved.

- Limit the amount that you invest during the dip stage

- Keep in mind that this is a very out-of-the-box trading strategy. Hence, expecting conventional returns to stable returns shouldn’t be there.

- Don’t wait for it to drop further. Say, if you have decided to buy an NFT when it drops by 15%, buy it to the extent your risk profile allows you to.

Advantages of Buying The Dip

Buying the NFT dip is a process that involves a lot of uncertainty and also unprecedented gains at times.

This magnitude of unprecedentedness makes it a make-it-or-break-it situation for much new age NFT entrants. Let us look at a few advantages of buying the NFT dip at the right time.

- Lock in a lower average for your collectibles of any specific asset

- It gives a sense of psychological relief to someone who just bought an NFT at a lower price than the rest.

- You might as well get to reap the benefits of the gains from the price rebound.

- It might be a good decision to invest in NFTs or enter the market as the prices dip.

Disadvantages of Buying The Dip

As mentioned above, buying the NFT dip can have its own sets of disadvantages, with the amount of volatility that is involved.

With NFTs prices dependent upon a large set of factors, internal and/or external, you can never be too sure of the market timing. Here are some of the major disadvantages of buying the NFT dip.

- No specific guarantee that an NFT might climb back to its original price.

- Missing out on long-term gains and exposing yourself to risks.

- May miss out on further gains, in case the asset doesn’t drop even further.

Conclusion

Buying the dips has become a synonymous catchphrase with NFTs and the overall crypto ecosystem.

While in some cases, investments are based on an NFTs strong fundamentals or its trading volume, the case isn’t the same when it comes to dips. Most of the dip-based investments are based on how well one can keep a look at the price movements.

This can be a pretty good way for someone who’s diligently involved in every activity that’s

moving the NFT market, but certainly not without ample background checks. Whenever you are entering the NFT world, have an exit strategy ready with you. Apart from that, it’s always recommended to spot a certain set of numbers to make a rational trade.

Conducting your own thorough research and due diligence can go a long way when you are entering into the NFT space or if you are going to buy the NFT dip.

Join Our Telegram channel to stay up to date on breaking news coverage